Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Arvind Krishna's First-Year Market Value Performance

- The Importance of Market Value

- Arvind Krishna's First-Year Market Value by the Numbers

Evaluating Arvind Krishna's First-Year Market Value Performance

How did Arvind Krishna's leadership affect IBM's 2020 market value in his first year as CEO? For 2020, IBM's market value was down 5.5%.

IBM’s market value is calculated by multiplying the corporation’s outstanding shares by those shares’ current market price. Lou Gerstner often used market value as a key business metric to evaluate his business success. He wrote to his shareholders about the significance of market value in IBM’s 1998 and 1999 annual reports. He called it “the most important measure of progress to investors.” Sam Palmisano, following his predecessor's example, wrote in the IBM 2003 Annual Report:

The board of directors approved sweeping changes in executive compensation. … IBM’s market value would have to increase by $17 billion [reaching $174 billion] before executives saw any benefit from this year’s option awards.

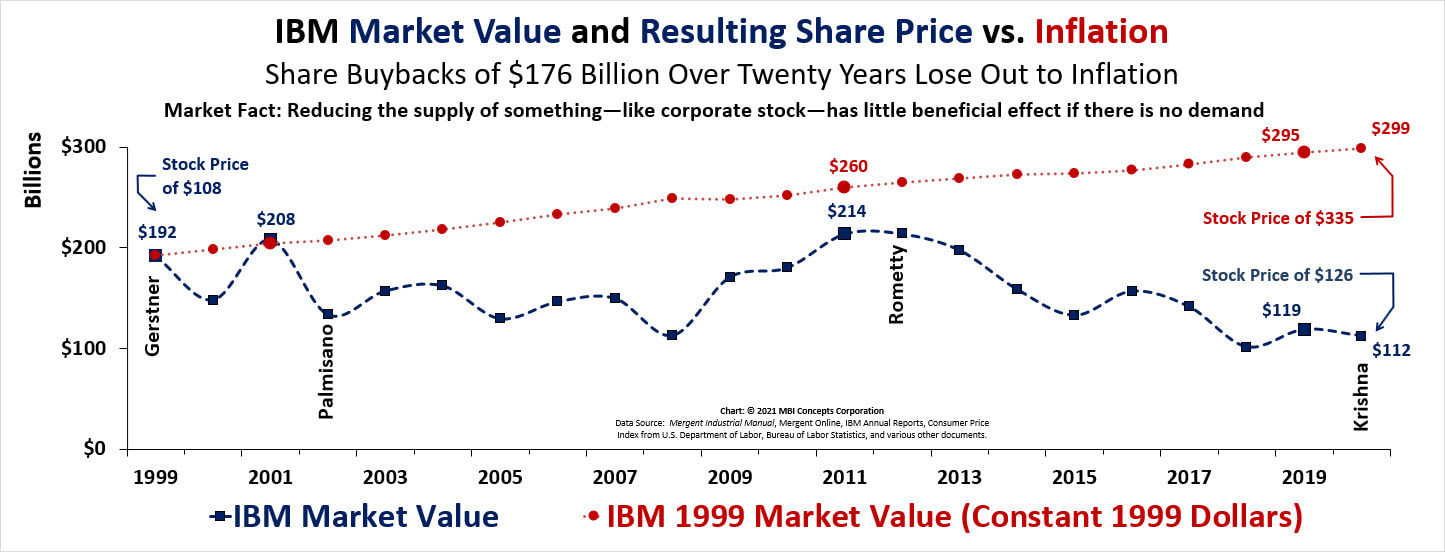

The following chart shows why Sam Palmisano abandoned this market value measurement of success for executive compensation and implemented earnings-per-share roadmaps. Competing with inflation, a market-value measurement would have yielded too few pennies for executive compensation.

In fact, not a single penny for a long, long time.

In fact, not a single penny for a long, long time.

Arvind Krishna's First-Year Market Value by the Numbers

- Krishna 2020 Market Value: Down 5.5%

- Krishna & Rometty 2012–20 Market Value: Down 47.4%

- Krishna, Rometty, Palmisano & Gerstner 2000–20 Market Value: Down 41.6%

- If the $176 billion in share buybacks since 1999 had accomplished one thing—kept market value in line with inflation, IBM’s 2020 share price would have been $335 a share instead of $126.