Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Ginni Rometty's Revenue and Profit Growth

|

|

Date Published: July 19, 2021

Date Modified: June 30, 2024 |

Questions answered by Virginia M. (Ginni) Rometty's key performance indicator (KPI) #7:

These are excerpts from "THINK Again!: The Rometty Edition."

- Was IBM in transition or decline?

- Historically, was its revenue and net income (profit) performance better or worse?

- How many times did IBM have positive revenue and profit (net income) growth in the last eight years?

These are excerpts from "THINK Again!: The Rometty Edition."

Virginia M. (Ginni) Rometty: Revenue and Profit Growth Were in the Ditch

- Which Stakeholder Takes Precedence: Customer, Shareholder, Employee?

- KPI #7: Revenue and Profit Growth Were in the Ditch

- Behavioral Changes to Consider Before Investing in IBM

Which Stakeholders Take Precedence: Customer, Shareholder, Employee?

"We have to consider three profits in IBM. The first goes to the users of our machines. The second goes to our employees. The third goes to the stockholders who entrust us with their money. From past experience we have found that when we take proper care of the first two profits, the stockholders always have been satisfied with what we had left for them."

Thomas J. Watson Sr., Business Machines, 1956

KPI #7: Revenue and Profit Growth Were in the Ditch

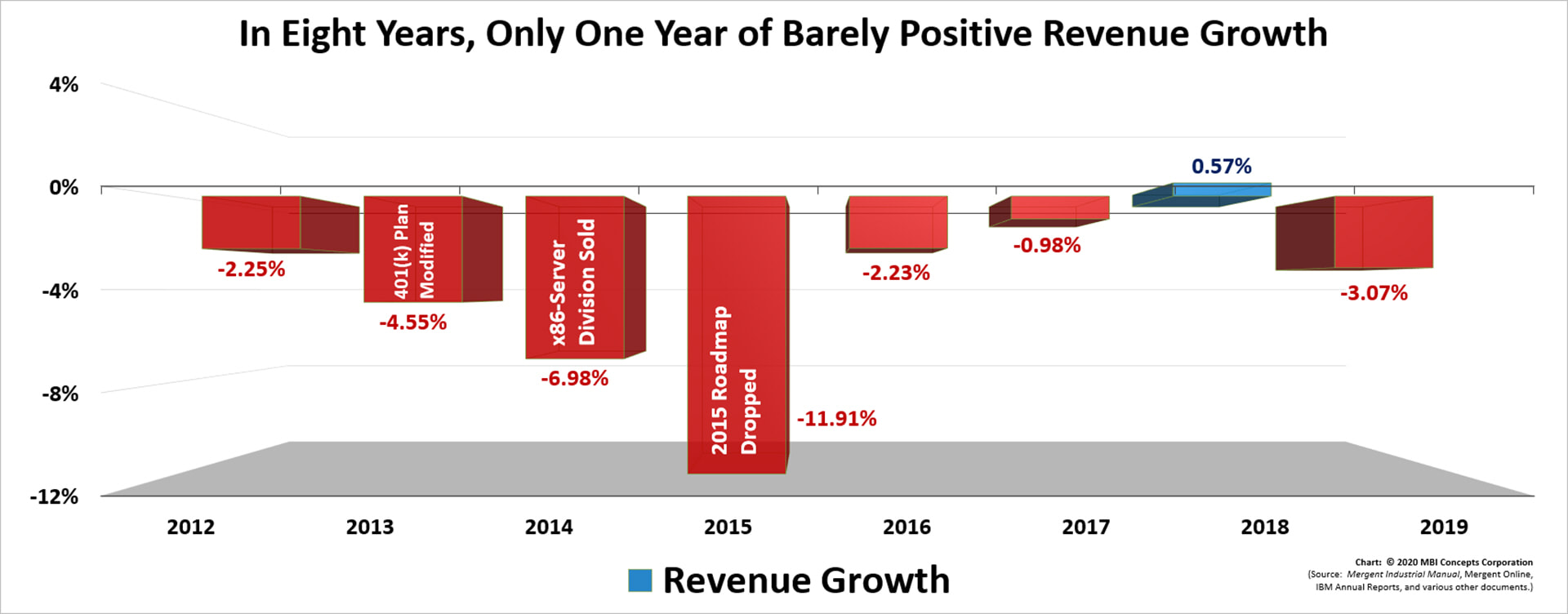

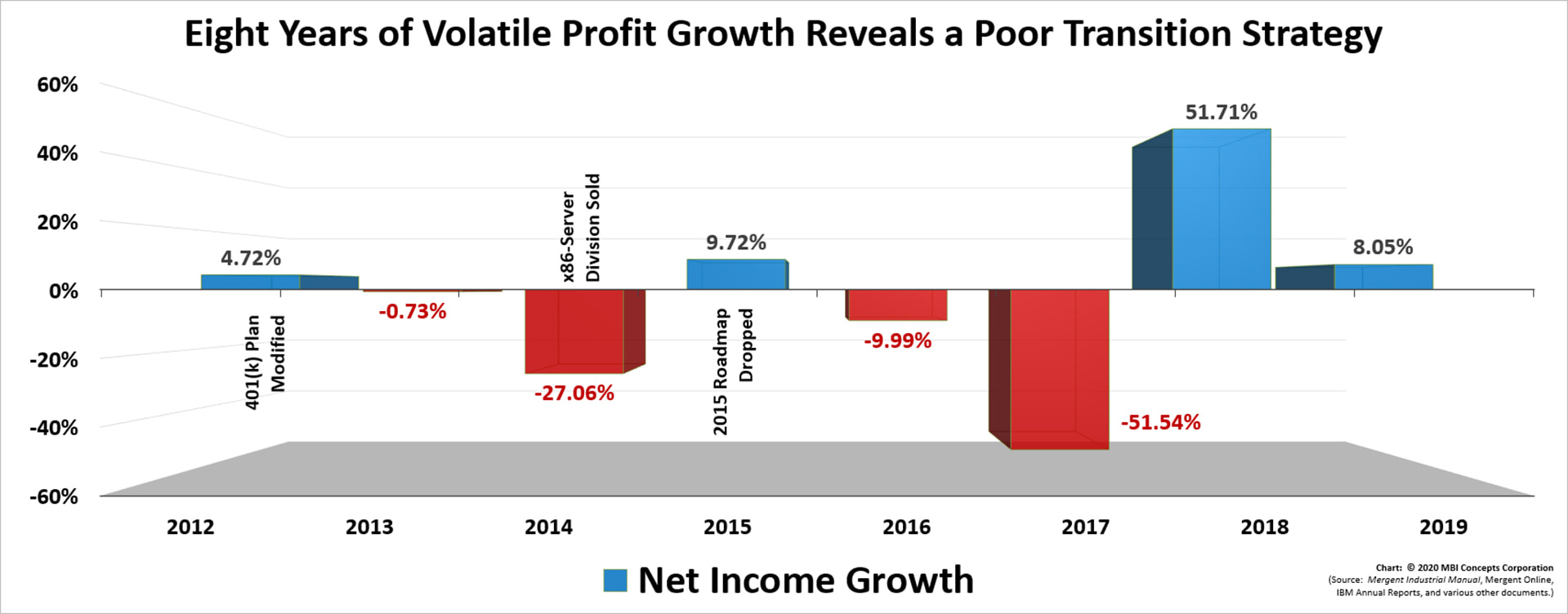

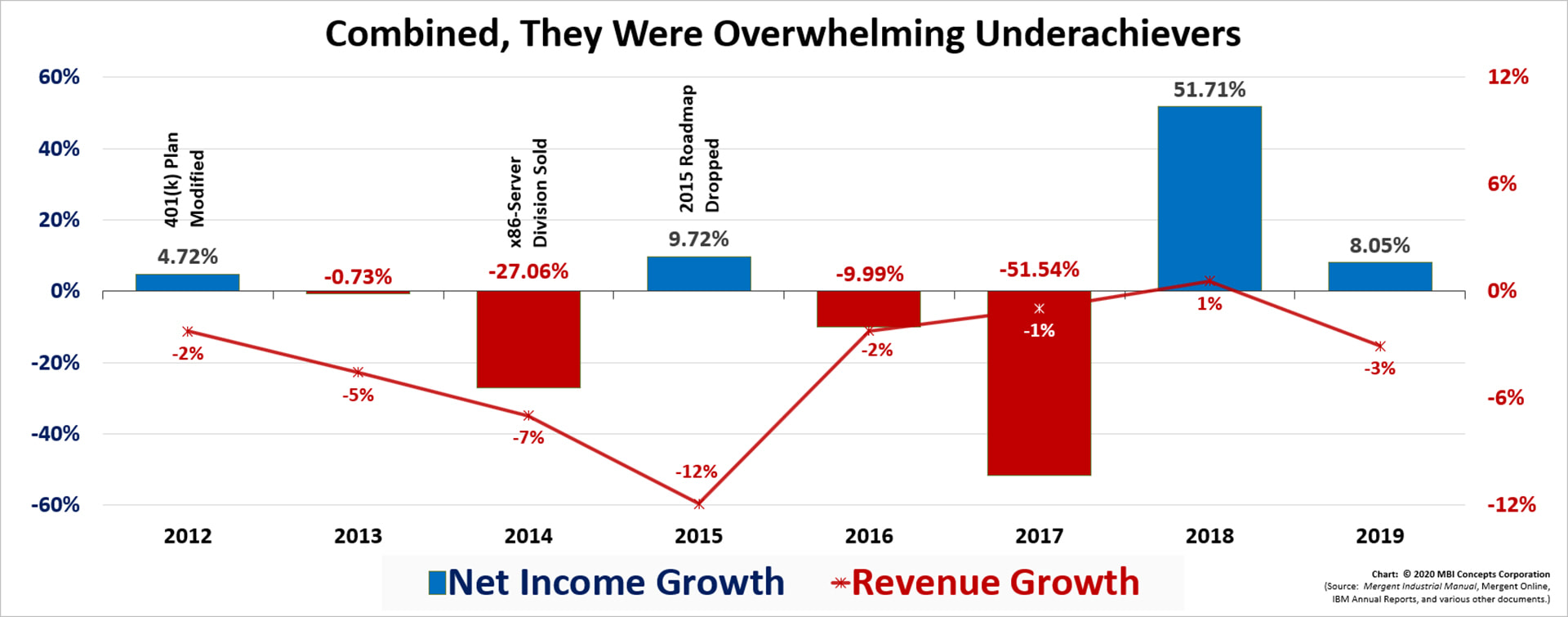

There is no amount of marketing spin that can make the next three charts tolerable. IBM has been in a downturn, not a transition. Over the last eight years, revenue growth has been nonexistent and profit growth has been, at best, erratic.[See Footnote #1]

Combine the two performances on a single chart, and only one question comes to mind: “How could such truly talented people allow themselves to get into such a morass?” Lou Gerstner asked this question of himself in his autobiography, but he left it unanswered.

In both situations the answer to Lou Gerstner’s rhetorical observation is the same: poor leadership with poor execution created the quagmires.

Behavioral Changes to Consider Before Investing in IBM

- An acknowledgement by the chief executive and board of directors that IBM’s two-decades-long strategy of stock buybacks has failed to drive revenue and profit growth—putting the fundamentals of running a healthy business at risk, and that they recognize the need to shift their investment dollars from paper (stock) to people, processes and products [IBM’s $201 Billion Paper Pyramid].

[Footnote #1] It may seem counterintuitive, but a 50% increase in profits (2018) following a 50% decrease (2017) does not balance out. Net income fell from $12 billion to $6 billion in 2017. It then increased from $6 billion to $9 billion. Overall, yearly net income was still down by $3 billion.