Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Ginni Rometty's Revenue and Profit Performance

|

|

Date Published: July 19, 2021

Date Modified: June 30, 2024 |

Questions answered by Virginia M. (Ginni) Rometty's key performance indicator (KPI) #8:

These are excerpts from "THINK Again!: The Rometty Edition."

- How much did revenue and profits fall during Virginia M. (Ginni) Rometty's tenure as chief executive officer (CEO)?

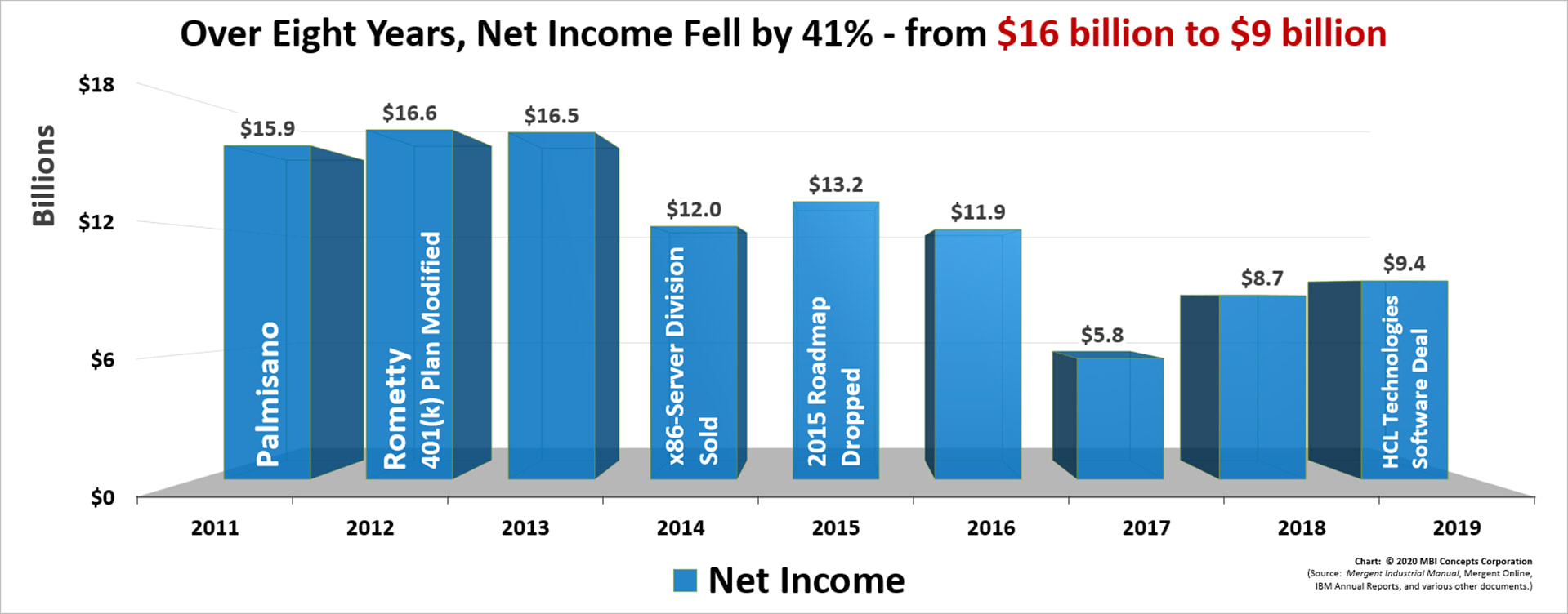

- Revenue fell by 28% and profits fell by 41%.

- How and why did the divestiture of the x86-Server Division impact corporate sales and profitability?

- Both sales and profitability fell because the x86-Server Division may have been a marginal business unit, but it had a value beyond the size of its margins.

These are excerpts from "THINK Again!: The Rometty Edition."

Virginia M. (Ginni) Rometty: Revenue and Profit Performance Deteriorated

- Selling off IBM’s Greatest Strength

- KPI #8: Revenue and Profit Performance Deteriorated

- Behavioral Changes to Consider Before Investing in IBM

Selling Off IBM’s Greatest Strength

"Customers once thought IBM was special. Its professional and ethical demeanor as well as the breadth of offerings ensured that one could get an audience with a company’s CEO. And with so many “solutions” there was always a reason to call on a variety of executives to talk about their business. …

"That environment no longer exists because today’s management doesn’t understand that sometimes even marginal business units have a value beyond the size of their margins [emphasis added]."

Former IBM Client Executive

KPI #8: Revenue and Profit Performance Deteriorated

To the chief executive, the x86-Server Division was a marginal business. Consider a few facts: (1) the majority of high-margin software sales were on IBM hardware; (2) services required hardware and software margins to be competitive; and (3) client executives in the largest and most productive customer accounts used marginal businesses to locate and close high-margin opportunities.

The x86-Server Division had a value beyond the size of its hardware margins. This information partially explains the 15% and 52% three-year drops in revenue and profits, respectively. Gerstner was right in one respect. There is a unique strength in offering “comprehensive solutions, a continuum of support.”

Behavioral Changes to Consider Before Investing in IBM

- Look for a recognition that an individually optimized, profit-driven, product portfolio is not the strategy that made the 20th Century IBM great, and that spinning off divisions because they aren’t profitable “enough” may spike profitability for a year, but it breaks critical long-term relationships with today’s customer recommenders who are tomorrow’s decision makers.

- IBM needs its top leadership and its middle and first-line management to be humble, approachable, intuitive, and a customer-driven management team that never stops fighting for its people who ensure right triumphs over might within the corporation.

Ultimately, it will take a significant change of heart within IBM’s leadership to turn the corporation around!

It has been fun. Good investing!

Cheers,

- Pete

It has been fun. Good investing!

Cheers,

- Pete

This is the end of the series on Virginia M. (Ginni) Rometty's performance as IBM's first female chief executive officer. Consider buying THINK Again! IBM CAN Maximize Shareholder Value: The Rometty Edition. If you started reading here, select either "button" below to get to the "Rometty Overview" page or start reading the key performance indicators in order by selecting the "Next Rometty KPI" button below.