Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Ginni Rometty's Dividend Strategy Performance

|

|

Date Published: July 19, 2021

Date Modified: June 30, 2024 |

Questions answered by Virginia M. (Ginni) Rometty's key performance indicator (KPI) #4:

These are excerpts from "THINK Again!: The Rometty Edition."

- How much money did Ginni Rometty spend on dividends?

- Did raising dividends every year compensate for the market’s lack of confidence in Rometty’s leadership and short-term strategies?

These are excerpts from "THINK Again!: The Rometty Edition."

Virginia M. (Ginni) Rometty: The Dividend Strategy Proved Pointless

- Watson Sr. May Have Coined the Term: "Widow’s and Orphan’s" Stock

- KPI #4: The Dividend Strategy Proved Pointless

- Behavioral Changes to Consider Before Investing in IBM

Watson Sr. May Have Defined the Term: "Widow’s and Orphan’s" Stock

We are responsible to more than 1600 stockholders—men, women, and children. … It is the money, in many cases belonging to widow’s and orphan’s; so, we have to deal with it in a serious and honest way." [See Footnote #1]

Thomas J. Watson Sr., One Hundred Percent Club, 1926

KPI #4: The Dividend Strategy Proved Pointless

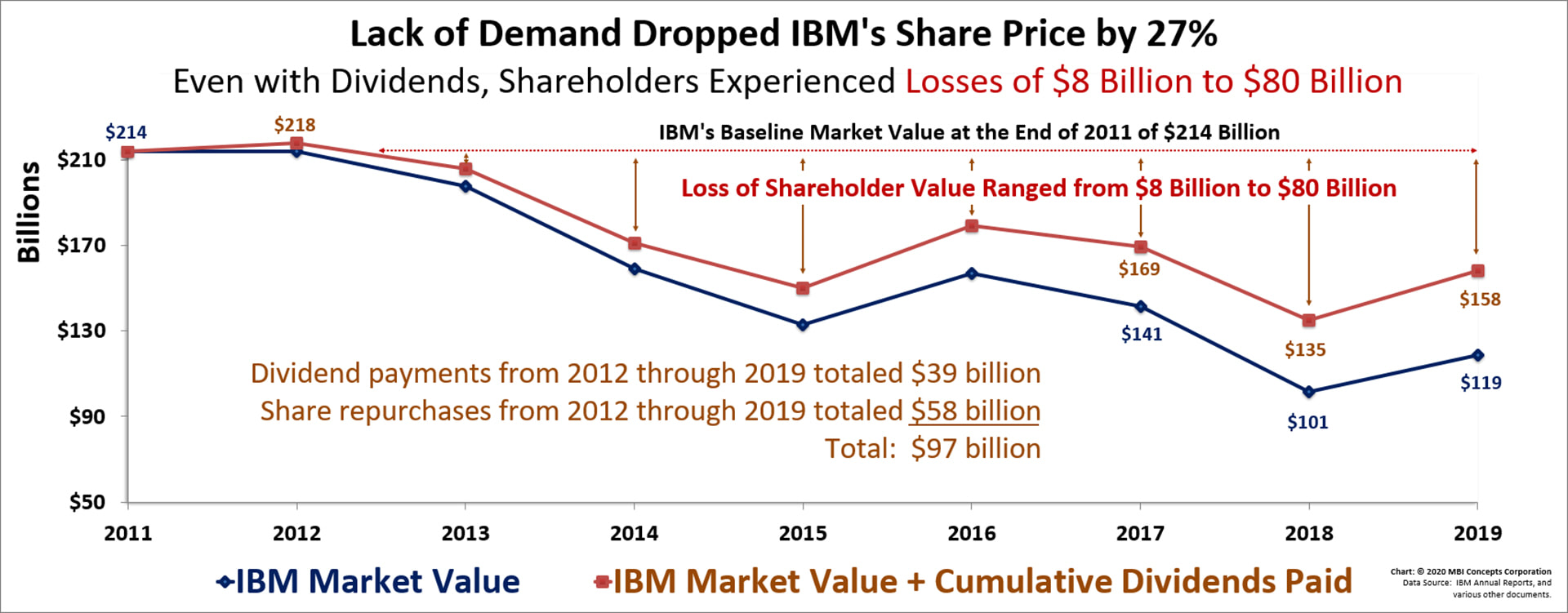

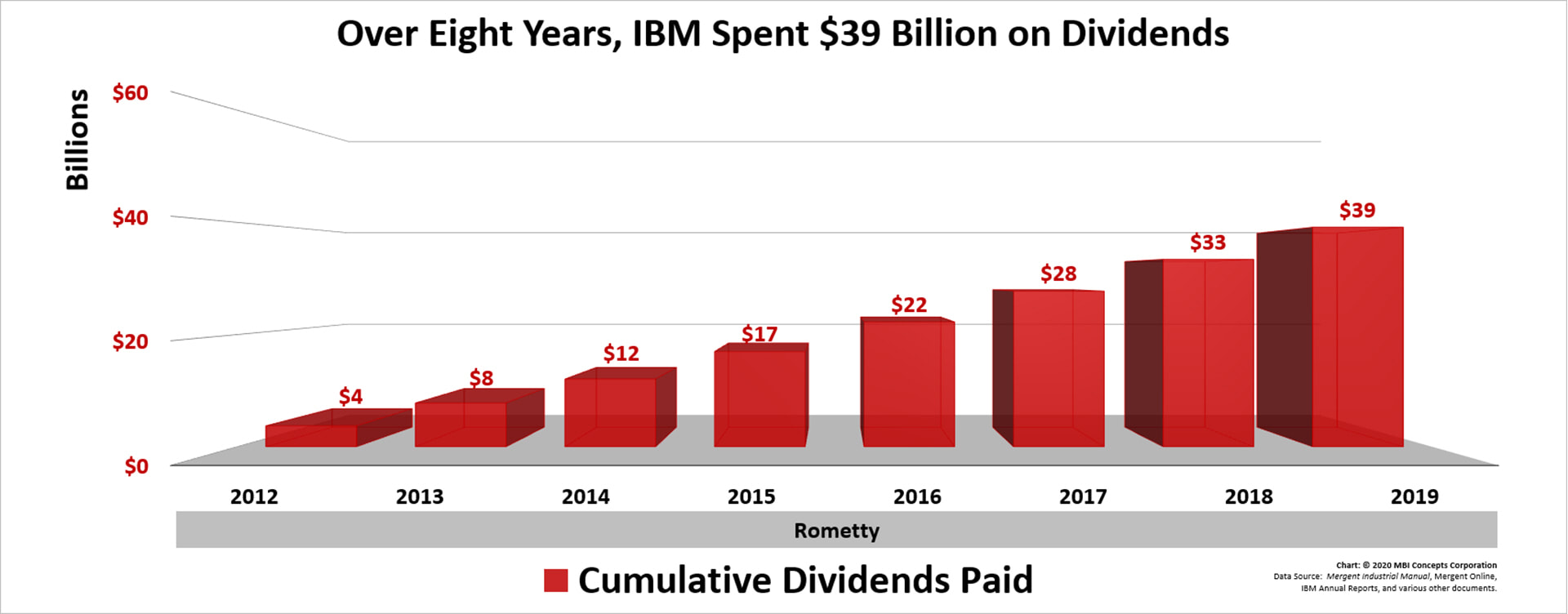

Shareholders, after the first year in the following eight-year analysis, lost anywhere from $8 billion to $80 billion because of falling market value—even considering the $39 billion the corporation spent on dividends.

It is a diversion to talk about the value of dividends or the corporation’s twenty-five-year history of ever-increasing dividends (Dividend Aristocrat), when an investor’s overall stock wealth, including dividends, falls by almost 40% (2018). The dividends paid below mean little to an investor in the face of such large losses. If an investor had to sell most anytime during the last decade, they would have lost money.

Because of IBM’s long-term drop in market value, its stock is no longer considered a “flight to safety” or a “widow’s and orphan’s” investment.

Behavioral Changes to Consider Before Investing in IBM

- To write about a stock’s dividend return as if it is the equivalent to a rate of return on a certificate of deposit is shortsighted and misleading. IBM needs a stable stock price again for dividends to matter. It needs to recover its brand image that it can, at a minimum, weather down economies. Then dividends can once again support the stock price—not until [How IBM Built its 20th Century Brand].

[Footnote #1] Today, a widow’s-and-orphan’s stock refers to an equity investment that is presumed low-risk (protects principle) but yields a stable dividend (i.e., provides income) that pays the rent. In 1956, shortly before Watson Sr.’s death, the annual report documented that, aside from institutional investors, shareholders were 48% women and 43% men, with the other 9% involving joint ownership.

Watson Sr.’s 1925 One Hundred Percent Club speech may have defined this term. This slogan was an insurance company (Equitable Insurance) tagline because it protected "widows and orphans" in the event of the death of the husband and father. This usage of the term in 1925 is the first recorded instance that the author has found that the "widows and orphans" term is used in reference to stocks.

Until Watson used this term—and IBM produced the results during the Great Depression—it would have seem ridiculous to have invested money in the stock market for a steady return. It was purely for speculative investments.

Watson Sr.’s 1925 One Hundred Percent Club speech may have defined this term. This slogan was an insurance company (Equitable Insurance) tagline because it protected "widows and orphans" in the event of the death of the husband and father. This usage of the term in 1925 is the first recorded instance that the author has found that the "widows and orphans" term is used in reference to stocks.

Until Watson used this term—and IBM produced the results during the Great Depression—it would have seem ridiculous to have invested money in the stock market for a steady return. It was purely for speculative investments.