If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

SFAS No. 142 eliminates the amortization of goodwill, requires annual impairment testing of goodwill and introduces the concept of indefinite life intangible assets. It was adopted on January 1, 2002. The new rules also prohibit the amortization of goodwill associated with business combinations that close after June 30, 2001.

IBM 2001 Annual Report

To understand how IBM's usage of this 2001 accounting change for its 224 acquisitions (2001-2023) listed here at a total cost of $99.2 billion (and $70.3 billion of Goodwill) has been increasing shareholder risk read this article: [Shareholder Risk]

|

Arvind Krishna's

Acquisitions and Goodwill Total Acquisitions: 39 acquisitions Total Outlay: $11.9 Billion Goodwill: $8.95 Billion List of Acquisitions: 2020 to 2023 |

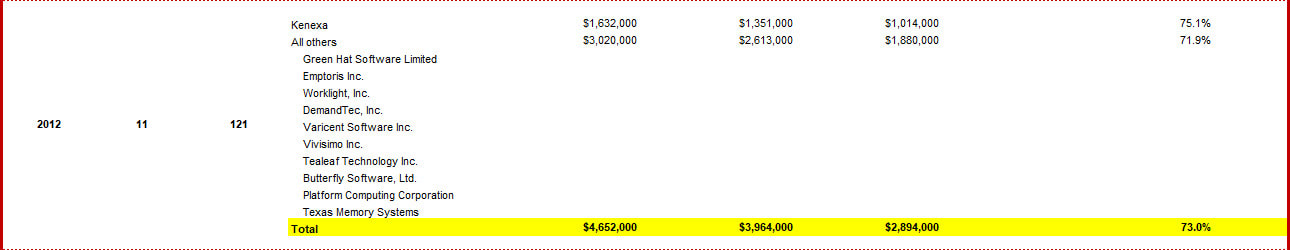

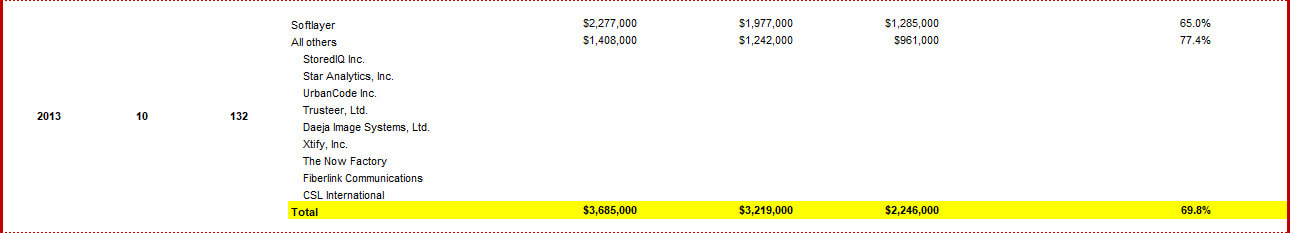

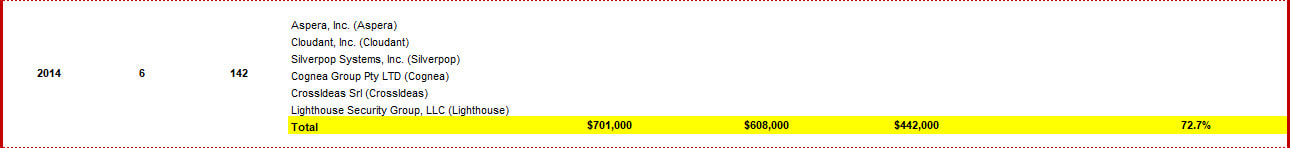

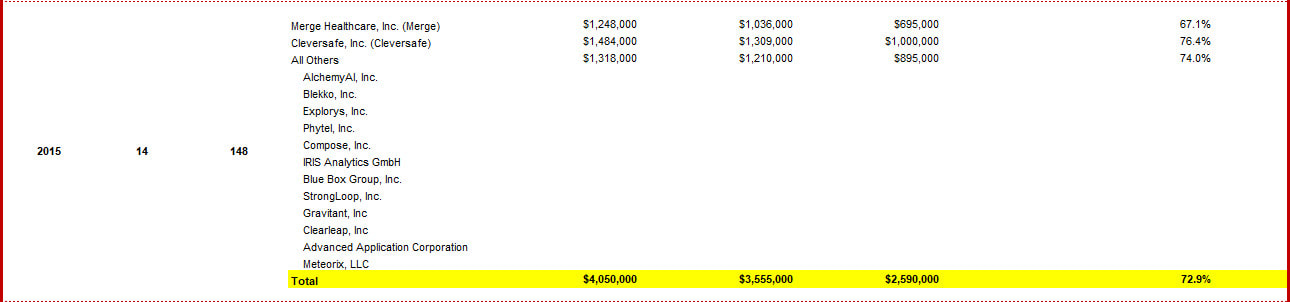

Virginia M. Rometty’s Acquisitions and Goodwill

Total Acquisitions: 64 acquisitions Total Outlay: $52.5 Billion Goodwill: $35.6 Billion List of Acquisitions: 2012 to 2019 |

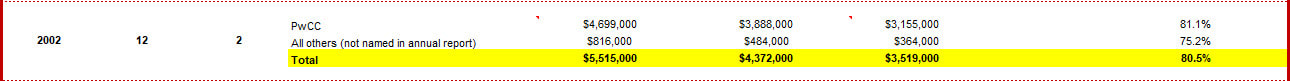

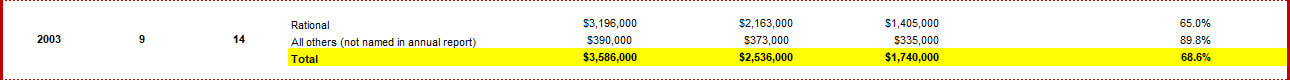

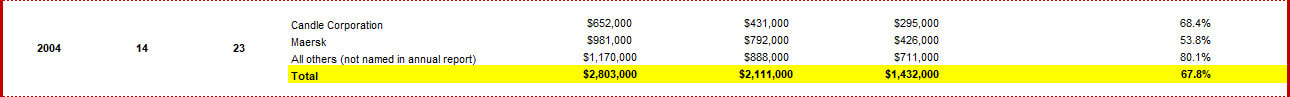

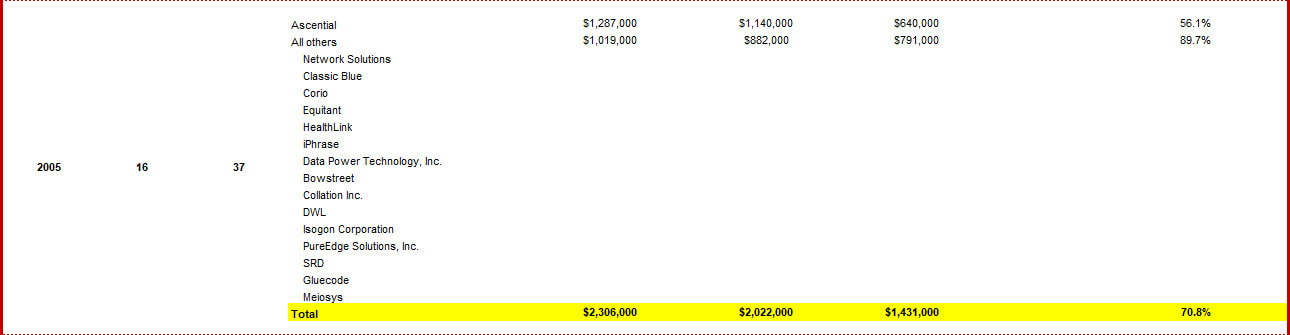

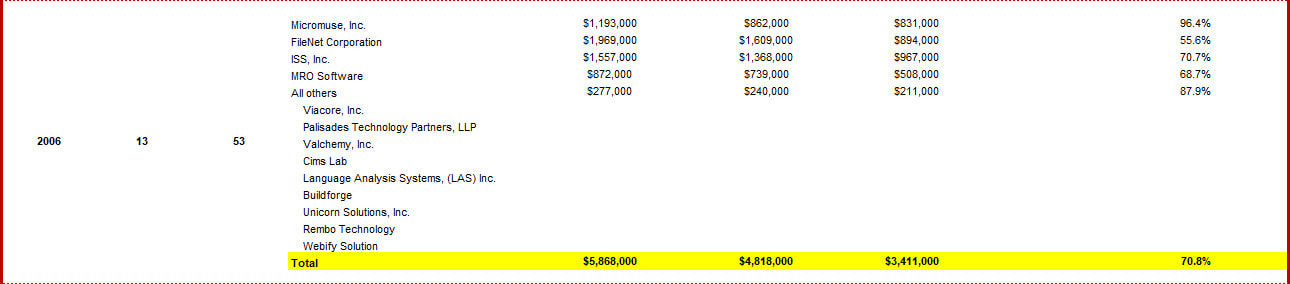

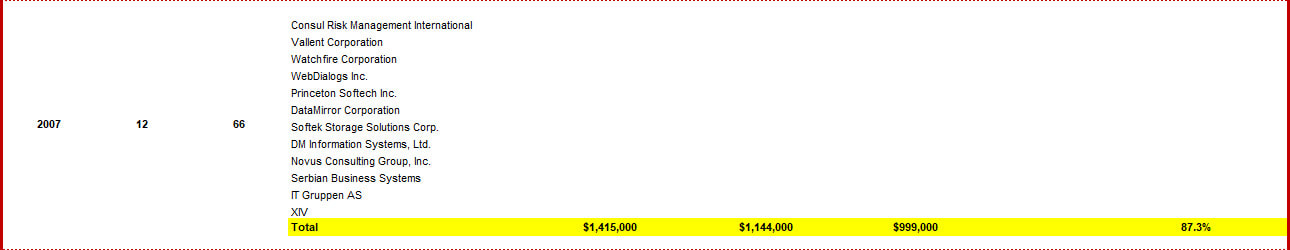

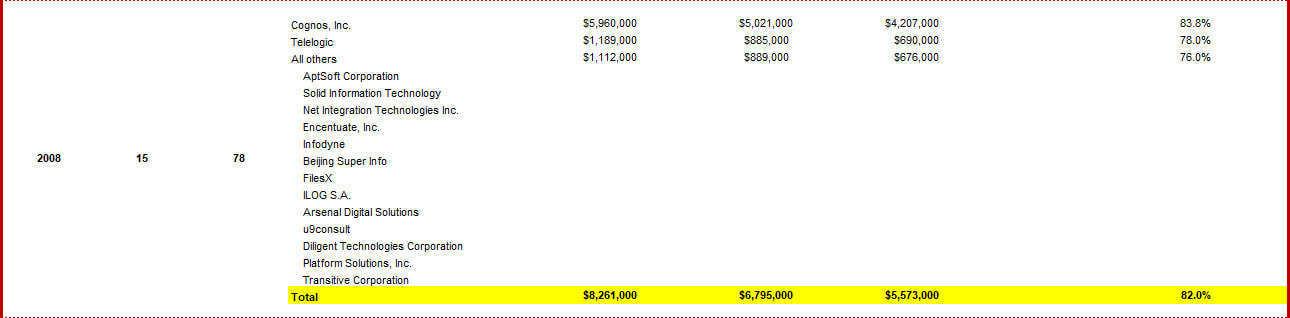

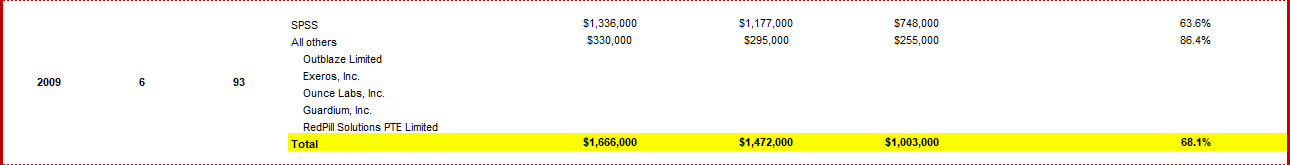

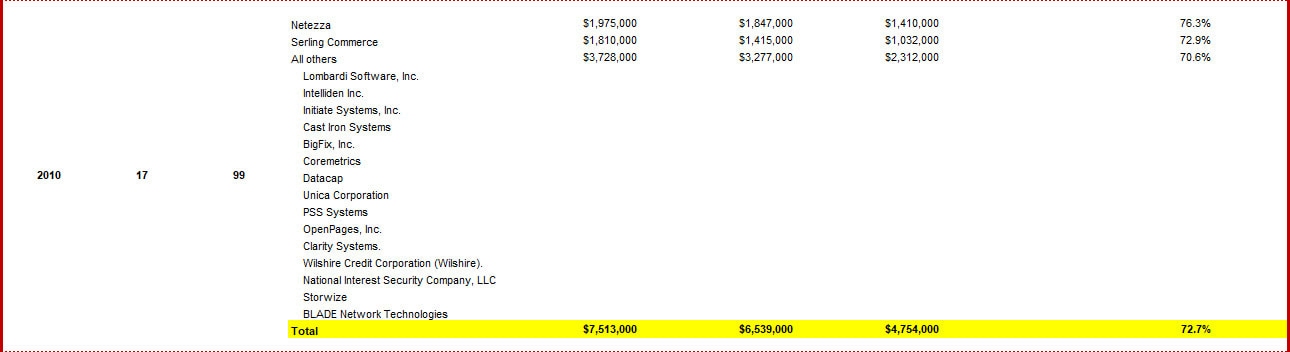

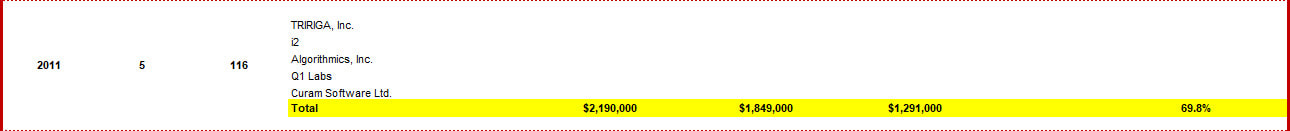

Samuel J. Palmisano’s Acquisitions and Goodwill

Total Acquisitions: 119 Acquisitions Total Outlay: $33.7 Billion Goodwill: 25.2 Billion List of Acquisitions: 2002 to 2011 |

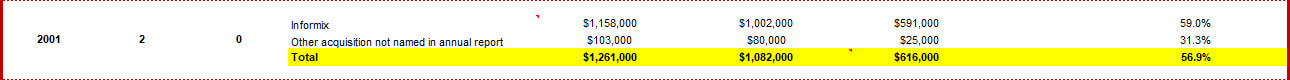

Louis V. Gerstner’s Acquisitions and Goodwill

Total Acquisitions: 2 Acquisitions Total Outlay: $1.1 Billion Goodwill: $.62 Billion List of Acquisitions: 2001 |

Louis V. Gerstner (select individual yearly image to enlarge or CTRL++ to zoom closer)

Samuel J. Palmisano (select individual yearly image to enlarge or CTRL++ to zoom closer)

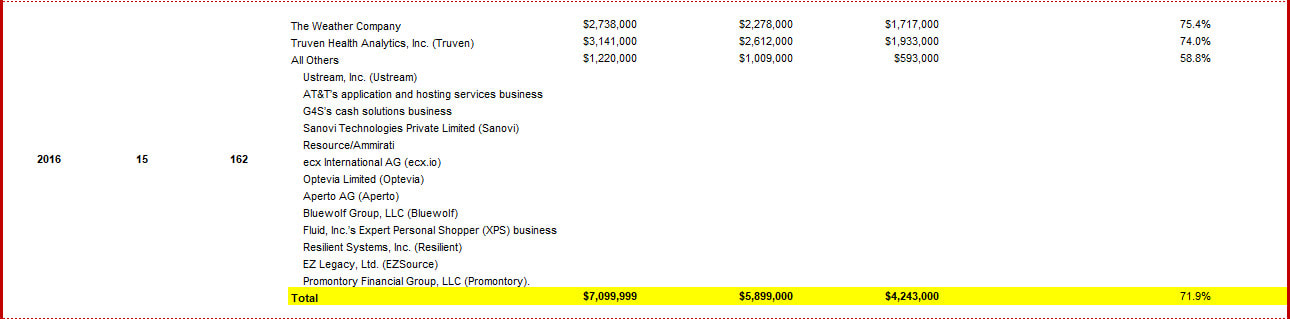

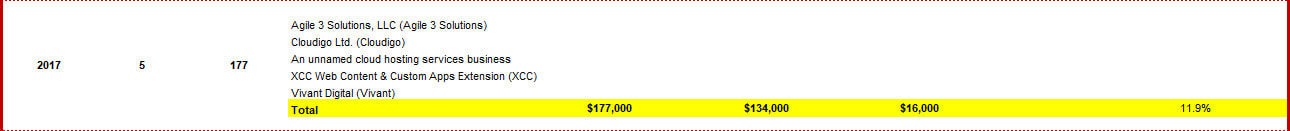

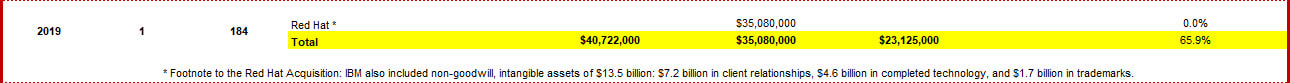

Virginia M. Rometty (select individual yearly image to enlarge or CTRL++ to zoom closer)

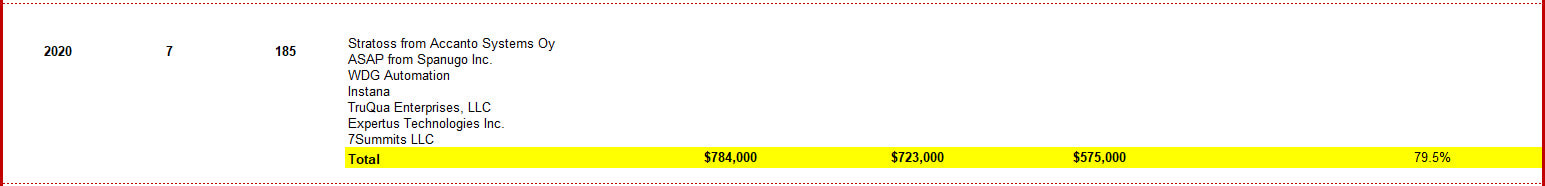

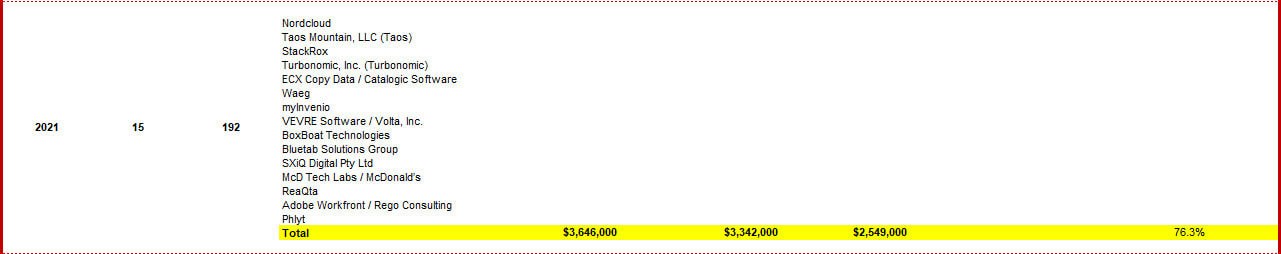

Arvind Krishna (select individual yearly image to enlarge or CTRL++ to zoom closer)

IBM Total Acquisitions and Goodwill 2001 through 2023 (select image or CTRL++ to zoom closer)