Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Ginni Rometty's Share Buyback Performance

|

|

Date Published: July 19, 2021

Date Modified: June 30, 2024 |

Questions answered by Virginia M. (Ginni) Rometty's key performance indicator (KPI) #3:

These are excerpts from "THINK Again!: The Rometty Edition."

- How much money did Ginni Rometty invest in share buybacks?

- From the perspective of market value and share price, was this money well spent?

These are excerpts from "THINK Again!: The Rometty Edition."

Virginia M. (Ginni) Rometty: The Supply-Side Market Strategy Failed

- At One Time, Market Value Mattered

- KPI #3: The Supply-Side Market Strategy Failed

- Behavioral Changes to Consider Before Investing in IBM

At One Time, Market Value Mattered to IBM

Market value, probably the most important measure of progress to investors, grew $24 billion [emphasis added].

Louis V. Gerstner, 1999 Letter to Investors

"The board of directors approved sweeping changes in executive compensation. They include innovative programs that ensure investors first receive meaningful returns—a 10 percent increase in the stock price—before IBM’s top 300 executives can realize a penny of profit from the stock option grants. … IBM's market value would have to increase by $17 billion [reaching $174 billion] before executives saw any benefit from this year’s option awards." [See Footnote #1]

Samuel J. Palmisano, 2003 IBM Annual Report

KPI #3: The Supply-Side Market Strategy Failed

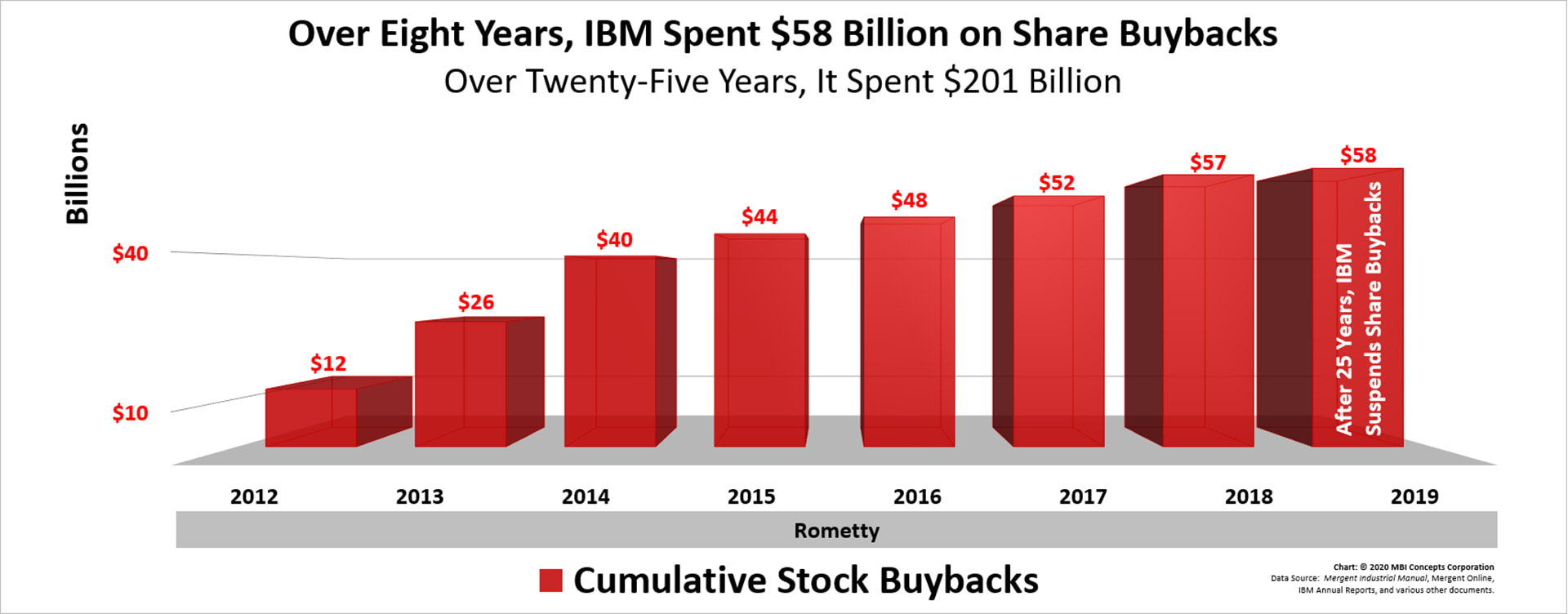

Reducing the number of shares through buybacks while market value was dropping—demonstrating a loss of confidence in the company—was meaningless. Rometty spent $58 billion in paper—greenbacks, on a different form of paper—stocks, rather than investing in business-first—people, processes and products.

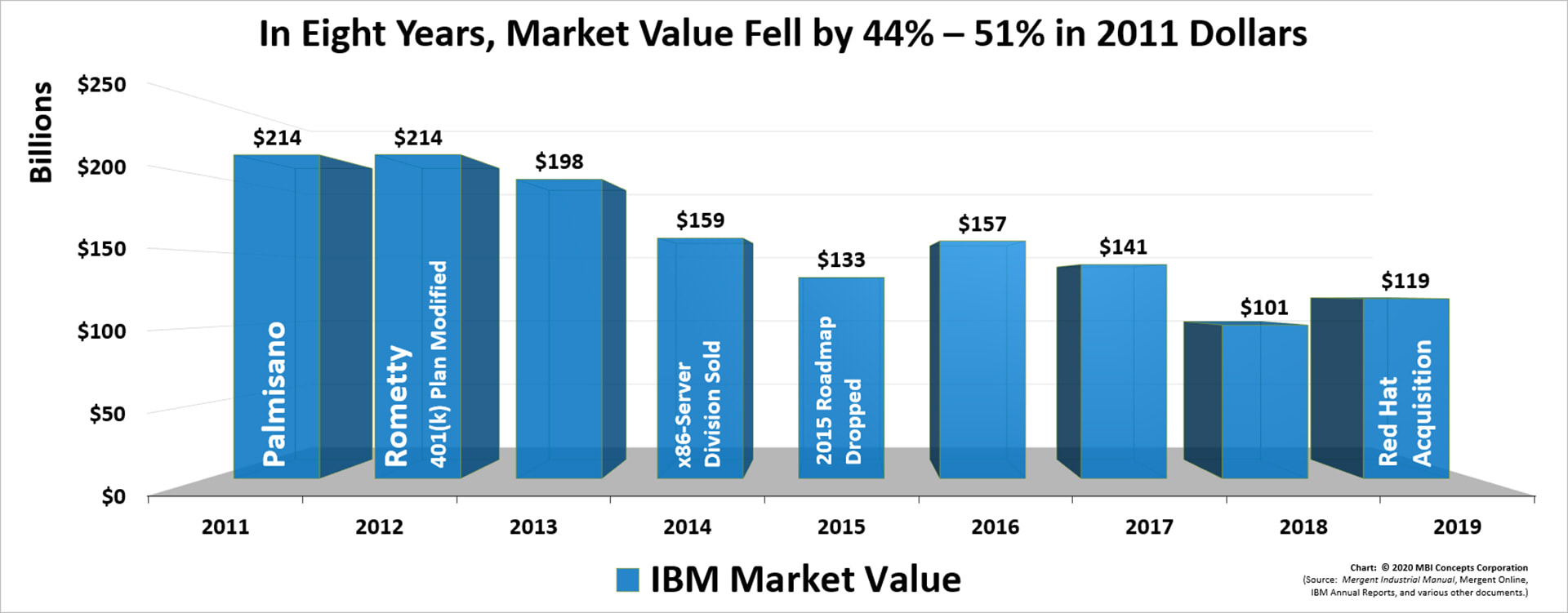

In eight years, IBM’s market value fell by 44%—more than 50% in 2011 dollars. This drop in market value exposes the stock-buyback dilemma: stock buybacks only address the supply side of the market-value equation.

In eight years, IBM’s market value fell by 44%—more than 50% in 2011 dollars. This drop in market value exposes the stock-buyback dilemma: stock buybacks only address the supply side of the market-value equation.

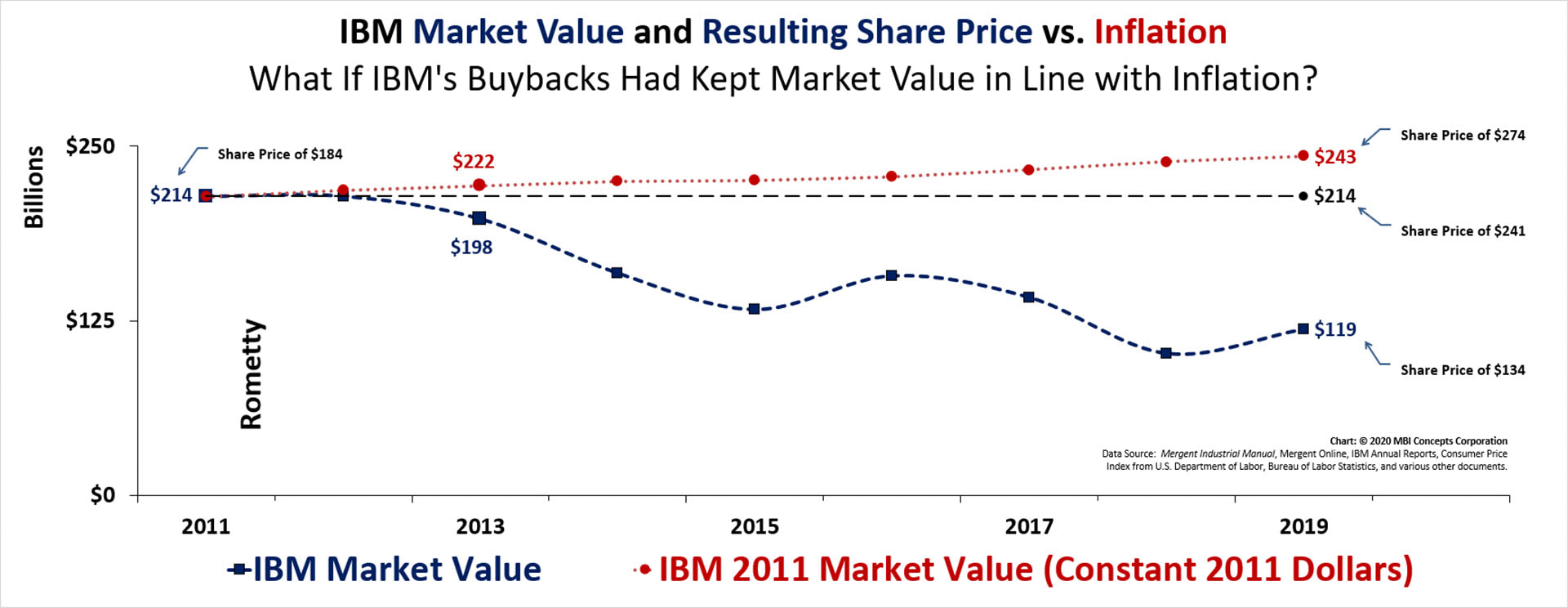

If this $58 billion investment in buybacks had just maintained the corporation’s 2011 market value, IBM’s share price—instead of $134 per share—at the end of 2019 would have been $241 per share. If the share buybacks had kept the corporation’s 2011 market value in line with inflation, the share price would have been $274 per share. [See Footnote #2]

A meaningful market value strategy addresses the demand side: building superlative products targeted at customers in growing markets; engaging employees to increase productivity; communicating with shareholders to increase stickiness; and investing in community relations to strengthen brand image.

A meaningful market value strategy requires more than reducing the supply of paper when there is dwindling demand for the paper in the first place.

A meaningful market value strategy requires more than reducing the supply of paper when there is dwindling demand for the paper in the first place.

Behavioral Changes to Consider Before Investing in IBM

- The board of directors should shift management’s focus from earnings per share back to a market value measurement—even if IBM’s top 300 executives fail to realize a “penny of profit.” There should also be some comparative measurements with the competition.

- A shift from a supply-side strategy to a demand-side strategy by shifting the corporation’s investment in share buybacks (paper and ink) and returning to its formerly significant—and industry-changing—investment in people, processes and products [similar to IBM’s mainframe investment in the 1960s].

[Footnote #1] In 2004, IBM only increased its market value by $5 billion to $162 billion—missing this executive compensation target. IBM’s stock price closed on December 31, 2003 at $92.680 and on December 31, 2004 at 98.580. This was a stock price increase of only 6.4%, considerably below the 10% target. There is no mention in the 2004 or 2005 annual reports how IBM’s top 300 executives reacted to missing every “penny of profit.” Market value then fell below the 2003 level until 2009 when it reached $171 billion—still less than the target set six years earlier. The 2004 market value set as the executive compensation target wasn’t reached until the end of 2010—seven years later—when it reached $180 billion. Market value peaked in 2012 and lost 44% of its value—coming to rest at $119 billion at the end of 2019.

[Footnote #2] This would be higher without the diluting effect of shares issued for stock-based compensation.

[Footnote #2] This would be higher without the diluting effect of shares issued for stock-based compensation.