Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Ginni Rometty's Shareholder Risk Performance

|

|

Date Published: July 19, 2021

Date Modified: June 30, 2024 |

The question answered by Virginia M. (Ginni) Rometty's key performance indicator (KPI) #2:

These are excerpts from "THINK Again!: The Rometty Edition."

- What has been a major side effect of Ginni Rometty's focus on growth through acquisitions instead of internal research and development?

These are excerpts from "THINK Again!: The Rometty Edition."

Virginia M. (Ginni) Rometty Maximized Shareholder Risk - Goodwill

- Learning From the Past: As a Country, We Have Been Here Before

- KPI #2: Maximized Shareholder Risk - Goodwill and Intangible Assets

- Behavioral Changes to Consider Before Investing in IBM

Learning From the Past: As a Country, We’ve Been Here Before

The farmer cannot inflate the value of his land. … the laborer cannot inflate the value of his labor. … the merchant cannot inflate the value of the goods upon his shelves. … Squeeze the water [goodwill] out of the stock and there will be a flood for a while, but there will be honest corporations afterward.

William Jennings Bryan, 1900

KPI #2: Maximized Shareholder Risk – Goodwill and Intangible Assets

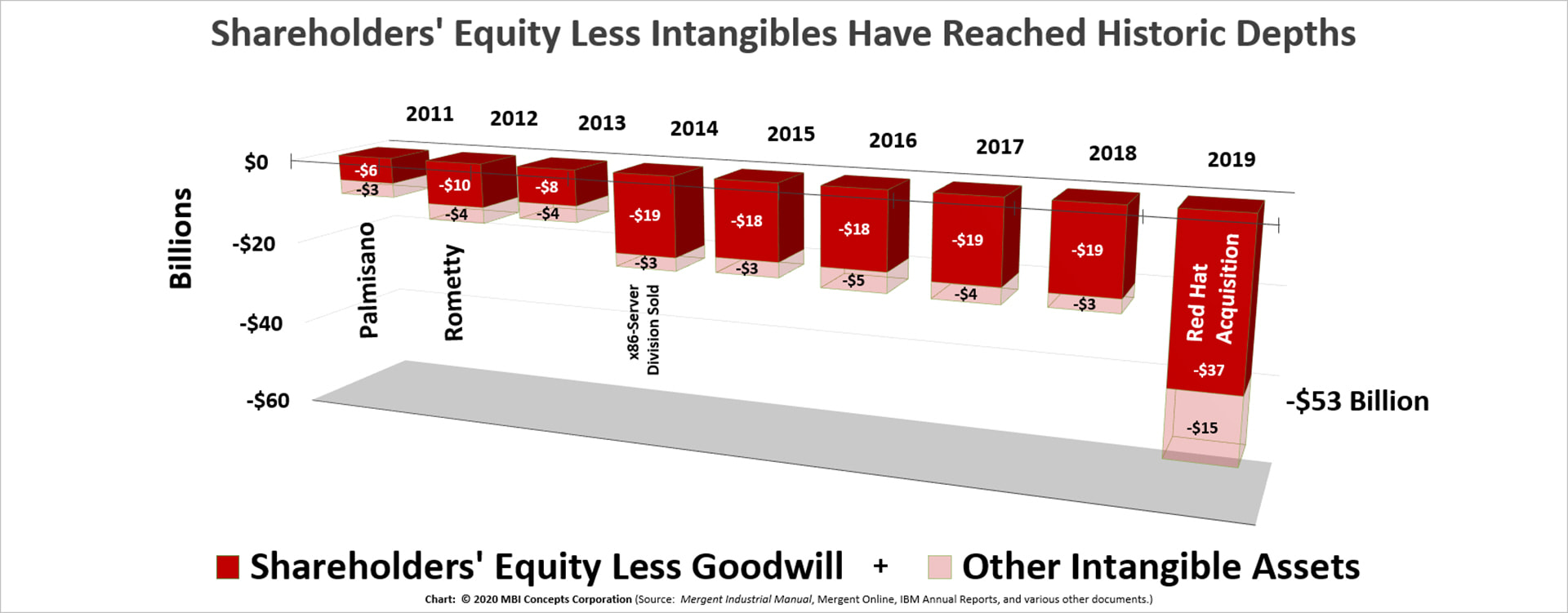

Goodwill, an intangible asset from acquisitions, has significantly inflated the corporation’s total assets—water on the books that should be squeezed out of any stock valuation. Of Ginni Rometty’s sixty-four acquisitions, Red Hat was her defining moment. This acquisition increased the corporation’s percentage of goodwill from 29% to 38%. Altogether, intangible assets increased from $39 billion to $73 billion. Intangibles are now half of total assets.

Shareholder equity less these intangibles is significantly in the red. Shareholders’ negative equity is at a level not experienced since IBM was known as the C-T-R Company. If hard times hit again, these intangible assets will have little value in contrast to the very tangible real estate assets Lou Gerstner sold off in the Crisis of 1992–93.

Shareholder equity less these intangibles is significantly in the red. Shareholders’ negative equity is at a level not experienced since IBM was known as the C-T-R Company. If hard times hit again, these intangible assets will have little value in contrast to the very tangible real estate assets Lou Gerstner sold off in the Crisis of 1992–93.

Although there are actuarial ways to avoid taking a goodwill impairment, there are ethical and practical reasons to squeeze this brackish water from the books.

Ethically, the company should not inflate the value of its assets. Practically, if market value falls too far Arvind Krishna may be forced to take an unscheduled goodwill impairment. [See Footnote #1] In one way of looking at the corporation’s fixed value of intangible assets, if IBM’s share price falls to $83 per share, the corporation’s market value will equal the value of its intangible assets. Is the corporation at that point valued as nothing but water? Probably not, but it points to an intangible asset problem with the books.

Ethically, the company should not inflate the value of its assets. Practically, if market value falls too far Arvind Krishna may be forced to take an unscheduled goodwill impairment. [See Footnote #1] In one way of looking at the corporation’s fixed value of intangible assets, if IBM’s share price falls to $83 per share, the corporation’s market value will equal the value of its intangible assets. Is the corporation at that point valued as nothing but water? Probably not, but it points to an intangible asset problem with the books.

Behavioral Changes to Consider Before Investing in IBM

|

- IBM’s Board of Directors and auditors should begin a thorough reevaluation of IBM’s 185+ acquisitions and their current book value [this a list of the corporation’s acquisitions from 2001 to 2019]. Until the situation is under control, the corporation should include in its annual reports a chart similar to its five-year shareholder returns but in this case, show a five-year shareholder equity less intangibles trend. [Read about IBM’s one-hundred year battle with goodwill]

[Footnote #1] One example is CenturyLink. In 2019, the corporation took a goodwill impairment of $6.5 billion. In the press release it wrote, “The continued decline in CenturyLink’s stock price during the first quarter was considered a triggering event requiring completion of a goodwill impairment analysis. Based on this analysis, the company recorded a non-cash $6.5 billion goodwill impairment charge driven by the difference between the company’s market capitalization and carrying value [emphasis added].”