Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Arvind Krishna's Overview Home Page

|

|

Date Published: July 22, 2021

Date Modified: April 10, 2024 |

This page was initially published on February 3, 2020. Information linked to from this site is now updated with IBM's 2020-2023 performance information to properly reflect Arvind Krishna's four-year performance as IBM's chief executive officer.

The information was updated to reflect the loss of James (Jim) Whitehurst. One has to wonder how many Red Hat employees have followed the former IBM-Red Hat President's example? Since IBM paid $3,000,000 per Red Hat employee for the company, the losses mounted up pretty quickly. No one apparently knows all the reasons for Jim's departure. Maybe he is saving the details for his "Who Ever Thought That Elephant Danced?" memoir. It will be a best seller!

The information was updated to reflect the loss of James (Jim) Whitehurst. One has to wonder how many Red Hat employees have followed the former IBM-Red Hat President's example? Since IBM paid $3,000,000 per Red Hat employee for the company, the losses mounted up pretty quickly. No one apparently knows all the reasons for Jim's departure. Maybe he is saving the details for his "Who Ever Thought That Elephant Danced?" memoir. It will be a best seller!

Evaluating Arvind Krishna: IBM’s Tenth Chief Executive Officer

- In 2020, Arvind Krishna Did Not Have Time to Waste

- Arvind Krishna's Critical Performance Metrics and Evaluation Points

In 2020, Arvind Krishna Should Have Acted Quickly

As Arvind Krishna was determining what he would do first, he should have considered prioritizing four activities:

- He should have: returned IBM’s Human Resources organization to its original function and purpose as a Human Relations organization. This would have improved employee productivity by increasing employee engagement, passion and enthusiasm. A human resources organization should not be the right arm of finance to help the corporation achieve quarterly, earnings-per-share targets.

In his four years in the corner office at IBM, Arvind Krishna has failed in this respect. Although it may appear employee productivity is improving, this is only because of inflation and cost increases passed on to IBM's customers, not any business-first philosophy of making people more productive, processes more effective, and products more valuable. - He should have: focused on maximizing stakeholder value to rebuild a sustainable stakeholder ecosystem. It was this ecosystem of customers, employees, shareholders, and societies that supported the corporation through its first eight decades. This meant rejecting the two extremes of maximizing shareholder value: shareholder-first and -foremost and me-first and -only.

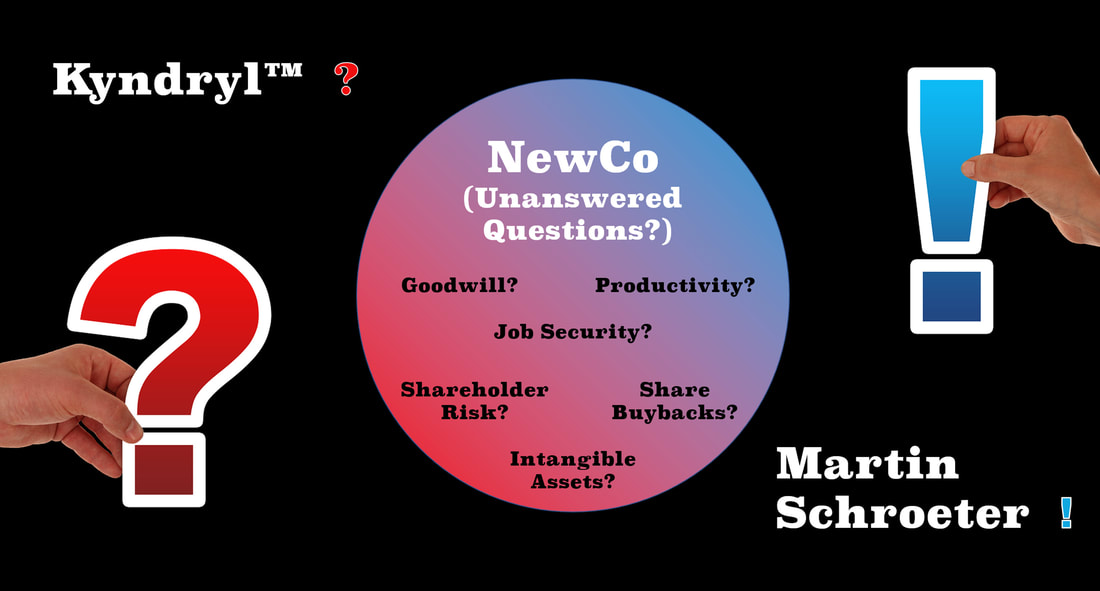

In this respect, Arvind Krishna has so far resisted--unlike his predecessors, spending money on share buybacks. Will he eventually buckle under pressure despite their failure in the past?

- He should have: taken goodwill impairments down and started with a clean slate: neither IBM nor Kyndryl should have started their new life apart with intangible assets of over 50%.

Another failure as shareholder risk has continued to rise. If IBM fails as a business over 50% of its assets have little to no value for shareholders which is a risk most investors fail to consider.

- He should have: ensured that James M. Whitehurst stuck around. IBM needed a true salesman or saleswoman in the corner office.

Jim was a chance—lost, in this area.

As always, the perspectives shared here are not Wall Street quarterly perspectives but a businessman’s perspective of years, decades, and, at times, centuries. So, don't expect to find insights into minor bumps on the business roadmap like one or two quarters of revenue growth. After all, Ginni had some of these positive, short-term growth "irregularities" too, but she still turned in horrible year-over-year and long-term revenue growth numbers.

|

Two other American industrialists who believed in adapting the Golden Rule to business were Thomas J. Watson Sr. and J. C. Penney.

|

IBM’s way forward is contained in this quote of Owen D. Young, former Chief Executive Officer of General Electric and a former Chairman of the Federal Reserve Bank.

"What is right in business requires, in highly complicated situations, that the golden rule be applied by men [and women] of great understanding and knowledge, as well as conscience. They must be technicians in the sense of making the connecting link between the golden rule on the one side and the most complicated business transaction on the other."

Owen D. Young, Delivered from Dr. Fosdick's New York Church, 1929

|

|

Mr. Arvind Krishna has a hard task in front of him: restoring the engagement, passion and enthusiasm of 305,300 employees—already down 20.5% or 78,500 employees since the end of 2019. If he is to bring IBM back, he will have to be a technician in Mr. Young’s sense: an individual who understands human nature first and technology second. This should be—no, must be—his overriding first initiative.

Unfortunately, I have worked in one of Arvind's organizations. Unless he has transformed "himself" in the last decade, he may have the desire but lack the ability to transform "his corporation." Although he is a "pleasant" individual, he is first and foremost a technologist with little sales sense. It is in this respect that Jim's loss was most felt: salesmanship. Cheers, - Pete |

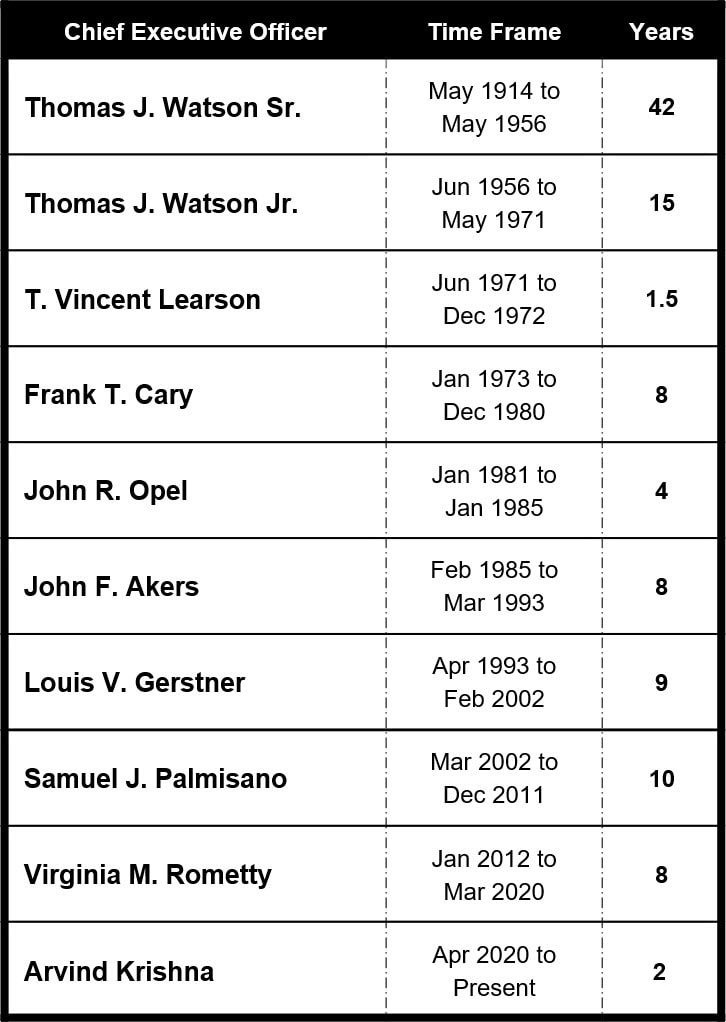

All of IBM's Chief Executive Officers with their dates and years of service.

|

Arvind Krishna's Critical Performance Metrics and Evaluation Points

When he retires I will again, hopefully, publish the third update in the "THINK Again" Series updating "THINK Again: The Rometty Edition" to "THINK Again: The Krishna Edition."

Until then, enjoy this yearly update of Arvind's key performance metrics. |

|

Let’s graph Krishna’s 2020 performances, and then put those performances within the context of the corporation’s 21st Century results.

|

|

Is there an IBM “New Deal?” Or is Arvind serving up the same old Gerstner-Palmisano-Rometty (GPR) stuff?

|

|

Reality will set in soon enough because when it comes to business fundamentals, Main Street and corporate stakeholders have proven themselves better able to understand long-term realities than Wall Street.

|

Does his track record as IBM's CFO indicate that he was a good choice?

|