If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

Challenging Forbes' Best Employers List

|

|

Date Published: July 26, 2021

Date Modified: April 16, 2024 |

While reading this article, consider that two years later—in February 2024, IBM has fallen all the way from 3rd to 170th in Forbes List of "Best Large Employers." No, I did not have the data with which to offer a knowledgeable opinion if Samsung or Amazon deserved the #1 and #2 spots, respectively, on Forbes’ 2020 Best Employers list, but I did have enough data and experience, though, to have had serious doubts if IBM deserved to be recognized as the world’s third-best employer.

Thankfully, we live in a democracy supported by an economic system that encourages the free flow of information and divergent opinions. After reading this article—whether you agree or disagree—your thoughts are appreciated and will be respected.

Thankfully, we live in a democracy supported by an economic system that encourages the free flow of information and divergent opinions. After reading this article—whether you agree or disagree—your thoughts are appreciated and will be respected.

Challenging Forbes' 2020 World's Best Employers List

- With All Thy Getting, Get Understanding

- "Getting" Information for Forbes' 2020 World's Best Employers

- Why Challenge Forbes' 2020 Best Employer's Ratings?

- The IBM Stories Forbes Missed

- IBMers Aren't Buying What IBM is Selling

- Engaged, Enthusiastic and Empowered Employees are Productive

- Contradictory Industry Data about the Corporation

- IBM Documents its Actions, Not the Effectiveness of its Activities

- This Author's Thoughts: "Where is Forbes' Understanding?"

While reading this article, consider that in February 2024 IBM has fallen all the way to 170th in Forbes List of "Best Large Employers." It seems that this article was prescient in its writing, doesn't it?

With All Thy Getting, Get Understanding

|

Let’s start with one of my favorite sayings from B. C. Forbes, the founder of Forbes, which I just recently learned (April 16, 2024) is from Proverbs 4: 1-9. This was his and his son's (Malcolm's) tagline for their "Fact and Comment" editorials in Forbes from at least 1921 through 1955.

Get understanding! “With All Thy Getting, Get Understanding.” B. C. Forbes, Forbes, “Fact and Comment” editorial tagline

|

Select Image to read Forbes book reviews

|

"Getting" Information for Forbes' 2020 World's Best Employers

Here is the methodology that Forbes used (partnered with Statista) in the “Getting.”

- Anonymous survey of 160,000+ full- and part-time worldwide workers

- Respondents:

- Rated willingness to recommend their employer to friends and family

- Rated other employers in their respective industries

- Rated companies on:

- Image

- Economic footprint

- Talent development

- Gender equality

- Social responsibility

Why Challenge Forbes' 2020 Best Employer's Ratings?

In very few words, employee engagement matters, and these surveys carry the implication that employees at these corporations are engaged, passionate and enthusiastic. Gallup believes in employee engagement. Deloitte believes in employee passion. Tom Watson Sr. looked in the eyes of his employees for enthusiasm. No matter which of these employee morale indicators an individual believes, IBM comes up short, and Forbes’ placement of IBM at the top of this hierarchy means that its methodology should be reviewed, or the Forbes' brand suffers every time someone, who knows better, looks at this list.

Consider the following thoughts because IBM needs drastic changes, and Forbes’ placement of the corporation on the winner’s pedestal is not performing a needed service for our country or the corporation. Forbes is failing to highlight a corporation that at one time did represent the best in Corporate America but no longer. In fact, Forbes’ failure to dig deeper and sanity check its information is a great disservice. A free press carries great responsibilities in a democracy, and Forbes has failed to shoulder one of those responsibilities in its traditional area of expertise: business and commerce.

There are several indications that IBM’s employees are not engaged, enthusiastic or passionate. Let’s start with their lack of enthusiasm to be employee-owners.

Consider the following thoughts because IBM needs drastic changes, and Forbes’ placement of the corporation on the winner’s pedestal is not performing a needed service for our country or the corporation. Forbes is failing to highlight a corporation that at one time did represent the best in Corporate America but no longer. In fact, Forbes’ failure to dig deeper and sanity check its information is a great disservice. A free press carries great responsibilities in a democracy, and Forbes has failed to shoulder one of those responsibilities in its traditional area of expertise: business and commerce.

There are several indications that IBM’s employees are not engaged, enthusiastic or passionate. Let’s start with their lack of enthusiasm to be employee-owners.

The IBM Stories Forbes Missed

In a world of "big data" maybe we should consider accepting that we live in a world of "uncomfortable data" too—especially when the "big data points" point in two different directions. When it does, maybe a human being should get involved?

- IBMers Aren't Buying What IBM is Selling

IBM has had an employee stock purchase plan since 1958. In 1990, Tom Watson Jr. wrote in Father, Son & Co. that “the model corporation of the future should be largely owned by the people who work for it.” He wrote of the challenges he faced getting individuals to buy into the corporation.

One friend told me how excited he would get when the percentage he contributed from his every paycheck to the stock purchase plan would finally buy a single share of IBM stock.

He found forever memorable those intermittent purchases of a single stock which only happened once or twice a year. He was a dedicated employee-owner. He was a believer in the company. Yet, one has to feel that if Tom Watson Jr. were alive today, he would be saddened by the current lack of employee ownership in his corporation.

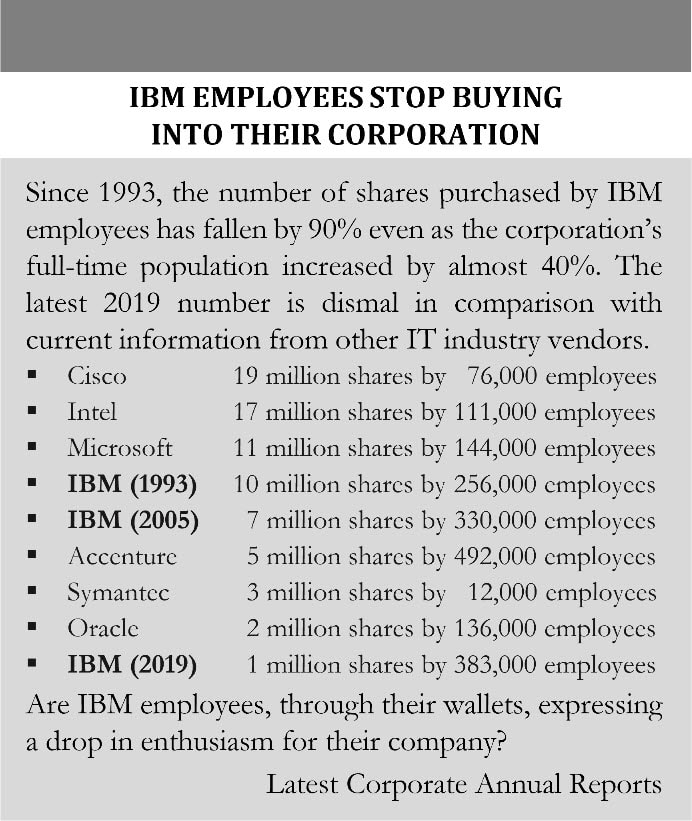

IBM’s employees have been showing a decreasing enthusiasm to take advantage of their corporation’s employee stock purchase plan. In fact, the number of shares purchased by employees in 2018, 2019, 2020 and 2021 hasn’t been so low since the early ’70s—a half century ago. And this was a time when salaries were significantly lower, and the share price was—as a proportion of salaries—exorbitantly higher: $402.00 a share at the end of 1972.

Yes, as my friend remembered, at times it took a year to buy a single share.

Yes, as my friend remembered, at times it took a year to buy a single share.

|

According to IBM's 2021 Annual Report, the ESPP discount was increased from 5% to 15% in April 2022.

|

When a corporation, such as IBM, fails to provide transparent information such as audited employee engagement numbers, one has to seek alternative methods to cut through the opaqueness of its annual reports to examine the degree of employee engagement or disengagement; and IBMers have been losing their enthusiasm to own the corporation’s stock since the turn of the century (the last time it hovered around 10 million shares purchased in a single year).

According to IBM's 2021 Annual report, "Employees purchased approximately one million shares under the ESPP during each year ending December 31, 2021, 2020, 2019 and 2018." As the sidebar documents, share purchases are not on par with the corporation’s competitors. Cisco, Intel and Microsoft employees put IBM employees to shame. The chart also documents the collapse of the employees' desire to invest in the company: in 1993 256,000 employees purchased 10 million shares; In 2019, 383,000 employees purchased "approximately" one million shares. This "approximately one million shares" continued another two years until 2021. |

As noted in the caption of the sidebar above, IBM increased its discount from 5 percent to 15 percent off the average market price on the date of purchase in early 2022. As the following note from the 2023 Annual Report documents, there was an increase in the number of shares purchased. Unfortunately, it would only move IBM from the bottom of the chart above two places just edging out Symantec which only has 12,000 employees. IBM's 2023 Annual Report documents that "employees purchased approximately 3.1 million, 2.4 million and 1.0 million shares under the ESPP during the years ended December 31, 2023, 2022 and 2021, respectively."

Consider these two metrics: (1) Since 1993, a low point for IBM employment, although the corporation’s full-time population has increased by almost 40%, the number of shares purchased by employees has fallen by 90%, and (2) the employees of competitors purchase from two to nineteen times more shares—even those with significantly fewer employees. [See Footnote #1]

These measurements alone should shake the foundation of the Forbes’ podium beneath IBM.

But let’s continue. …

But let’s continue. …

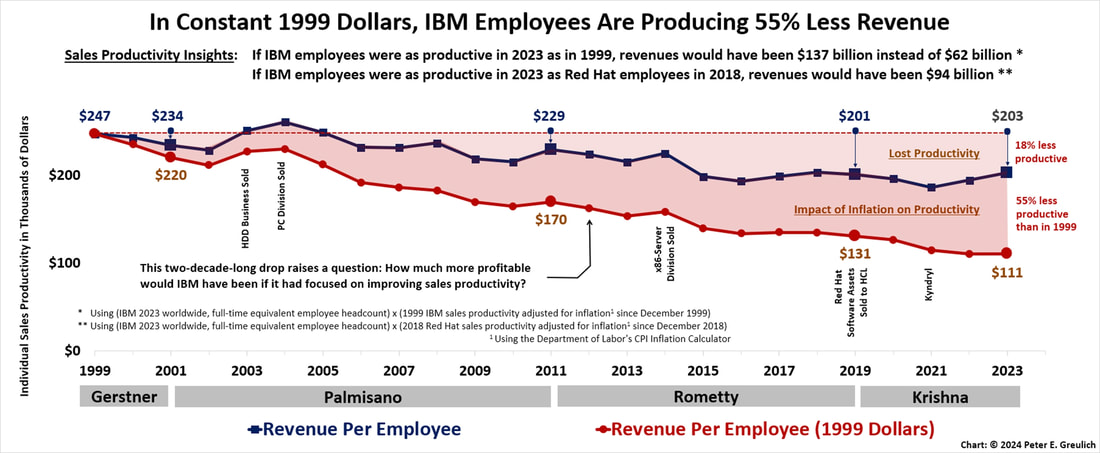

- Engaged, Enthusiastic and Empowered Employees are Productive

The next two charts require little comment other than to point out that these are productivity numbers which is a better measurement than raw revenue attainment. Acquisitions should drive revenue up; divestitures usually drive revenue down; but if sales productivity declines it is a concern because the corporation isn’t effectively selling what it has, is acquiring the wrong technology, or is divesting the wrong organizations. IBM’s Chief Financial Officer in almost every analysts’ review adjusts revenue for divestitures but rarely, if ever, acquisitions. If he ever discussed sales productivity, most of the analysts would faint because sales productivity transcends such financial games.

If employee productivity declines, whether it involves an acquisition or a divestiture, a war room should be convened to understand why and take corrective action—at a minimum don't keep making the same mistakes.

Sales productivity is a corporate-wide measurement of the effect corporate actions have on the ability and/or desire of the individual employee to get their sales job done. Since 1999, IBM's strategies and policies have dropped sales productivity through 2023 by 18%—55% considering inflation.

If employee productivity declines, whether it involves an acquisition or a divestiture, a war room should be convened to understand why and take corrective action—at a minimum don't keep making the same mistakes.

Sales productivity is a corporate-wide measurement of the effect corporate actions have on the ability and/or desire of the individual employee to get their sales job done. Since 1999, IBM's strategies and policies have dropped sales productivity through 2023 by 18%—55% considering inflation.

Including inflation, if an IBM employee were as productive in 2023 as in 1999, revenues would have been $137 billion instead of $62 Billion; and if an IBM employee was as productive in 2023 as a 2018 Red Hat employee, revenues would have been $94 billion. As this chart documents, IBM's employee productivity has been dropping for over two decades.

Profit productivity, unlike sales productivity, is a number that can be distorted by either aggressive bookkeeping or financial engineering. In this century, IBM has used both. Aggressive bookkeeping has shifted money by raiding worldwide pension plans, reducing employee benefits, and selling tangible assets—even whole divisions; financial engineering has shifted jobs overseas with a "worldwide" workforce rebalancing strategy. International workload rebalancing, highlighted in the chart below, enabled IBM to increase profit productivity while hiring a net increase of 150,000 people in low-wage countries and resourcing at least 50,000 employees in high-wage countries like the United States and Europe.

In the 2011-2013 timeframe, this profit-driven, financial gamesmanship obviously hit a brick wall. As the chart below documents, from 2013 through 2023, IBM's profit productivity—considering inflation—has fallen 47%.

Profit productivity, unlike sales productivity, is a number that can be distorted by either aggressive bookkeeping or financial engineering. In this century, IBM has used both. Aggressive bookkeeping has shifted money by raiding worldwide pension plans, reducing employee benefits, and selling tangible assets—even whole divisions; financial engineering has shifted jobs overseas with a "worldwide" workforce rebalancing strategy. International workload rebalancing, highlighted in the chart below, enabled IBM to increase profit productivity while hiring a net increase of 150,000 people in low-wage countries and resourcing at least 50,000 employees in high-wage countries like the United States and Europe.

In the 2011-2013 timeframe, this profit-driven, financial gamesmanship obviously hit a brick wall. As the chart below documents, from 2013 through 2023, IBM's profit productivity—considering inflation—has fallen 47%.

The company is running out of (1) tangible assets to raid or sell, (2) divisions to discard, and (3) highly-skilled, highly-productive and therefore highly-paid jobs to relocate overseas. When the corporation sold off the x86-Server Division, a client executive observed that although it was a “marginal business unit” it had “a value beyond the size of its margins.” The drop in profit productivity after the division was sold in 2014 reflects that the "out-sized margins" this division produced for the corporation . . . are now gone. Little did Virginia M. (Ginni) Rometty understand that every low-margin, hardware sale pulled along with it a significant amount of high-margin software and services transactions. IBM's seemingly low-value hardware business had a value beyond the size of its recognized margins.

IBM should have convened an early 21st Century war room to understand why its employees' sales productivity was dropping. If it had, it would have realized that the policies it had in place to drive up earnings per share were driving down employee productivity. If it had acted on that information, it would be a different company today because productive employees do not refer to themselves as "roadmap roadkill."

But let’s keep going. …

IBM should have convened an early 21st Century war room to understand why its employees' sales productivity was dropping. If it had, it would have realized that the policies it had in place to drive up earnings per share were driving down employee productivity. If it had acted on that information, it would be a different company today because productive employees do not refer to themselves as "roadmap roadkill."

But let’s keep going. …

- Contradictory Industry Data about the Corporation

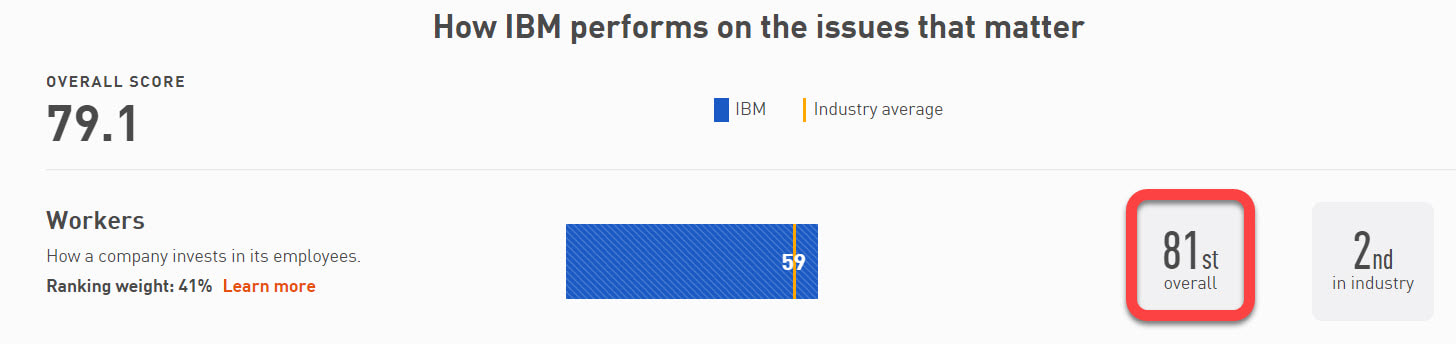

Although there are also problems with how JUST Capital ultimately ranks IBM, they are JUST Getting Started. But they are—true to their commitment—transparent with their information. It is easily found, researched, and evaluated. [See Footnote #2].

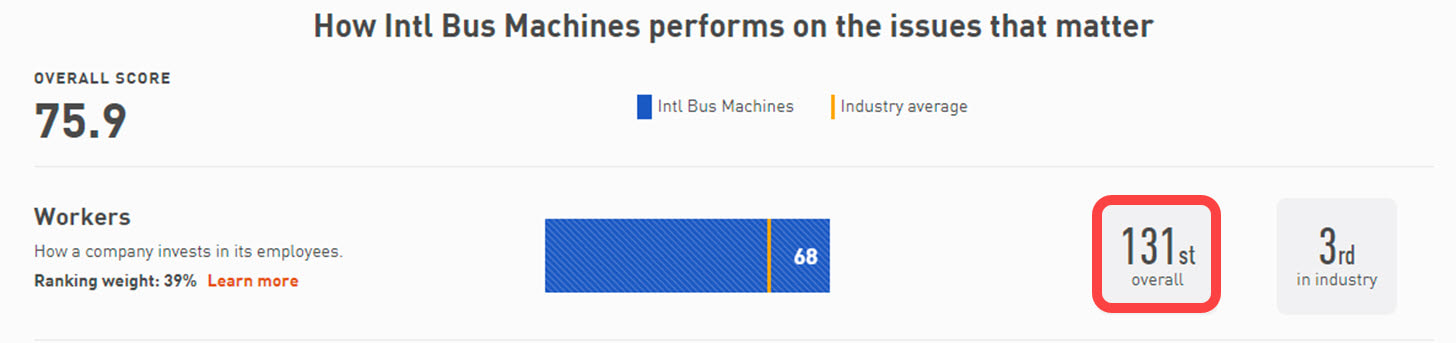

When it comes to IBM’s employees, it is as if Forbes and JUST Capital were two astronomers transcribing their long-range, telescopic views of two different corporations on two different planets. The following tables summarize JUST Capital’s 2021 and 2022 outlooks for those issues that it believes matters the most to workers.

IBM wasn’t ranked a Forbes' 3rd but 81st in 2021 and 131st in 2022 for how the company "performs on the issues that matter to its workers."

When it comes to IBM’s employees, it is as if Forbes and JUST Capital were two astronomers transcribing their long-range, telescopic views of two different corporations on two different planets. The following tables summarize JUST Capital’s 2021 and 2022 outlooks for those issues that it believes matters the most to workers.

IBM wasn’t ranked a Forbes' 3rd but 81st in 2021 and 131st in 2022 for how the company "performs on the issues that matter to its workers."

- From 2021

- Falling to 131st in 2022 indicates that the company is losing ground in this area, not gaining.

And the underlying data isn’t pretty.

Our capitalist system is surely in trouble if the world's third-best employer ranks 450th, 403rd, 268th and 42nd—with only one 1st?

Our capitalist system is surely in trouble if the world's third-best employer ranks 450th, 403rd, 268th and 42nd—with only one 1st?

As far as employees and workplaces go Is Forbes right? Or is JUST Capital right? They can't both be right—the data is just "uncomfortable" and "contradictory" isn't it? This data would drive an artificial intelligence engine insane. And, unfortunately, IBM doesn’t do much to help its cause in its yearly Annual Reports and Corporate Responsibility Reports.

Within these reports, the head fake is focusing the reader on the right-sounding activities instead of documenting the results of the activities.

Within these reports, the head fake is focusing the reader on the right-sounding activities instead of documenting the results of the activities.

- IBM's Annual Reports Document its Activities, Not the "Effectiveness" of its Activities

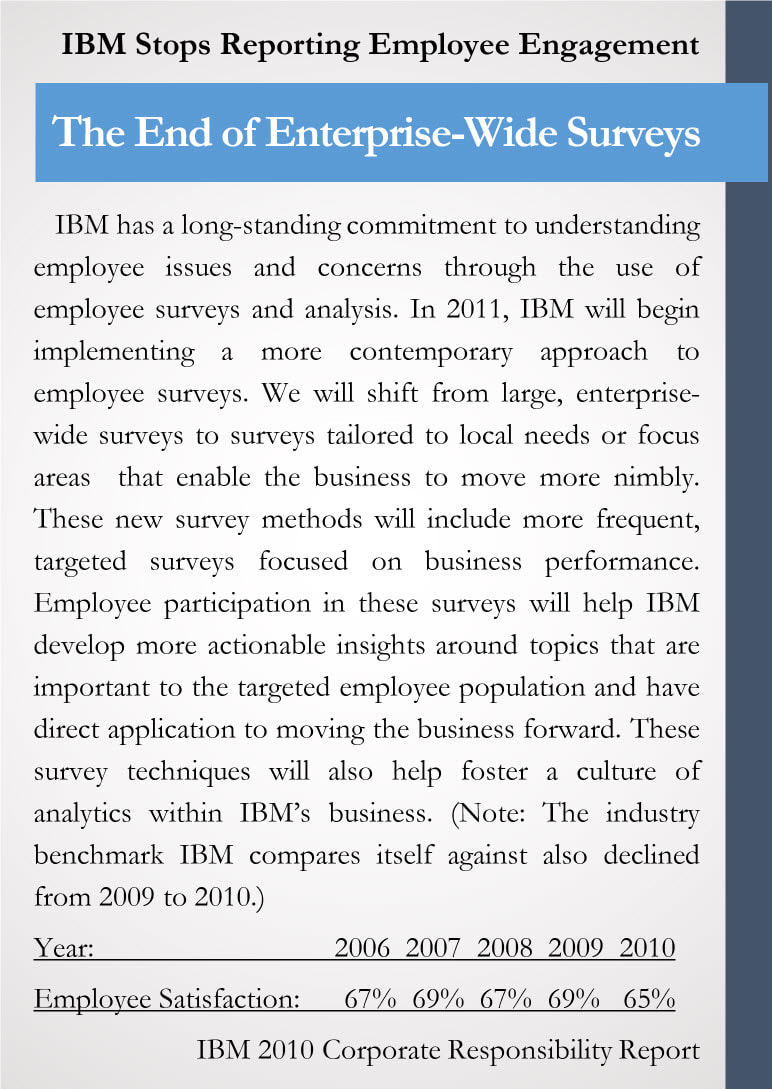

IBM writes extensively in its Annual Reports and Corporate Responsibility Reports on what the company is doing for its employees. Its written commitment in many critical areas is beyond reproach and this is documented by those organizations that emphasize in their evaluations the reading of such materials. But, since 2011, IBM has failed to document if what it is doing is actually working.

Are its actions as highlighted in the Forbes’ survey (corporate image, economic footprint, talent development, gender equality, and social responsibility) and other areas such as JUST Capital’s, actually making the company a better place to work? Because of its actions, are its employees more engaged, enthusiastic and passionate? Or are some of its other processes so violating a human being’s most basic needs that admirable goals fall by the wayside when reality sets in?

|

This sidebar provided is the information from IBM’s 2010 Corporate Responsibility Report is the last time IBM provided critical, detailed information on employee satisfaction or employee engagement—a decade ago.

Focusing since then on activities and failing to provide audited engagement results like these, is the equivalent of a salesman reviewing with his or her first-line manager how long and how hard they have worked their territory and failing to mention that they didn’t make quota. A first-line manager’s comment after such a review would be, “I can appreciate that you feel that you traveled a long ways … over difficult terrain … and you feel good about what you did … but your results indicate that you traveled in the wrong direction … over the wrong obstacles … and failed.”

With a corporation, as with an individual, effort does matter, but documenting what is being done has little value if the results of these activities aren’t gathered, recorded, audited, published, reviewed and scrutinized.

|

It is impossible to discern from IBM’s Annual Reports or its Corporate Responsibility Reports if the company is succeeding or failing as an employer, but one thing can be counted on from IBM’s marketing organization: if there are results worth publicity they would push them out. In this case, absence of positive results and presence of creative wordsmithing suggests a problem. In its 2019, 2020 and 2021 Annual Reports, IBM provided this poetic, strongly-worded but factually-anemic bit of information. [See Footnote #3]

IBM understands that diversity is a fact, but inclusion is a choice. We have made our choice. And that is just one reason why our employee engagement score is at an all-time high, improving 17 points since 2014 [emphasis added].

Why is this information factually anemic to a discerning reader?

These are the problems with the presentation of this employee engagement information: (1) there is no reference how this engagement score stands in relation to the corporation’s industry; (2) there is no mention in the referenced 2014 Annual or Corporate Responsibility Reports of any baseline engagement score; (3) there is no mention in the 2019 Annual or Corporate Responsibility Reports as to what the engagement score actually is; and finally, (4) how “all-time” is this high — since 2014 or 1914?

So, the company could be at the bottom or the top of its industry. Its score could have risen from 0 to 17 or from 82 to 99 or almost any seventeen-point range in between. One must assume, though, that it is closer to the former than to the latter because marketing would have surely screamed a positive if it were possible. And if engagement were at a century-long “all-time high,” every investor would want to know the details because it would mean IBM is back. And it is not.

These are the problems with the presentation of this employee engagement information: (1) there is no reference how this engagement score stands in relation to the corporation’s industry; (2) there is no mention in the referenced 2014 Annual or Corporate Responsibility Reports of any baseline engagement score; (3) there is no mention in the 2019 Annual or Corporate Responsibility Reports as to what the engagement score actually is; and finally, (4) how “all-time” is this high — since 2014 or 1914?

So, the company could be at the bottom or the top of its industry. Its score could have risen from 0 to 17 or from 82 to 99 or almost any seventeen-point range in between. One must assume, though, that it is closer to the former than to the latter because marketing would have surely screamed a positive if it were possible. And if engagement were at a century-long “all-time high,” every investor would want to know the details because it would mean IBM is back. And it is not.

|

What are resource actions? Select this image to experience one IBM Resource Action (R.A. Day)

|

Unfortunately, inclusion—in and of itself—does not make employees more productive or ensure that a workplace is conducive to cooperation and collaboration.

It is a very nice talking point and a worthy goal, but if a corporation, such as IBM with workforce rebalancing, continually threatens every single employee’s employment—no matter sex, ethnicity or religious affiliation, it sends a message that job performance doesn’t ensure employment security. Employees soon learn that workforce rebalancing lightning bolts can strike anyone, anywhere—indiscriminately. |

And might that not impact employee engagement? Isn’t this a worthy discussion to have before ranking a corporation as a top worldwide employment winner?

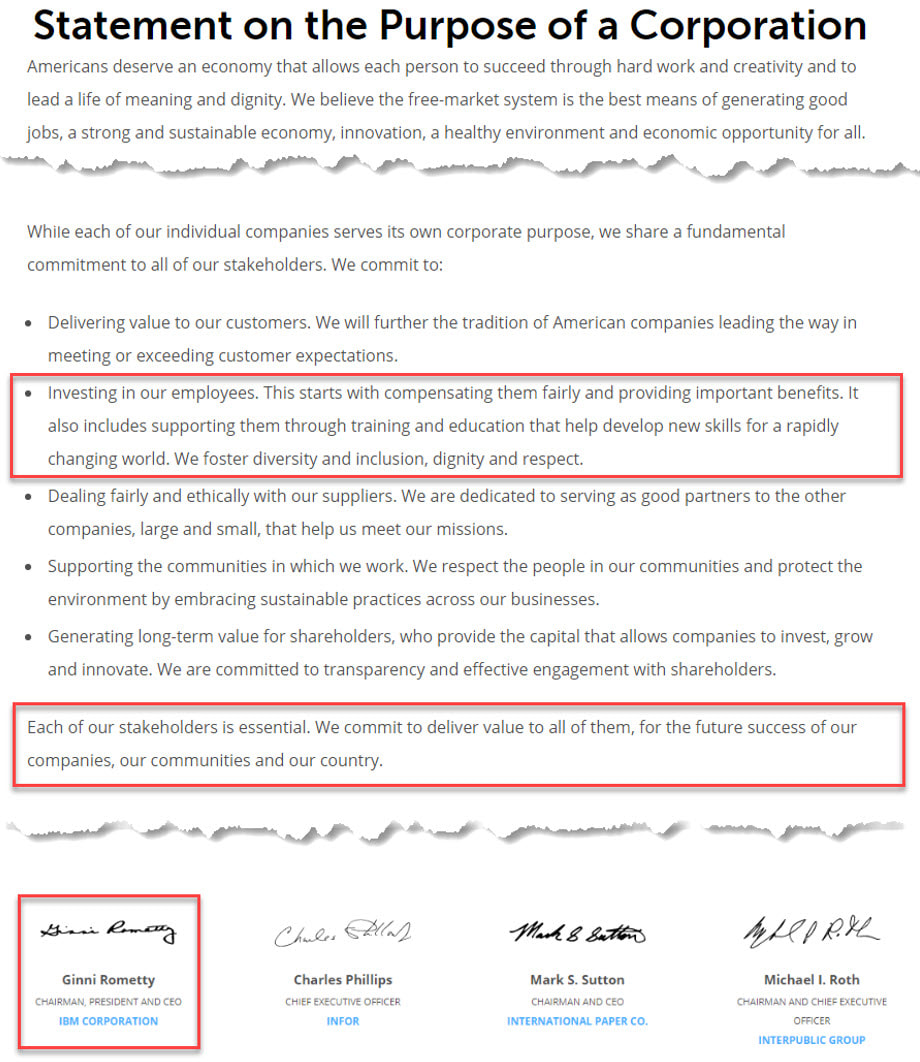

This Author's Thoughts: "Where is Forbes' Understanding?"

Did Forbes “Get” the right information and convey to its readership an “Understanding” of what it takes to be a great employer in the 21st Century? I believe not. All it did was generate a list—evidently, a weakly qualified list. IBM employees might as well apply their Forbes’ “Best Employer Ever” decal to their home office whoopee cushion.

If Forbes is to be seen as a credible source of information for business, it cannot rely on its 20th Century brand—something IBM’s chief executive officers have been doing for two decades. As Watson Sr. and Jr. built IBM, B. C. Forbes and Malcolm Forbes built the 20th Century Forbes’ brand. And it, just like IBM, must rebuild and reestablish itself in the 21st Century. The means to accomplish this is to be of service. Forbes must provide a service to its customers, its customers’ employees, its customers’ shareholders, and its customers’ communities.

For Forbes this will require the vetting of all its information, but it is especially important when presenting a “worldwide best employer” award. It requires an understanding of basic employee motivations. It might consider adding a Gallup employee engagement expert into its process, [The author has no affiliation with Gallup other than to receive its newsletters.] and it should consider testing its social metrics against a multitude of economic metrics as a sanity check. Two decades of declining sales productivity at IBM indicates a corporate systemic problem, and red flags are waving everywhere concerning the corporation’s employees.

Even Virginia M. (Ginni) Rometty and her 186 peers, failed to mention employment security in this document on the purpose of a corporation.

If Forbes is to be seen as a credible source of information for business, it cannot rely on its 20th Century brand—something IBM’s chief executive officers have been doing for two decades. As Watson Sr. and Jr. built IBM, B. C. Forbes and Malcolm Forbes built the 20th Century Forbes’ brand. And it, just like IBM, must rebuild and reestablish itself in the 21st Century. The means to accomplish this is to be of service. Forbes must provide a service to its customers, its customers’ employees, its customers’ shareholders, and its customers’ communities.

For Forbes this will require the vetting of all its information, but it is especially important when presenting a “worldwide best employer” award. It requires an understanding of basic employee motivations. It might consider adding a Gallup employee engagement expert into its process, [The author has no affiliation with Gallup other than to receive its newsletters.] and it should consider testing its social metrics against a multitude of economic metrics as a sanity check. Two decades of declining sales productivity at IBM indicates a corporate systemic problem, and red flags are waving everywhere concerning the corporation’s employees.

Even Virginia M. (Ginni) Rometty and her 186 peers, failed to mention employment security in this document on the purpose of a corporation.

How absurd is this? Have we progressed to the point where our chief executives believe that if they just hire a diverse mix of folks and write or say the right things, they can continually threaten those same individuals’ hearth and home with layoffs? It seems almost idiotic that IBM states this in its 2021 Annual Report:

In response to changing business needs, the company periodically takes workforce reduction actions to improve productivity.

Investing in employees starts with employment security. An employee that is constantly worrying about their job is not a productive employee. Maybe these executives need to invite some of their employees to proof the next document they produce for signature … because they have lost touch. If they did, their employees would help them, as B. C. Forbes wrote a century ago: “Get Understanding.”

As always, a humble opinion open to others’ insights, updates, comments and yes, even objections!

Cheers,

- Pete

As always, a humble opinion open to others’ insights, updates, comments and yes, even objections!

Cheers,

- Pete

[Footnote #1] Remember that in 1993, Wall Street thought that IBM was a “dead man walking.” Wall Street had given up but not IBM’s employees. They were still engaged. This chart is from the 2020 refresh of THINK Again!: IBM CAN Maximize Shareholder Value—The Rometty Edition.

[Footnote #2] Evidently even IBM doesn't have time to dig into the underlying data as it highlights Just Capital's information in its 2021 Annual Report: "These efforts—and others—were recently recognized by JUST Capital, which named IBM the most just company in our industry"--evidently just not for workers/employees. IBM does not mention JUST Capital in its latest 2023 Annual report as the company fell from 5th place overall in 2019 to 60th place in 2023 and is no longer "the most just company in its industry."

[Footnote #3] In contrast to IBM’s approach consider SAP’s openness and documentation. It wrote in its 2019 Annual Report, “We use various performance measures to manage our performance with regard to our primary financial objectives, which are growth and profitability, and our primary non-financial objectives, which are customer loyalty and employee engagement. We view growth and profitability as indicators of our current performance, while we see customer loyalty and employee engagement as indicators of our future performance [emphasis added].” SAP provides information on how it is doing in the form of audited employee engagement (83%) and, significantly, customer loyalty results. IBM provides neither.

[Footnote #2] Evidently even IBM doesn't have time to dig into the underlying data as it highlights Just Capital's information in its 2021 Annual Report: "These efforts—and others—were recently recognized by JUST Capital, which named IBM the most just company in our industry"--evidently just not for workers/employees. IBM does not mention JUST Capital in its latest 2023 Annual report as the company fell from 5th place overall in 2019 to 60th place in 2023 and is no longer "the most just company in its industry."

[Footnote #3] In contrast to IBM’s approach consider SAP’s openness and documentation. It wrote in its 2019 Annual Report, “We use various performance measures to manage our performance with regard to our primary financial objectives, which are growth and profitability, and our primary non-financial objectives, which are customer loyalty and employee engagement. We view growth and profitability as indicators of our current performance, while we see customer loyalty and employee engagement as indicators of our future performance [emphasis added].” SAP provides information on how it is doing in the form of audited employee engagement (83%) and, significantly, customer loyalty results. IBM provides neither.