Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Arvind Krishna's First-Year Revenue and Profit Performance

- The Importance of Revenue and Profit

- Arvind Krishna's First-Year Revenue by the Numbers

- Arvind Krishna's First-Year Net Income by the Numbers

Evaluating Arvind Krishna's First-Year Revenue and Net Income (Profit)

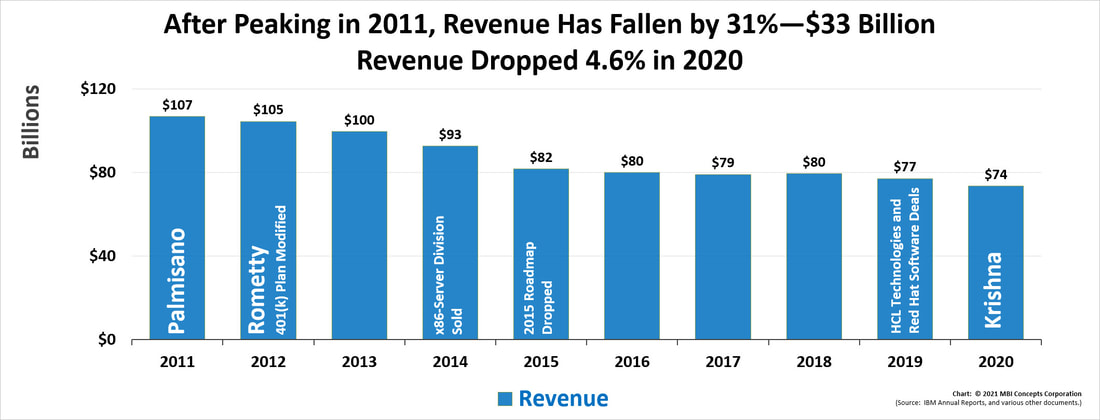

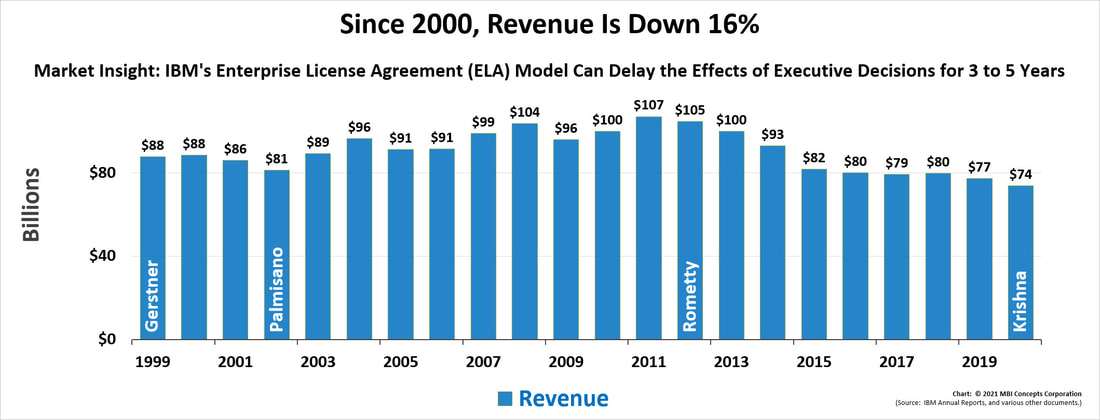

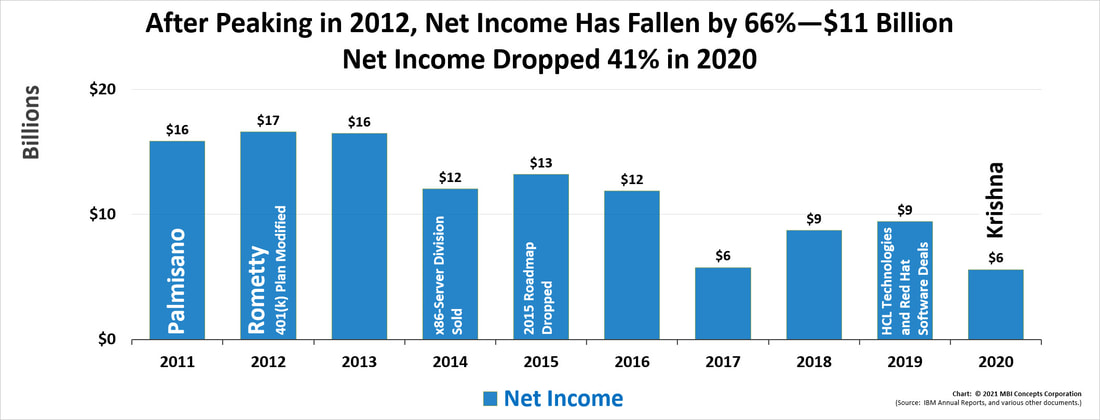

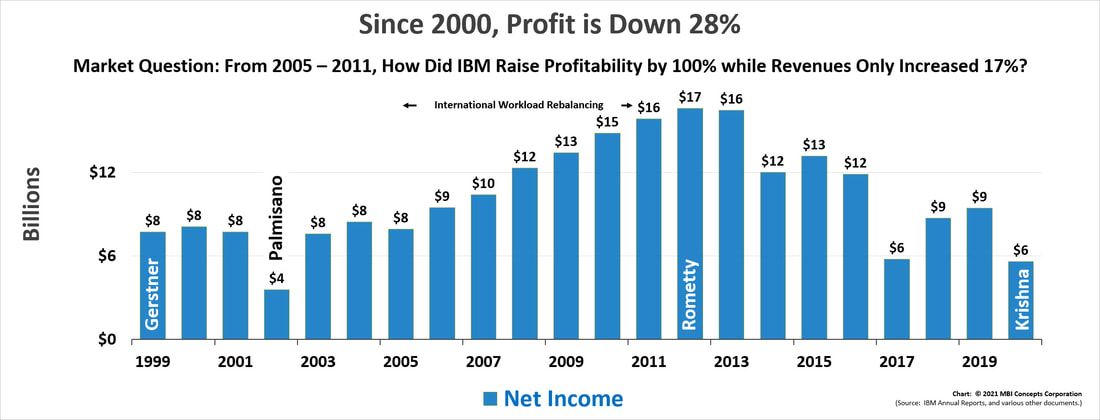

What were Arvind Krishna's first-year 2020 revenue and profit performance numbers? For the full year of 2020, revenues were down 4.6% and profit was down 41%.

A worthless car is one that can’t move passengers or cargo between points "A" and "B" safely and reliably. Corporations, within a capitalist economy, lose value as they fail in their main purpose: moving products of competitively higher value off the showroom floor into a customer’s hands while generating enough profits to ensure a self-sustaining stakeholder ecosystem—enough money to invest equitably between customers, employees, shareholders, and their supportive societies.

In this respect the following charts show that IBM has been failing to deliver products of higher value to its customers. Selling products at a profit is, ultimately, the responsibility of the corner office. These charts reflect what should be the two top priorities of the corner office, not earnings per share.

Long-term, sustainable revenue and profitability should be the chief executive’s two top performance metrics.

Long-term, sustainable revenue and profitability should be the chief executive’s two top performance metrics.

Arvind Krishna's First-Year Revenue by the Numbers

- Krishna 2020 Revenue Performance: Down 4.6%

- Krishna & Rometty 2012–20 Revenue Performance: Down 31%

- Krishna, Rometty, Palmisano & Gerstner 2000–20 Revenue: Down 16%

Arvind Krishna's First-Year Net Income (Profit) by the Numbers

- Krishna 2020 Profit Performance: Down 41%

- Krishna & Rometty 2012–20 Profit Performance: Down 66% from a 2012 peak

- Krishna, Rometty, Palmisano & Gerstner 2000–20 Profit: Down 28%