Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Ginni Rometty's Acquisition Strategy Performance

|

|

Date Published: July 19, 2021

Date Modified: June 30, 2024 |

Questions answered by Virginia M. (Ginni) Rometty's key performance indicator (KPI) #5:

These are excerpts from "THINK Again!: The Rometty Edition."

- How did the Red Hat acquisition affect market value?

- What is the cornerstone of this acquisition’s success?

- Does the acquisition play to IBM’s strengths?

These are excerpts from "THINK Again!: The Rometty Edition."

Virginia M. (Ginni) Rometty: The Demand-Side Strategy Worked—at a Price

- IBM Has Been Here Before

- KPI #5: The Demand-Side Strategy Worked—at a Price

- Behavioral Changes to Consider Before Investing in IBM

IBM Has Been Here Before

Fool me once, shame on you. Fool me twice, shame on me.

A Texas old-timer’s saying

IBM has been here before. John Opel was a demand-side, market strategist. After selling off the corporation’s lease equipment to spike revenue and profits, he talked about the $100 billion IBM by 1990. His words, backed by a strong corporate brand, doubled the corporation’s market value.

This demand-side strategy worked until the financial engineering it was based on reached an all-too-predictable end. After John Akers admitted failure, IBM lost 70% of its market value.

This demand-side strategy worked until the financial engineering it was based on reached an all-too-predictable end. After John Akers admitted failure, IBM lost 70% of its market value.

KPI #5: The Demand-Side Strategy Worked—at a Price

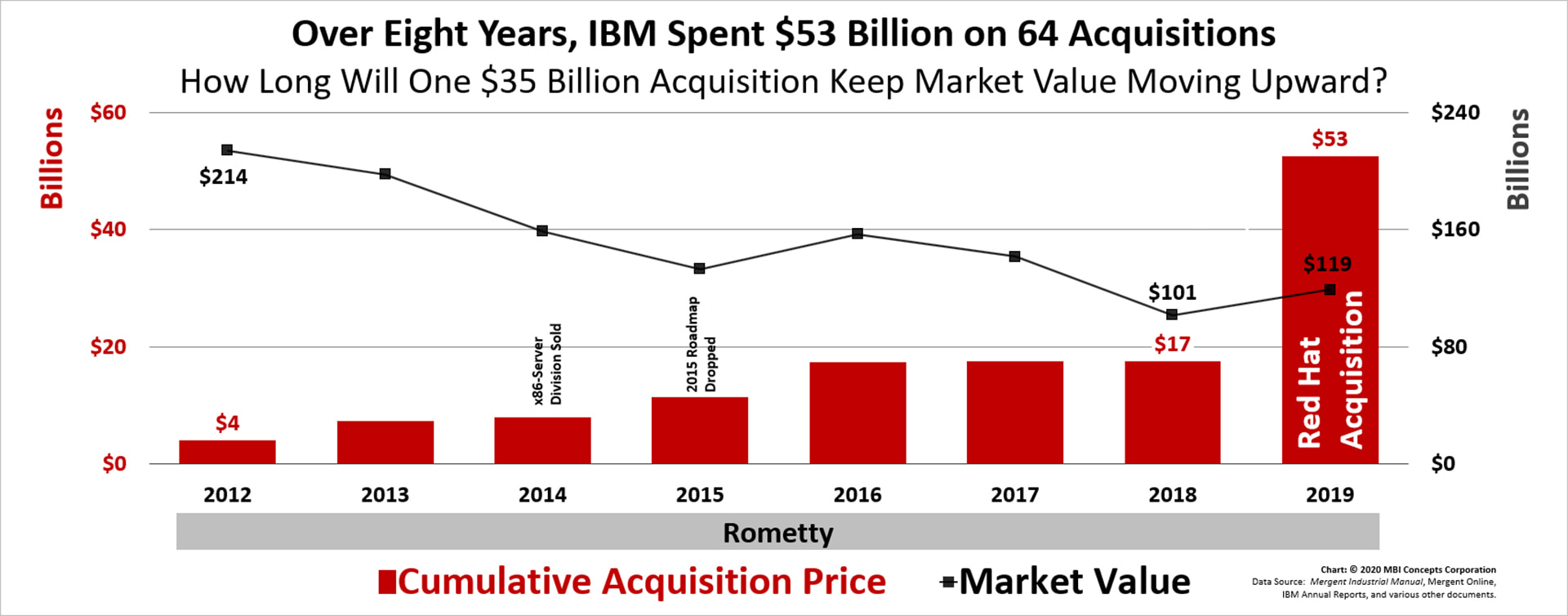

So, after seven years of failing to drive market value higher through earnings-per-share roadmaps, share buybacks, ever-increasing dividends, and additional small acquisitions, Ginni Rometty’s final act was to jump the shark. [See Footnote #1] She implemented her own demand-side strategy. She announced the Red Hat acquisition.

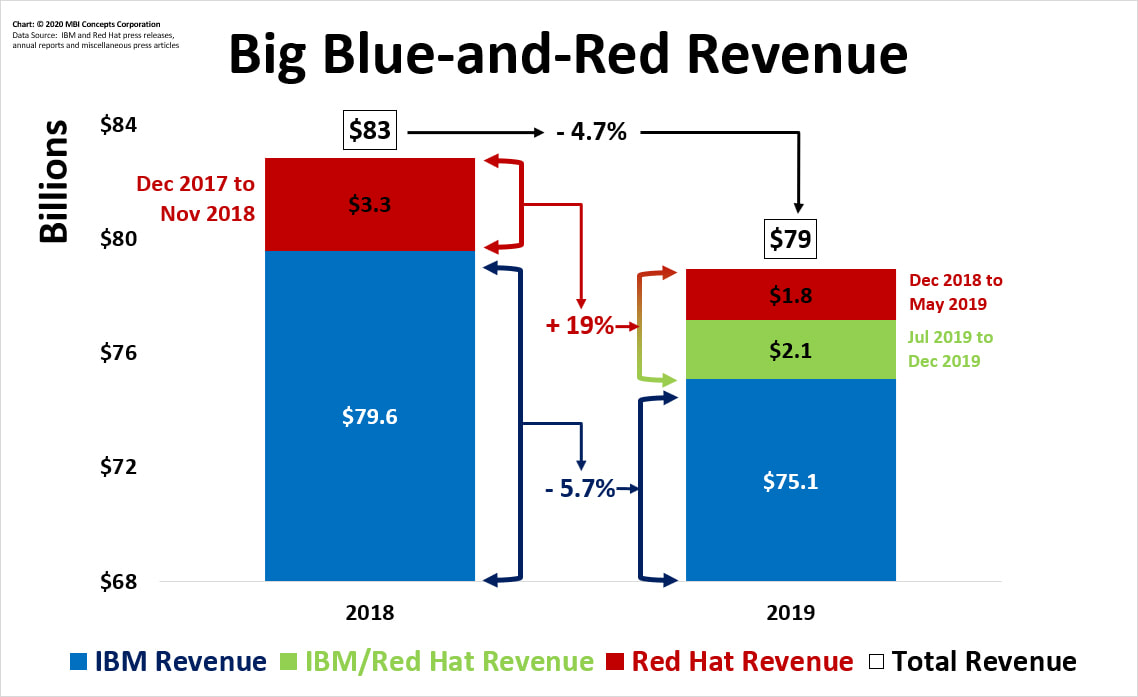

The annual report proudly called it the “largest acquisition in the history of the company.” The corporation paid the equivalent of $3 million per employee: $35.1 billion. Unfortunately, only its price tag—approximately 35% of IBM’s market value at announcement—was large. Red Hat added only 3.4% more people, 4.2% more revenue and 5.1% more net income.

The annual report proudly called it the “largest acquisition in the history of the company.” The corporation paid the equivalent of $3 million per employee: $35.1 billion. Unfortunately, only its price tag—approximately 35% of IBM’s market value at announcement—was large. Red Hat added only 3.4% more people, 4.2% more revenue and 5.1% more net income.

Few tangible assets were acquired as goodwill and other intangible assets grew by $34.1 billion, 97% of the $35.1 billion purchase price. This acquisition’s success depends on the “synergies of the combined workforces,” which is IBM’s greatest weakness that is deeply ingrained in its two-decades-long, human resource practices.

The demand-side strategy worked, though, as market value increased by 17%.

But will the increase survive the reality of poor business fundamentals?

The demand-side strategy worked, though, as market value increased by 17%.

But will the increase survive the reality of poor business fundamentals?

Behavioral Changes to Consider Before Investing in IBM

- Look for honesty in the chief executive officer’s shareholder communications similar to Thomas J. Watson Jr.’s statements at the 1961 Annual Shareholders’ Meeting concerning the 1960’s spike in earnings. It is important that all stakeholders know and understand “what is taking place” at all times [text of speech is here].

|

IBM revenue adjusted for "divestitures"

|

[Footnote #1] “Jumping the shark” is an idiom that describes the moment an individual executes a publicity stunt in an attempt to revive a past glory but instead it only serves to highlight their irrelevance.