If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

Even A Blind Squirrel Finds the Occasional Nut

|

|

Date Published: July 26, 2021

Date Modified: April 25, 2024 |

"Even a blind squirrel finds the occasional nut." This was an old IBM sales representative saying which is so true in analyzing the revenue performance of the 21st Century IBM. When it comes to IBM, always wait for the full-year revenue results.

Even then, it is advisable wait a little longer.

Even then, it is advisable wait a little longer.

Even a Blind Squirrel Finds the Occasional Nut

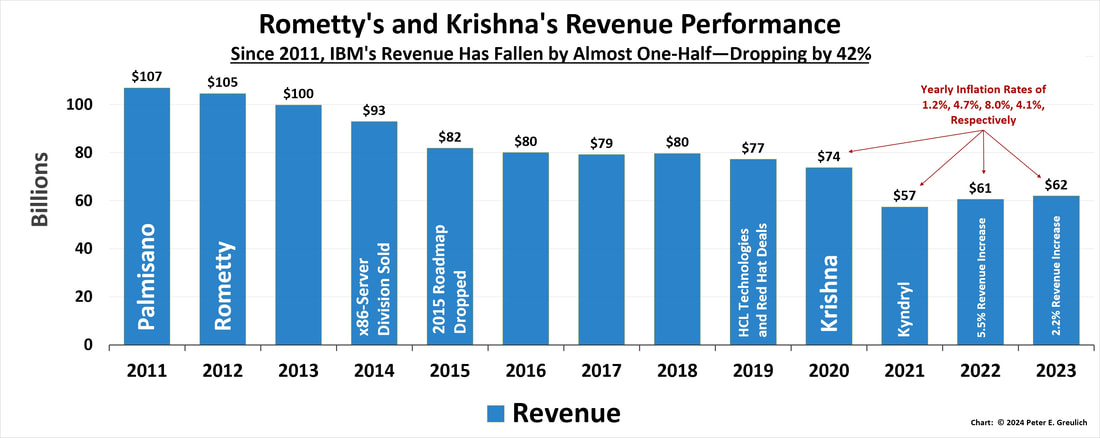

- IBM's Revenues Have Dropped from $107 Billion to $62 Billion in Twelve Years

- IBM’s Revenues Could Have Been $137 Billion Instead of $62 Billion

- IBM Has Not Maximized Shareholder Value

- What Is Wrong at IBM?

Too Many "Years" of Declining Revenue

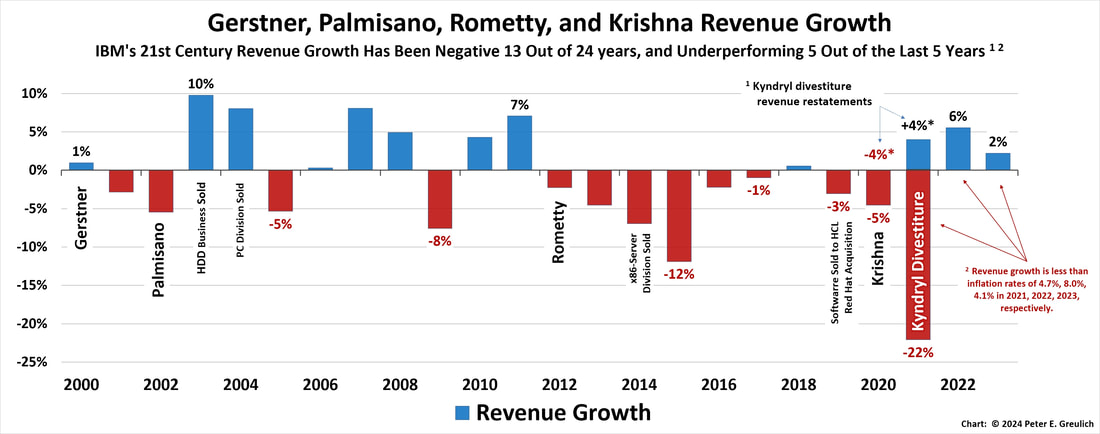

Recently "analysts' expectations" of IBM's revenue growth aren't even having it keep up with inflation. Unfortunately a "quarterly" gain means little when (1) the yearly revenue returns that IBM has achieved from 2011 through 2023 has fallen so significantly, and (2) when it has revenue gains that are probably only inflation driven, not new sales, new customer driven.

First, revenues since 2011 are down by $45 billion. Second, even the seeming bright spot of increasing revenues in 2022 and 2023 fails when inflation is considered. Using a best-case scenario which considers the Kyndryl divestiture, IBM’s 2021 revenue growth was up 3.9% but inflation was up more at 4.7%; IBM’s 2022 revenue growth was up 5.5% but inflation was up more at 8.0%; and finally, IBM’s 2023 revenue growth was up 2.2% but inflation was up more at 4.1%.

This is nothing that Arvind Krishna, his leadership team or the board of directors should brag about to their shareholders.

IBM's revenue performance is atrocious.

First, revenues since 2011 are down by $45 billion. Second, even the seeming bright spot of increasing revenues in 2022 and 2023 fails when inflation is considered. Using a best-case scenario which considers the Kyndryl divestiture, IBM’s 2021 revenue growth was up 3.9% but inflation was up more at 4.7%; IBM’s 2022 revenue growth was up 5.5% but inflation was up more at 8.0%; and finally, IBM’s 2023 revenue growth was up 2.2% but inflation was up more at 4.1%.

This is nothing that Arvind Krishna, his leadership team or the board of directors should brag about to their shareholders.

IBM's revenue performance is atrocious.

Whenever IBM breaks its string of quarterly or yearly revenue declines, it is reminiscent of what IBM salesmen would tell a rookie after they closed their first deal and started strutting around the office like they were hot stuff. After letting the salesman or saleswoman enjoy the moment, one of the thirty-plus-year IBM reps would tap the salesperson on the shoulder and say, “Enough son, even a blind squirrel finds the occasional nut. You need to go out there and do it again and again for the next thirty years to maintain a career with this company.”

IBM, though, is a blind squirrel that has only been able to find the occasional year-over-year revenue nut because of two decades of misplaced investment dollars ($201 billion investment in share repurchases) and abysmal human relations practices. Now even inflation is outpacing its sales growth.

IBM, though, is a blind squirrel that has only been able to find the occasional year-over-year revenue nut because of two decades of misplaced investment dollars ($201 billion investment in share repurchases) and abysmal human relations practices. Now even inflation is outpacing its sales growth.

Sales Productivity Is Horrendous

|

If IBM’s 305,300 employees produced revenue at the end of 2023 as productively as employees in 1999 (in inflation adjusted dollars), the corporation would have attained revenues of $137 billion instead of $62 billion.

To state it in terms (rather cynically) that even James J. Kavanaugh, IBM's Chief Financial Officer, could understand—a reduction in headcount rather than increased revenue: The corporation should have achieved its $62 billion in 2023 revenue with only 137,197 employees—168,000 fewer employees. |

Select image to read why sales productivity should be considered a corner office problem

|

With this realization, it doesn’t take much management intuition to realize that there is a long-term, business-execution problem at IBM, not quarterly, short-term, sales-execution issues. It is a corner office, sales-leadership problem because customer revenue is really, really hard to financially engineer.

It takes an entire corporation working together as one to drive revenue productively.

Shareholder Returns Are Suffering

To wake up the long-term shareholders, it is necessary to be brutally honest and hit them right where it hurts: in their long-term returns. It can be shown "In One Chart" that IBM is on the wrong path. IBM’s first three, twenty-first-century chief executive officers invested $176 billion dollars since 1999 in their own stock (paper) and have returned less value to an investor than an equivalent investment in lower-risk index funds that track either the Dow Jones Industrial Average (DJIA) or large-company stocks. [See Footnote #1]

All stakeholders should be wondering if IBM spent this $176,000,000,000 of the shareholders’ money wisely. IBM’s history reflects that instead of investing in paper the corporation’s executives should have invested in business-first: making people more productive, processes for effective, and products more valuable [Read "Do Stock Buybacks Work?"].

What is Wrong at IBM?

It is not a corporation's goal of shareholder maximization that is wrong, but how a business attempts to maximize that value. A study of IBM’s successes and failures at maximizing shareholder value reveals an almost non-intuitive truth: the path to maximize shareholder value is a two-way road that must be shared between a stakeholder community of customers, employees, and shareholders who maintain supportive economic and political societies that allow a business to maximize its profits.

|

In other words, it isn't the goal of maximizing shareholder value that has been the problem at IBM, but its chosen path—best exemplified in its two, earnings-per-share roadmaps that left employees strewn along the roadside like so much roadkill.

Shareholder-first and -foremost, and me-first and -only are not viable means to maximize profits through which an equitable distribution of profits can be made to all stakeholders Cheers, - Peter E. |

Select the image to read about the two extremes of shareholder maximization

|

[Footnote #1]: Virginia M. Rometty left $2 billion dollars in approved share buybacks (repurchases) unspent. Arvind has as yet to make any statements on restarting the share buybacks, but they are already approved by the board of directors and could be easily resumed.