Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Arvind Krishna's 2020-23 IBM Market Value Performance

- The Importance of Market Value

- Arvind Krishna's 2020-23 IBM Market Value Results

- Krishna and Rometty's 2011-23 IBM Market Value Results

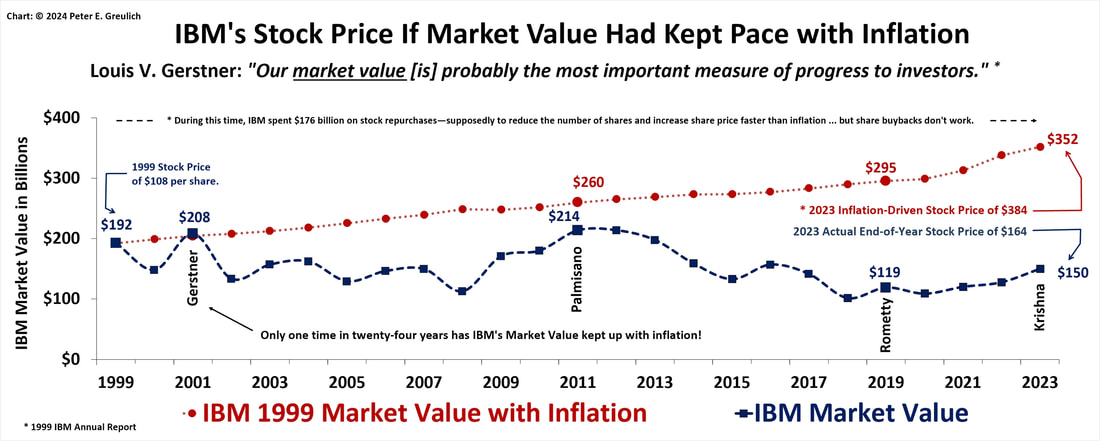

- Krishna, Rometty, Palmisano, and Gerstner's 1999-2023 IBM Market Value Results

The Importance of Market Value

Why should long-term stakeholders keep IBM's market value "top of mind"

IBM’s market value is calculated by multiplying the corporation’s outstanding shares by those shares’ current market price; therefore, there is a direct correlation between share price and market value. Lou Gerstner often used market value as a key business metric to evaluate his business success. He wrote to his shareholders about the significance of market value in IBM’s 1998 and 1999 annual reports. He called it “the most important measure of progress to investors.” Sam Palmisano, following his predecessor's example, wrote in the IBM 2003 Annual Report:

The board of directors approved sweeping changes in executive compensation. … IBM’s market value would have to increase by $17 billion [reaching $174 billion] before executives saw any benefit from this year’s option awards.

The last chart in this series of three charts documents why Sam Palmisano abandoned this market-value measurement of success for executive compensation and implemented earnings-per-share roadmaps. A market-value measurement would have yielded only pennies, if that, in executive compensation. In fact, IBM executives' under a market-value compensation system would not seen "any benefit from their option awards" for seven years: IBM did not surpass $174 billion in market value until 2010!

So, rather than keep the measurement the executive team changed the rules of their compensation game!

So, rather than keep the measurement the executive team changed the rules of their compensation game!

Arvind Krishna's 2020-23 IBM Market Value Results

How did Arvind Krishna's leadership affect IBM's 2020-23 market value in his fourth year as CEO? In what would seem a bright star for IBM's short-term stakeholders, IBM's market value increased 17.4% in 2023. Over the four years since Krishna took over control of the corner office from Virginia (Ginni) M. Rometty in 2019, IBM's market value has improved 26.1%. The surge in IBM's market value in 2023 has enabled it to outperform inflation which was up almost 20% during the same four years.

For long-term shareholders, whether this Artificial Intelligence (A.I.) powered surge in market value can be maintained is a key question that should occupy all stakeholders' concerned with either share price, product quality, and/or job security.

For long-term shareholders, whether this Artificial Intelligence (A.I.) powered surge in market value can be maintained is a key question that should occupy all stakeholders' concerned with either share price, product quality, and/or job security.

- Arvind Krishna 2020-23 IBM Market Value Performance

- IBM Market Value was up with an overall 26.1% increase over Arvind Krishna's four years: including a market value increase of 17.4% in 2023. It is important to note that this four-year uplift in market share was accomplished after ending two and one-half decades of share repurchases in 2019. The total cost of these share repurchases from 1995 to 2019 was $201 billion dollars. Arvind Krishna has left unspent since 2019—but still approved to spend—$2.0 billion in share buybacks.

This chart depicts the inflation rate over this four year period but does not consider its impact.

Inflation was up almost 20%: 19.2%.

- IBM Market Value was up with an overall 26.1% increase over Arvind Krishna's four years: including a market value increase of 17.4% in 2023. It is important to note that this four-year uplift in market share was accomplished after ending two and one-half decades of share repurchases in 2019. The total cost of these share repurchases from 1995 to 2019 was $201 billion dollars. Arvind Krishna has left unspent since 2019—but still approved to spend—$2.0 billion in share buybacks.

Krishna and Rometty's 2011-23 IBM Market Value Results

- Krishna & Rometty 2011–23 IBM Market Value Performance

- IBM Market Value over the last decade was down 30%—losing an overall $64 billion, which included several major events intended to move market value by either selling or divesting supposedly poorly performing internal divisions or acquiring new technologies: (1) selling the x86-Server Division, (2) abandoning the 2015 Roadmap, (3) acquiring Red Hat and 102 other organizations, and (4) divesting Kyndryl.

Inflation was up 35% over this twelve-year period.

- IBM Market Value over the last decade was down 30%—losing an overall $64 billion, which included several major events intended to move market value by either selling or divesting supposedly poorly performing internal divisions or acquiring new technologies: (1) selling the x86-Server Division, (2) abandoning the 2015 Roadmap, (3) acquiring Red Hat and 102 other organizations, and (4) divesting Kyndryl.

Krishna, Rometty, Palmisano, and Gerstner's 1999-2023 IBM Market Value Results

- Krishna, Rometty, Palmisano, & Gerstner 1999–2023 IBM Market Value Performance

- IBM Market Value over the last two decades has lost 22.1% of its value—an overall $42.5 billion.

If the $176 billion in share buybacks since 1999 had accomplished one thing—kept IBM market value in line with inflation, IBM’s share price would have been $384 a share instead of $164 at the end of 2023—134% higher! Does it matter if IBM is a Dividend Aristocrat if it is continually paying dividends on a stock price that is not only falling in value but not keeping its market value high enough to ensure its stock price outpaces inflation?

If a long-term shareholder had to sell most anytime during this period, maybe certificates of deposits would have been a better investment or found a way to increase their return with less risk through technology and large company index funds.

IBM is a case study in the weakness of adhering myopically to a dividend aristocrat investment philosophy.

- IBM Market Value over the last two decades has lost 22.1% of its value—an overall $42.5 billion.