A Review of "USA: The Permanent Revolution"

|

|

Date Published: July 28, 2023

Date Modified: June 30, 2024 |

“The February issue of Fortune magazine attempts to do the impossible—and almost succeeds. It attempts to analyze ‘the meaning of America’ under the title, ‘USA: The Permanent Revolution.’ All in all, it is probably one of the more remarkable accomplishments in the record of contemporary journalism. … Under the general supervision of Russell Davenport, former managing editor of Fortune—it comes as close to accomplishing its objective as anybody could reasonably expect.”

The Yardstick, The Advance Register, 1951

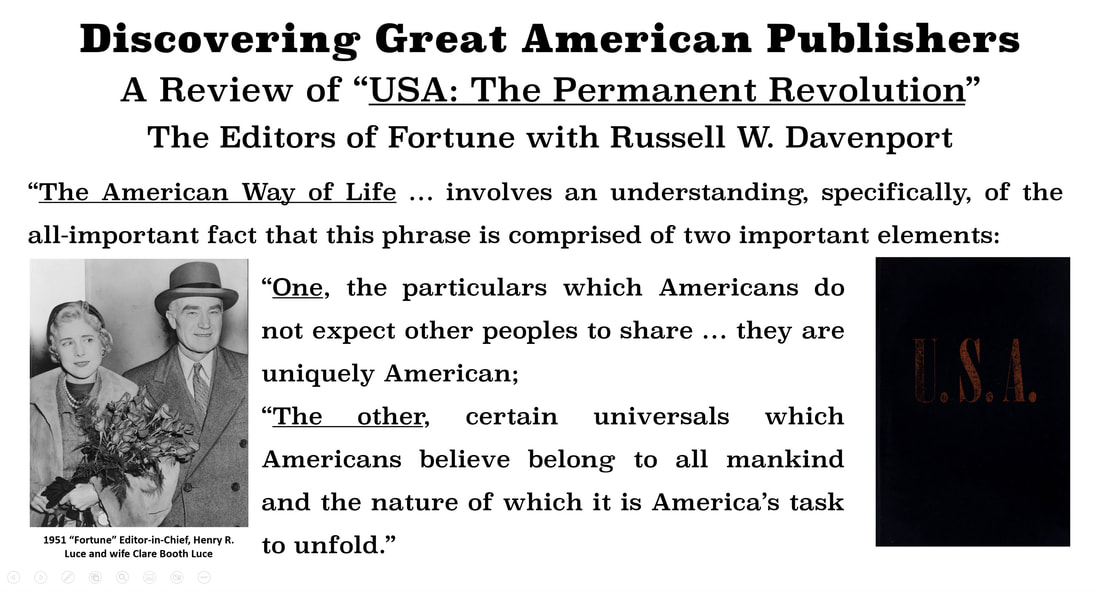

A Review of "USA: The Permanent Revolution" by the Editors of Fortune

- Reviews of the Day: 1951

- Selected Quotes from "USA: The Permanent Revolution"

- This Author’s Thoughts and Perceptions

Reviews of the Day: 1951

Each chapter in "USA: The Permanent Revolution" was released as an individual Fortune article that was carried in series in local and national newspapers. The book was written and released by the Editors of Fortune with Russell W. Davenport, a former managing editor of the magazine.

|

Here are a few of the 1951 “Reviews of the Day”.

“This is a good book for reading on May Day. Americans would do better to read a thought-provoking book than to parade and demonstrate. It also would be good for Americans to shut themselves away from the shouting and the tumult and spend some time in earnest cogitation.

“ ‘We face not just a gang of villains,’ says the Fortune book, ‘but a system of evil ideas, and these can be defeated only if we keep our system of ideas more powerful and more relevant to the real problems of mankind.’ ” The Salt Lake Tribune, May 1, 1951

|

“USA: The Permanent Revolution” appeared in newspapers across the United States as a series.

|

“When the editors of Fortune set out to define the meaning of America, They did not expect to get any final answers. But this study … does present a heartening approach to the problem.

“In presenting America not as an achievement but as a process of development to meet new conditions, they argue that the 18th Century principles upon which our government is based—that men are created equal and endowed with inalienable rights to life, liberty and the pursuit of happiness—are equally valid today.”

“In presenting America not as an achievement but as a process of development to meet new conditions, they argue that the 18th Century principles upon which our government is based—that men are created equal and endowed with inalienable rights to life, liberty and the pursuit of happiness—are equally valid today.”

The Washington D.C. Sunday Star, May 13, 1951

“This is an adult book which younger folk in high school history classes would do well to analyze. Here is a sober book for young or old—the younger the better, since it is to these of the fewer years most of the stalks of wrath will fall for the binding.”

The Indianapolis Star, May 13, 1951

“The editors of Fortune beat the big drum for our system of government, and do it quite effectively. The book is most opportune. It is high time some of us renewed our faith in the wellsprings of our own national well-being. … This book shows, step by step, how everything that we have become flows out of the original proposition on which this nation was founded. …

“Whether we like it or not, we have in fact become a kind of practical workshop for all of free mankind.”

“Whether we like it or not, we have in fact become a kind of practical workshop for all of free mankind.”

The Berkshire Evening Eagle, May 19, 1951

Selected Quotes from "USA: The Permanent Revolution"

- "USA: The Permanent Revolution:" Restates Capitalistic Theory in Modern American Terms

“American capitalism today is actually nothing like it was fifty years ago. There has occurred a great transformation, of which the world as a whole is as yet unaware, the speed of which has outstripped the perception of the historians, the commentators, the writers of business books—even many businessmen themselves.

“No important progress can be made in the understanding of America unless the nature of this transformation is grasped and the obsolete intellectual stereotypes discarded. Many evidences of the transformation are at hand, though they have never yet been drawn together into what is very urgently needed—a restatement of capitalistic theory in modern American terms.”

“No important progress can be made in the understanding of America unless the nature of this transformation is grasped and the obsolete intellectual stereotypes discarded. Many evidences of the transformation are at hand, though they have never yet been drawn together into what is very urgently needed—a restatement of capitalistic theory in modern American terms.”

- "USA: The Permanent Revolution:" Great Business Executives Manage Shareholder Expectations

“The decline of Wall Street actually began long before the reforms of the New Deal.

“It began when corporations grew rich and independent. The rights to their profits, of course, were by traditional economics vested in the stockholders; but their managers saw no point in paying, say, $20 a share in dividends on their stock, when $10 was enough to sustain the company’s credit rating. They also reasoned that it was they, and not the stockholders, who were directly responsible for the profits [Read Henry Ford Takes Control].

“So they began to hold back on the stockholders and put the money into corporate reserves. … Owen Young of G.E. and others, some years later, further developed the idea of self-capitalization, arguing that the money plowed back [into the business] would in the long run enhance the stockholder's equity.”

“It began when corporations grew rich and independent. The rights to their profits, of course, were by traditional economics vested in the stockholders; but their managers saw no point in paying, say, $20 a share in dividends on their stock, when $10 was enough to sustain the company’s credit rating. They also reasoned that it was they, and not the stockholders, who were directly responsible for the profits [Read Henry Ford Takes Control].

“So they began to hold back on the stockholders and put the money into corporate reserves. … Owen Young of G.E. and others, some years later, further developed the idea of self-capitalization, arguing that the money plowed back [into the business] would in the long run enhance the stockholder's equity.”

- "USA: The Permanent Revolution:" The Stakeholder Ecosystem is Critical to Long-Term Success

|

“The manager is becoming a professional in the sense that like all professional men he has a responsibility to society as a whole. This is not to say that he no longer needs good, old-fashioned business sense. He does, and more than ever; the modern enterprise should be in business to make money. … But the great happy paradox of the profit motive in the American System is that management, precisely because it is in business to make money years on end, cannot concentrate exclusively on making money here and now.

“To keep making money years on end, it must, in the words of Frank Abrams, Chairman of Standard Oil of New Jersey, ‘conduct the affairs of the enterprise in such a way as to maintain an equitable and working balance among the claims of the various directly interested groups—stockholders, employees, customers, and the public at large.’ ” |

Tom Watson's honesty, integrity, and worth as an executive officer.

|

This Author's Thoughts and Perceptions

In “USA: The Permanent Revolution,” I would recommend the following chapters as starting points: “The American Way of Life,” “The Transformation of American Capitalism,” “The Busy, Busy Citizen,” and “Individualism Comes of Age.”

- Positioning “USA: The Permanent Revolution” with the Milton “Friedman Doctrine”

As you read "USA: The Permanent Revolution," consider what Milton Friedman wrote two decades later in closing out his New York Times essay entitled “A Friedman Doctrine—The Social Responsibility of Business Is to Increase Its Profits:”

“That is why, in my book ‘Capitalism and Freedom,’ I have called it [social responsibility] a ‘fundamentally subversive doctrine’ in a free society, and have said that in such a society, ‘there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.’ ”

This author finds it quite interesting that Milton Friedman in his article fails to address “maximizing short-term vs. long-term profits,” “increasing business longevity,” or if the rules of the game should extend beyond deception and fraud to include what may be “legal but not necessarily ethical.” This book does a much better job of putting 20th Century American business and its most successful businessmen within the context of 20th Century Capitalism and its supportive political system: Democracy—as instituted under our founders’ federated principles of governance.

As I was reading this book I wondered if Milton Freedman, the economist, had ever read it? A search of Milton Friedman’s works and comments failed to reveal if he had any relevant insights into the subject matter in this book. Cynically—but most factually, if the businessmen of America had not fulfilled their “societal obligations” during World War II [IBM World War II Contributions], our families would be living under fascist, socialist, or anarchistic regimes today. Was Milton Friedman primarily concerned in his article about the extremes that “social responsibility” might reach? If he was, he took the idea to its other extreme: “the one and only one social responsibility of business” is to increase profits.

As I was reading this book I wondered if Milton Freedman, the economist, had ever read it? A search of Milton Friedman’s works and comments failed to reveal if he had any relevant insights into the subject matter in this book. Cynically—but most factually, if the businessmen of America had not fulfilled their “societal obligations” during World War II [IBM World War II Contributions], our families would be living under fascist, socialist, or anarchistic regimes today. Was Milton Friedman primarily concerned in his article about the extremes that “social responsibility” might reach? If he was, he took the idea to its other extreme: “the one and only one social responsibility of business” is to increase profits.

|

One has to wonder what his position would have been when:

It was exactly the fact that American businessmen and -women met their social responsibilities in the 20s, 30s, 40s, and 50s that fascist, socialist, and anarchist philosophies were stymied and then halted in their tracks.

It is amazing that Milton Friedman’s memory was so shortsighted. He was alive to experience first-hand how the Great Depression and World War II were handled by the Tom Watsons, J.C. Penneys, George F. Johnsons, Owen D. Youngs, Bernard Baruchs, and Gerard Swopes. All these individuals understood their business’ social responsibilities. Unfortunately, the “Friedman Doctrine” has been used by some 21st Century chief executive officers—motivated by stock option incentives and short-term, earnings-per-share metrics, to abandon the 20th Century business model described in this book. They are driving American Capitalism back to its antiquated 19th Century roots—a business model these authors believe were abandoned thereby making the country a better place to live, work, and conduct business. |

Employee perspective on Tom Watson's leadership.

|

- What Was Lacking in “USA: The Permanent Revolution”

One of the major additions I would make to the book is a section on positioning profit vs. greed in a capitalist system. Too many times those who attack our economic system use these words interchangeably. At such times, the two words should be properly positioned with profit at the heart of Capitalism, not greed.

The following is an updated version of what I wrote in “THINK Again: The Rometty Edition.”

The following is an updated version of what I wrote in “THINK Again: The Rometty Edition.”

Greed, Not Profit, Increases Risk

If greed is permitted to reign supreme, “profit” is the single word used to describe all that is wrong with capitalism. While capitalism is based on profits, profit does not equal greed. The proper distribution of profits funds future economic growth, pays wages, enables retirements, rewards educational advancements, builds new leading-edge products, ensures quality service, builds societal infrastructures, and economically stabilizes the political system chosen by a society’s citizens.

It is the obligation of those who believe in capitalism—and want it to thrive, to understand how tenuous the bond is between our economic and political systems. They must stand in opposition to any economic, self-destructive tendencies. They must support a system of checks and balances against greed within, without, and between their companies because greed can not only destroy a properly functioning economic system, but also undermine its supportive sociopolitical system.

Tom Watson believed in business-first, but his concept of business-first involved communicating so clearly, precisely, and repetitively with all his stakeholders that they understood the importance of his balanced investment decisions to maintain a sustainable stakeholder community of customers, employees, shareholders, and their shared societies. I found it very encouraging that a concept I arrived at through an independent study of one of our great American industrialists was so profoundly identified, supported, and published in USA: The Permanent Revolution eight decades ago—around the time of Tom Watson’s death.

This author wonders if Russell Davenport, Milton Friedman, and the Fortune editors might find common ground in what is summarized below:

Any individual stakeholder who believes their standing as a consumer, worker, investor, executive or member of any social community entitles them to a special hyphenated consideration of ‑first and ‑foremost, would be at odds with not just Tom Watson Sr. but many of America’s greatest, twentieth-century industrialists.

For this elite group of industrialists, it was business-first, not shareholder-first, not labor-first, not society-first, not customer-first, and especially not me-first. These industrialists believed in business-first, and one of their top jobs was ensuring an equitable distribution of profits between stakeholders supported by a judicious, stakeholder communication plan. Tom Watson explained to all his stakeholders why a balanced, self-sustaining, stakeholder policy contributed to a healthy business environment that delivered higher, longer-term profits. Too often, individual corporate stakeholders lose sight of how dependent they are on each other. Shareholder-first and ‑foremost or the single-minded goal of shareholder maximization at the expense of the other stakeholders, is as wrong-headed as any approach that is based on an unqualified, individual stakeholder perspective of me‑first and ‑only.

Now with the arrival of the twenty-first century, conditions have changed yet again. Today’s corporate stakeholders’ goals are found imbedded and interweaved throughout an individual’s life.

Almost everyone, as they go through daily life, swaps out the mantles of different stakeholder personas:

They are a consumer dropping off their children at a local day care or elementary school; they are a worker assembling a new marketing campaign; they are an investor checking on their 401(k)/403(b) retirement savings; and they are members of a society who, collectively, expect traffic signals—built by corporations and properly positioned by government entities—to keep them and their children safe on the communal roads home after work.

More so today than any time in history all individuals are consumers, workers, and investors; and all corporations’ bottom lines are impacted by the success or failure of their supportive societies that provide critical business transportation infrastructures and judicial systems.

To say otherwise is ludicrous.

Stakeholders’ investments are maximized through an equitable distribution of corporate profits. This is what a chief executive officer should be paid to accomplish, and if there are temporary imbalances necessary in the distribution of profits for economic, social, or political reasons—such as a world war or a massive recession/depression, he or she must have exemplary communication skills to convey the appropriateness of their profit-dividing decisions.

What matters is an enlightened version of business-first:

What matters is an enlightened version of business-first:

Business-first is investing in making people more productive, processes more effective, and products more valuable so that: customers purchase a product because of improved functionality and quality available at ever-lower prices; employees are more emotionally engaged, productive, and satisfied in their work because of higher wages and targeted benefits that accompany their ever-expanding job opportunities; and shareholders stand ready to fund future business projects because of good, long-term management decisions that provide stable dividends and long-term capital growth—the combination of the two being a critical consideration. All of which must be done profitably to pay taxes that can then be used to support and protect our democratic society.

I would ask these journalists, editors, and one economist, “Isn’t business-first what you had in mind?”

Cheers,

- Peter E.

Cheers,

- Peter E.