If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

IBM's 21st Century Key Performance Indicators

- The Executive Decision: Manage the Business or Manage the Stock

- The Data Is Crystal Clear: The 21st Century IBM Has a Performance Problem

- Comparing the Results: Managing the Stock Instead of the Business

The Executive Decision: Manage the Business or Manage the Stock

If you want me to come in here and operate this business for the benefit of the business, I'll do it, but I will not have anything to do with the operation of it from a stock standpoint.

Thomas J. Watson Sr. to the C-T-R Board of Directors, 1914

The Lengthening Shadow

The Lengthening Shadow

The Data Is Crystal Clear: The 21st Century IBM Has a Performance Problem

In the 20th Century, IBM made a sixteen-year transition that set it apart from and ahead of its competition for almost a half century [Read: The Greatest Business Gamble of the 20th Century]. Some analysts believe that IBM is in a similar transition in the 21st Century. Over the last sixteen years how have IBM's chief executive officers (Palmisano, Rometty and Krishna) performed against some similar critical key performance indicators?

IBM's performance from the period 2007 through 2023 was as follows (non-inflation adjusted): net income was down 28%, net income productivity was a flat 1%, revenues (sales) were down 37%, sales productivity was down 12%, market value was a flat 0%, stock price appreciation was up 51%, tangible assets were down 38%, and goodwill and intangible assets were up 334%, employment was down 28%. [See Footnote #1]

Of course, even with all the negative numbers this performance must be put within some sort of context to intelligently make sense of the numbers and answer the question, "How is IBM performing?"

IBM's performance from the period 2007 through 2023 was as follows (non-inflation adjusted): net income was down 28%, net income productivity was a flat 1%, revenues (sales) were down 37%, sales productivity was down 12%, market value was a flat 0%, stock price appreciation was up 51%, tangible assets were down 38%, and goodwill and intangible assets were up 334%, employment was down 28%. [See Footnote #1]

Of course, even with all the negative numbers this performance must be put within some sort of context to intelligently make sense of the numbers and answer the question, "How is IBM performing?"

In the mid-’60s, Watson Jr. invested $5 billion or 12 times IBM's 1964 net income to deliver a product of superior value—the mainframe. During this time, Watson Jr. prioritized hiring and retaining the best people, building new worldwide communication processes, and pushing individuals to their inventive and innovative limits. In contrast, the three chief executives of this timeframe—Palmisano, Rometty and Krishna, prioritized investments in paper and outside acquisitions over investing in their own people, their own processes, and their own products. Over this latter twenty-first century, sixteen-year period, these chief executives invested $125 billion in paper, their own stock--12 times IBM’s 2007 net income, and $82.2 billion in acquisitions. Stakeholders should compare and question the results of two opposing investment philosophies: investing in reducing the supply of paper or investing in making people more productive, processes more effective, and products move valuable. [see Footnote #2]

The following table contrasts these two sixteen-year periods of transition for the company: A 20th Century transition and a 21st Century transition. It depicts the results of one chief executive officer who invested in the business with three chief executives who invested in paper. [See Footnote #3]

The following table contrasts these two sixteen-year periods of transition for the company: A 20th Century transition and a 21st Century transition. It depicts the results of one chief executive officer who invested in the business with three chief executives who invested in paper. [See Footnote #3]

Comparing the Results: Managing the Stock Instead of the Business

|

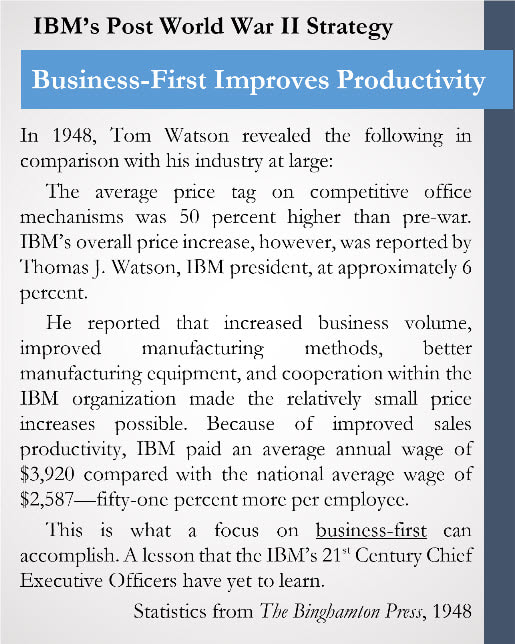

As covered in THINK Again: The Rometty Edition, IBM managed its business from 1960 to 1976 through an immutable belief system based on respect for the individual, service to the customer, and the pursuit of excellence; from 2007 to 2023, IBM managed its stock price through two immutable, earnings-per-share roadmaps. The contrasting results of these two strategies highlight the wisdom of Watson Sr.’s gut-level response quoted above to his prospective board of directors about his priority: he would always manage the business . . . as did his son.

Not one of IBM’s stakeholders has profited from IBM’s twenty-first-century management of the corporation’s stock price. IBM’s shareholder-first and -foremost strategy or, arguably, its CEO's me-first and -only strategy has been a dismal failure and the direction must change. Maybe someday, IBM’s Board of Directors will act to avoid the looming failure of an iconic company that, at one time, represented all that was great about the American form of capitalism

To find prosperity in its second century, the board will need to ensure that Arvind Krishna executes a business-first strategy that returns value to all the corporation’s stakeholders: customers, employees, shareholders, and the societies these investors share in common. |

This requires that the chief executive officer and the board of directors acknowledge that IBM has never conducted a successful share repurchase/buyback program that has benefited any of its stakeholders, including shareholders [Read: IBM Case Study: Do Share Buybacks Work?].

[Footnote #1] "Goodwill + Other Intangible Assets" is red because a large growth in this area is generally not seen as a positive since it is increasing shareholder risk.

[Footnote #2] Since the share buybacks started in 1995 under Louis V. Gerstner, IBM has spent $201 billion. For the time being (2020-21) the repurchases have been "suspended." There is still $2 billion authorized for share repurchases.

[Footnote #3] Arvind is not given a bye on this one because it is stated in the 2023 Annual Report that as of "December 31, 2023, $2,008 million of common stock repurchase authorization was available. … We suspended our share repurchase program at the time of the Red Hat acquisition closing … in order to reduce this debt and return to target leverage ratios within a couple of years." He has also, even though he is out of Watson Research, prioritized investments in acquisitions rather than his own employee's inventiveness. Part of Arvind Krishna's legacy will be losing the premier top spot in the production of patents after IBM had held this position for more than two decades.

[Footnote #2] Since the share buybacks started in 1995 under Louis V. Gerstner, IBM has spent $201 billion. For the time being (2020-21) the repurchases have been "suspended." There is still $2 billion authorized for share repurchases.

[Footnote #3] Arvind is not given a bye on this one because it is stated in the 2023 Annual Report that as of "December 31, 2023, $2,008 million of common stock repurchase authorization was available. … We suspended our share repurchase program at the time of the Red Hat acquisition closing … in order to reduce this debt and return to target leverage ratios within a couple of years." He has also, even though he is out of Watson Research, prioritized investments in acquisitions rather than his own employee's inventiveness. Part of Arvind Krishna's legacy will be losing the premier top spot in the production of patents after IBM had held this position for more than two decades.