IBM Crises, Recoveries & Lessons Learned

|

|

Date Published: June 8, 2021

Date Modified: June 29, 2024 |

Under Tom Watson Sr.’s leadership, IBM weathered ten major economic declines, three major wars, and four of the six largest declines in U.S. stock market history.

And during all this economic, social, and political turmoil, IBM advanced through forty-two years of unprecedented technological change: it divested coffee grinders, candy scales, and cheese and meat slicers, and invested in time devices and tabulating machines; it followed the expansion of electricity around the world and transitioned its warehouse inventory from hand-cranked, spring-driven, standalone, time-recording devices to electrically-powered, dispersed and synchronized, time- and security-recording devices; and it shifted investment dollars from products that landed on the customer’s front counter to higher-value machines filling their corporate back offices. Even though it was slow to the market, IBM then strengthened its position in those back offices with the acquisition of electric typewriter technology.

And during all this economic, social, and political turmoil, IBM advanced through forty-two years of unprecedented technological change: it divested coffee grinders, candy scales, and cheese and meat slicers, and invested in time devices and tabulating machines; it followed the expansion of electricity around the world and transitioned its warehouse inventory from hand-cranked, spring-driven, standalone, time-recording devices to electrically-powered, dispersed and synchronized, time- and security-recording devices; and it shifted investment dollars from products that landed on the customer’s front counter to higher-value machines filling their corporate back offices. Even though it was slow to the market, IBM then strengthened its position in those back offices with the acquisition of electric typewriter technology.

An investment in 100 shares of IBM stock in 1914 when Tom Watson took charge would have cost approximately $2,750. In 1956, at the time of his death it would have become 5000 shares with a market value of $2.33 million (at $465 per share) and paid over $200,000 in dividends. This is a compound annual rate of return of 17.64 percent.

Tom Watsons’ learning process to achieve these results can be found in three major crises during his tenure as IBM’s traditional founder: The Crisis of 1914-15, The Crisis of 1920-21, and The Crisis of 1933-34 (the trough of the Great Depression).

Tom Watsons’ learning process to achieve these results can be found in three major crises during his tenure as IBM’s traditional founder: The Crisis of 1914-15, The Crisis of 1920-21, and The Crisis of 1933-34 (the trough of the Great Depression).

Watson Sr.’s History of Crises, Recoveries, and Lessons Learned

- Tom Watson’s Crises and Recoveries

- Busting the Myth of the IBM Social Security Act Win

- Tom Watson’s Lessons Learned

Tom Watson’s Crises and Recoveries

|

The Crisis of 1914-15 |

When Watson Sr. walked through the doors of the Computing-Tabulating-Recording Company (C-T-R) in 1914, it was on the brink of failure. Over the objections of the shareholders, Watson and Flint stopped dividend payments and acquired funding to ensure the business survived. He immediately invested in new product development and addressed the morale of his employees.

Watson Sr. reminisced about this time at the 1929 One Hundred Percent Club:

" My mind went back to the first convention I held after I came into this business, fifteen years ago last May. We had very few men. We had very little enthusiasm, but what we did have … gave us a great start, and the other men fell in line."

Watson Sr. reminisced about this time at the 1929 One Hundred Percent Club:

" My mind went back to the first convention I held after I came into this business, fifteen years ago last May. We had very few men. We had very little enthusiasm, but what we did have … gave us a great start, and the other men fell in line."

|

The Crisis of 1920-21 |

Next up was the Crisis of 1920-21. This was a lengthy eighteen-month recession and included the fifth-largest stock market decline in history. This economic storm caught most of America’s greatest industrialists by surprise.

|

It forced the reorganization of General Motors under Alfred P. Sloan Jr., General Electric under Gerard Swope and Owen D. Young, and threatened the existence of Firestone Tire Company under Harvey S. Firestone.

These industrialists’ optimism met the reality of a bursting automobile bubble and a weak post-World War I economy. Entering this crisis, C-T-R’s net income dropped first by 40%, and then by almost 75%, to $331,000 — one-third less than what it had been when Watson took charge seven years earlier. Bankruptcy was on the horizon. So, Tom Watson acted - as he best knew how. |

He cut all wages, including his own salary, by 10%. His total income, because of its dependence on a profit-sharing formula, was reduced 40%. He laid off employees, with expensive skilled labor going first — only four of fifty in the development department survived — which slowed the production of any new technology including a printer needed by his customers. C-T-R entered the Roaring Twenties with a weak product line and 13% fewer employees which meant a reduced sales force was chasing fewer opportunities with old technology. Consequently, revenue per employee declined for four straight years instead of improving with the economy. Because of Watson Sr.’s mistakes, the rising economic tide did not lift his corporate boat like it should have.

In the 1931 One Hundred Percent Club he acknowledged his mistakes saying:

In the 1931 One Hundred Percent Club he acknowledged his mistakes saying:

" I am ashamed of it. I am ashamed of that record because it was not necessary for us to show even the slight decrease in our profits that we did show in 1921. … We just didn't hang on to our courage and our belief in IBM and in IBM men. That was the only reason why in 1921 we fell behind."

|

The Crisis of 1933-34: The Trough of the Great Depression Now, it was the heart of the Great Depression, and Tom Watson changed his approach to economic downturns. He hung onto his courage and belief in his company and its employees. He invested in new factories, broke ground on new research and development laboratories, and constructed a new corporate education facility.

He kept the manufacturing lines running at full speed to maintain employment which required turning the newly constructed facilities into storage warehouses full of unsold parts. IBM faced economic devastation. The question was, “Would the economy turn upward before the company’s financial fortunes turned downward?” Although oral tradition says that IBM was saved by winning the Social Security bid and that these parts were just sitting around waiting to be used, this is corporate folklore with, as usual, some basis in fact. The real story is more valuable in its instructive worth to corporate leaders facing major economic downturns or making industry transitions. |

Let's analyze IBM's 1936 business and how the corporation was function prior to the Social Security win.

MythBuster: IBM Was Firing on all Cylinders Before the Social Security Act

In January 1936, IBM announced that the corporation hit a historic “new high mark” in sales for the month.

In March 1936, Walter F. Titus, IBM Vice President announced that total sales in the first two months of the year were 54 percent higher than the previous year and 20 percent greater than any January and February in corporate history.

In June 1936, Watson told the press that sales for the first five months were the highest for “any like period in its history” and were continuing at a “high level.”

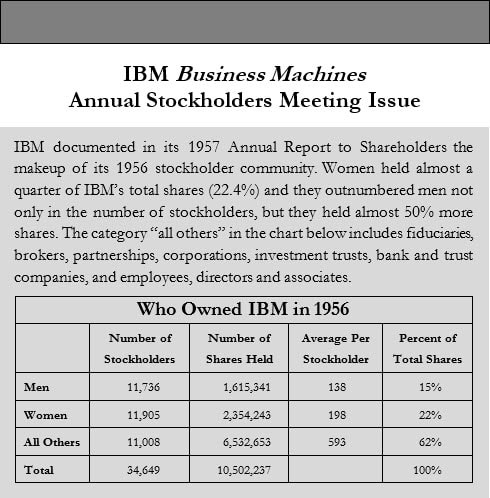

In July 1936, IBM reported that it had achieved the “largest six months earnings in its history.” This means that by mid-year 1936, IBM had overcome the effects of the Crash of 1929 which was its previous high sales point. [See Footnote #1] The Social Security win came late in 1936. IBM was firing on all cylinders before the Social Security Board awarded the corporation the contract over sixteen other vendors.

In November 1936, Walter F. Titus reinforced that private businesses – not just the Social Security Administration – were placing large orders. Only an initial deployment of the rental equipment (three train carloads) was sent in the fourth quarter of 1936 to Baltimore—the initial home base for the Social Security effort. The major rental/leasing revenue uplift to IBM from the win was not felt until 1937 with major deliveries that were scheduled to be shipped to the Social Security Administration in February, April, July and the fall of 1937.

Watson Sr.’s investments in people, products and processes were already paying high dividends before the federal government win. By then, those spare parts stored in the Endicott factories were long gone—the corporation was running extra shifts and paying overtime. The Social Security contract was icing on the cake. It was not crucial to IBM’s continued existence. Some authors have attributed this Social Security win to Tom Watson’s extraordinarily lucky “ability.” In this case, the business definition of luck does define this “ability” of Tom Watson: Luck is what happens when preparation meets opportunity.

These three top crises of Tom Watson’s career had prepared him and his corporation to exploit an amazing opportunity—of which, the Social Security Board was only one. Two decades of crises, recoveries and lessons learned were the foundation of IBM’s early 20th Century success.

In March 1936, Walter F. Titus, IBM Vice President announced that total sales in the first two months of the year were 54 percent higher than the previous year and 20 percent greater than any January and February in corporate history.

In June 1936, Watson told the press that sales for the first five months were the highest for “any like period in its history” and were continuing at a “high level.”

In July 1936, IBM reported that it had achieved the “largest six months earnings in its history.” This means that by mid-year 1936, IBM had overcome the effects of the Crash of 1929 which was its previous high sales point. [See Footnote #1] The Social Security win came late in 1936. IBM was firing on all cylinders before the Social Security Board awarded the corporation the contract over sixteen other vendors.

In November 1936, Walter F. Titus reinforced that private businesses – not just the Social Security Administration – were placing large orders. Only an initial deployment of the rental equipment (three train carloads) was sent in the fourth quarter of 1936 to Baltimore—the initial home base for the Social Security effort. The major rental/leasing revenue uplift to IBM from the win was not felt until 1937 with major deliveries that were scheduled to be shipped to the Social Security Administration in February, April, July and the fall of 1937.

Watson Sr.’s investments in people, products and processes were already paying high dividends before the federal government win. By then, those spare parts stored in the Endicott factories were long gone—the corporation was running extra shifts and paying overtime. The Social Security contract was icing on the cake. It was not crucial to IBM’s continued existence. Some authors have attributed this Social Security win to Tom Watson’s extraordinarily lucky “ability.” In this case, the business definition of luck does define this “ability” of Tom Watson: Luck is what happens when preparation meets opportunity.

These three top crises of Tom Watson’s career had prepared him and his corporation to exploit an amazing opportunity—of which, the Social Security Board was only one. Two decades of crises, recoveries and lessons learned were the foundation of IBM’s early 20th Century success.

Tom Watson’s Lessons Learned

- Tom Watson invested in business-first

The survival of the business and investing for the future came before shareholders’ short-term interests; after 1921, paychecks – although lean at times – were consistent, and performance guaranteed stable employment; and it became a priority during economic downturns to double down on education and new product development. This meant that when a recession first turned upward—and business men feel an upward turn before any economist writes about it—IBM had the best trained sales force with the best customer relationships selling the best competitive solutions: a trilogy of bests that was hard for the competition to match. - Tom Watson built a tight corporate family

While paychecks mattered, employees worked for more than a paycheck, so, he took his chief executive’s enthusiasm and sense of family on the road and delivered it with a contagious, personal touch to build employee enthusiasm about the company.

|

Tom Watson built a sustainable, cooperative stakeholder ecosystem. Every stakeholder, whether shareholder, employee, customer or their supportive societies understood the corporation was always in their corner and they were a team that looked out for each other’s best interests.

This was the essence of IBM’s early 20th Century brand and its major strength in surviving so many economic downturns, political interventions, and competitive battles.

This was the essence of IBM’s early 20th Century brand and its major strength in surviving so many economic downturns, political interventions, and competitive battles.

[Footnote #1] The Great Depression was not a short term recession with only one long-term down and up. There were multiple fluctuations in business cycles during this time. Most likely it was during the later part of the Great Depression that Tom Watson was producing excess parts.

This is what he told the Endicott employees in January 1940: "Business has now begun to improve very materially. December [1939] was the best month we ever had. Therefore, up to date, my predictions are working out in a way that makes me feel that there is no danger of our having to change our policy on the manufacturing of extra parts."

This is what he told the Endicott employees in January 1940: "Business has now begun to improve very materially. December [1939] was the best month we ever had. Therefore, up to date, my predictions are working out in a way that makes me feel that there is no danger of our having to change our policy on the manufacturing of extra parts."