If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

IBM's Twenty-First Century Corporate Practices

|

|

Date Published: July 19, 2021

Date Modified: January 2, 2024 |

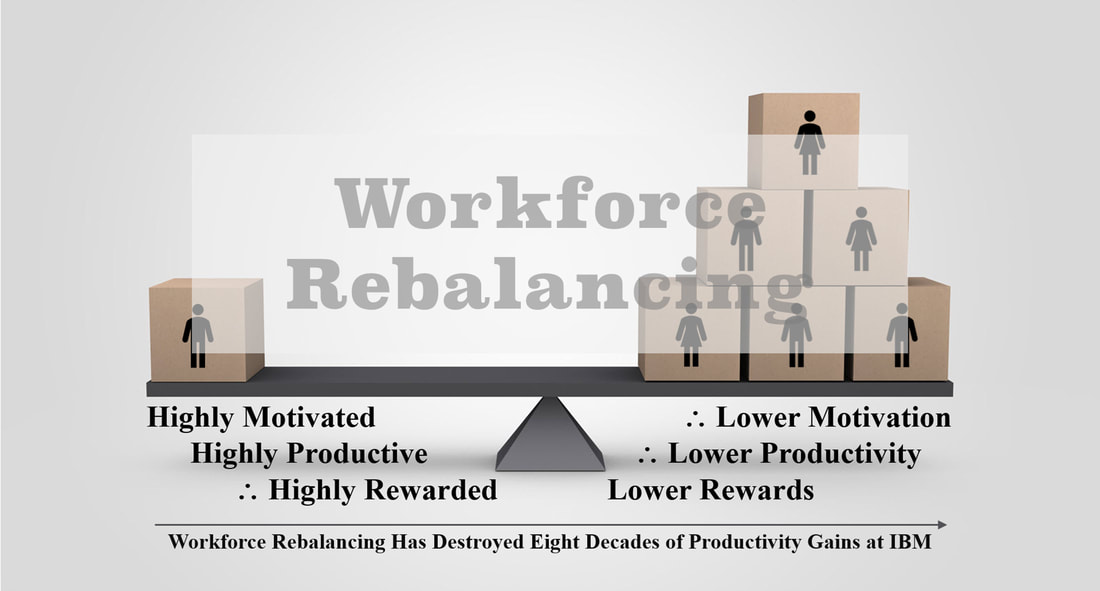

IBM's current leadership has focused on producing profits through (1) financial engineering: workforce reductions and (2) aggressive bookkeeping: divestitures, pension plan changes, 401(k) retirement plan changes, and severance pay reductions.

These policies have destroyed the corporation's sales productivity.

These policies have destroyed the corporation's sales productivity.

IBM 21st Century Corporate Practices

Acquisitions

Wouldn’t it be hard for a small business man or woman to justify a $500,000 business loan to purchase a competitor that had a yearly net income of less than $5,000 and a ten-year, average net income of half that number?

Don't get lost in the big numbers! |

IBM has been exploited this change. This is a list of IBM's yearly acquisitions as listed in each of its annual reports since 2001—207 acquisitions as of the end of 2021.

|

|

IBM has exploited a 2001 accounting change by adding $64 billion of goodwill to its balance sheet as of the end of 2021. This is a list of the acquisitions since 2001 and a summary of its year-over-year goodwill growth that is increasing shareholder risk.

|

Centralization

To say today that your executive is hand-picked by the corner office is to say that you have a controller that will enforce corporate financial policy at the expense of reason, common sense, and service to the customer.

|

IBM needs a leader to bring back the substance and spirit of Alfred P. Sloan Jr.'s "coordinated decentralization."

|

Divestitures

|

Reality will set in soon enough because when it comes to business fundamentals, Main Street and corporate stakeholders—customers, employees, long-term shareholders, and society have proven themselves better able to understand long-term business realities than Wall Street.

|

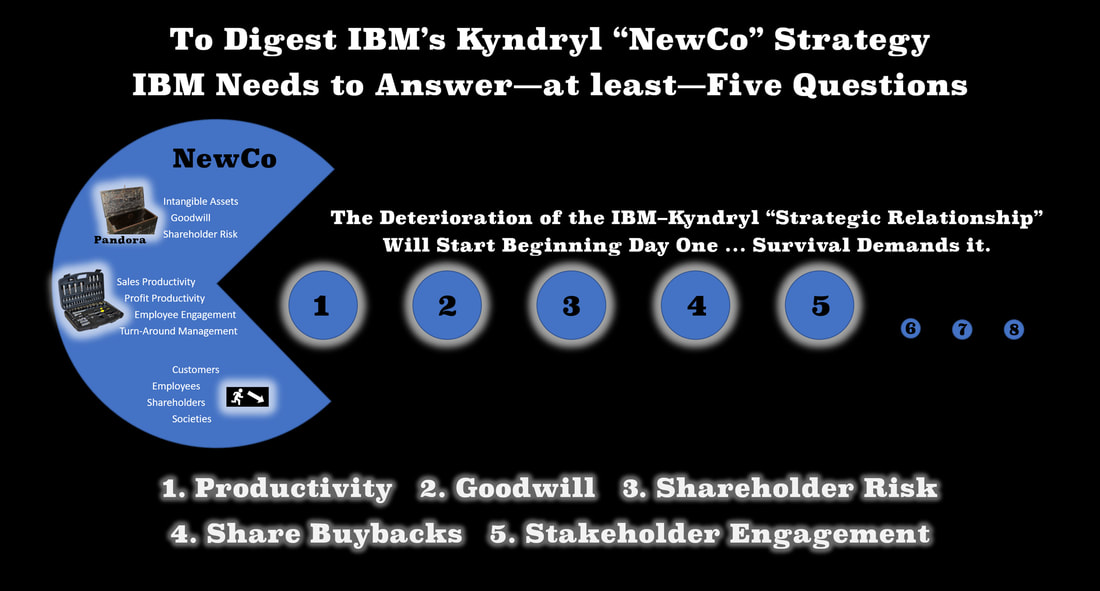

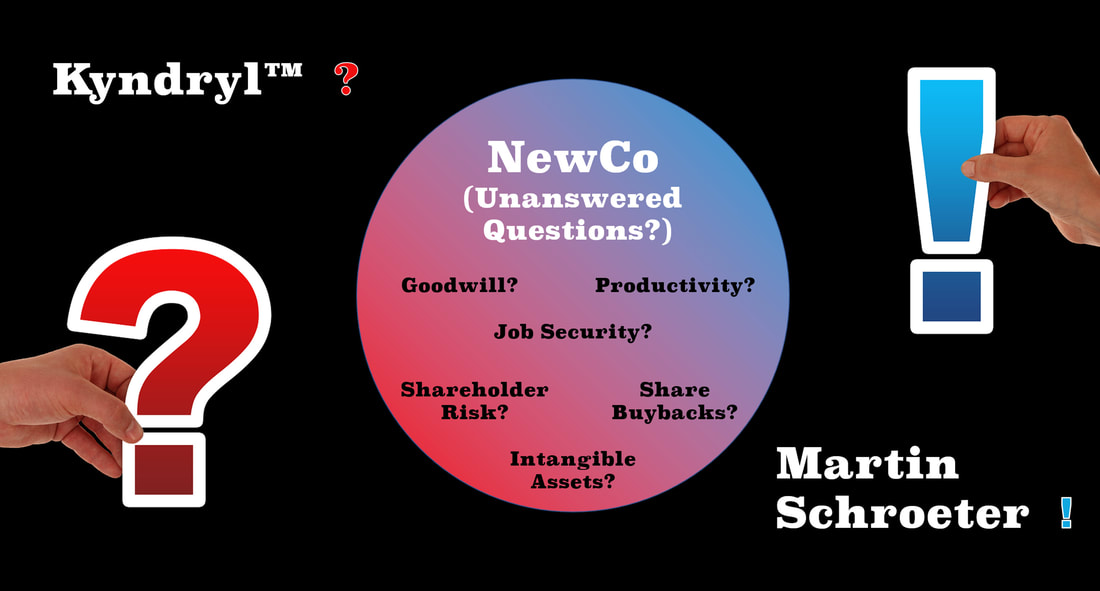

In all deference to the marketing organization, these two corporations will immediately start the parting of their ways after the spin-off. Neither chief executive will tie their success to the other—except in press releases.

|

Does Martin Schroeter's track record as IBM"s CFO indicate that he was a good choice to lead Kyndryl?

|

Employee Relations

IBM refers to this ongoing layoff practice in their 2021 Annual Report as "workforce reduction actions" and it performs them to "improve productivity." Here are two "R. A. Days" I experienced. Arvind Krishna has continued this tradition of his three predecessors.

Would you be more productive after experiencing one of these R.A. Days?

|

Older workers at IBM are wishing for a pair of ruby red slippers they could click together to take them back to Kansas: a time and place when IBM’s management “adjusted policies based on principles” instead of “adjusting principles to implement a policy.” The New York Times is finally documenting some of these actions: Making Dinobabies Extinct.

This article shows that the news organization is late to the game. |

The 21st Century IBM is proving the corollary to these practices and, in so doing, have reversed the financial and business results of the Watsons.

|

|

According to IBM's 2021 Annual report, "Employees purchased approximately one million shares under the ESPP during each year ending December 31 2021, 2020, and 2019."

The employees' financial investment in their corporation isn't competitive, has plummeted since the turn of the century, and betrays a deep truth about the company's human resource practices. |

The real threat to the company is not necessarily in its declining revenue but in management’s inability to reverse their falling sales productivity over almost two decades.

|

If IBM had prioritized tracking and investing in work-at-home productivity improvements, greater savings would have flowed to the corporation's bottom line over a longer-term.

|

Financial Engineering

The U.S. meaning of "scheme" is probably correct as applied to all IBM's pension changes since 1995: scheme: /skēm/ - to make plans, especially in a devious way or with intent to do something illegal or ethically wrong.

|

IBM has been increasing profits by lowering wages, but this has been offset by the ever-decreasing productivity of a newer, larger, discouraged, more disconnected, and widely dispersed workforce.

|

Shareholder Value and Risk

At one time, our country’s chief executives believed that the business of America was business-first. It seems, though, that too many of our twenty-first century crop of chief executives believe that the business of their businesses is Wall Street-first.

|

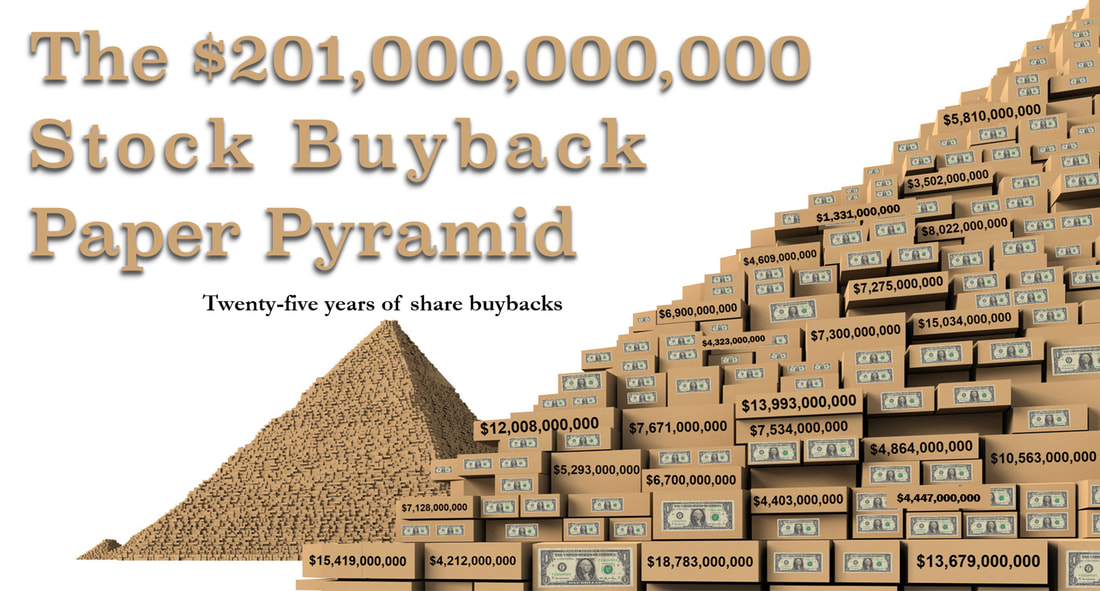

Even though IBM spent $201 billion on share buybacks from 1995 though 2019, its twenty-first-century returns have significantly underperformed common low-risk indexes.

|

|

Watson Sr. and Jr. understood this concept well and because of it they achieved some amazing results: 17% compound annual growth rate (CAGR) over 32 years, and 21% CAGR over 15 years, respectively.

This is how IBM could get back those shareholder returns by establishing a sustainable stakeholder ecosystem. |

Its walls and moats were defended by enthusiastic, engaged, and passionate stakeholders: customers, employees, shareholders, and their supportive societies. Warren should have learned that share buybacks can not compensate for the market's lack of trust and confidence in a corporation's leadership.

|

|

There are better investments a technology company can make than in buying paper. This article looks at IBM's history of three failed stock buybacks: 1978–79, 1986–1998, 1999–2019.

It isn't pretty. |