Goodwill and Intangible Assets by IBM CEO

Comparing IBM CEO Goodwill & Intangibles

|

|

Date Published: August 7, 2021

Date Modified: June 29, 2024 |

An intangible asset is something that, if dropped on your toe, doesn’t leave a mark. It is ethereal, and its value is open to personal interpretation, imagination, and creative thinking.

For the purposes of this article, intangible assets are presented in two ways: first, the goodwill that arises directly from an acquisition; and second, all other intangible assets—patents, brand image, customer relations, non-binding contracts, strategic alliances, or others. Goodwill is the difference between the full amount paid for an acquisition less all other intangible and tangible assets.

For the purposes of this article, intangible assets are presented in two ways: first, the goodwill that arises directly from an acquisition; and second, all other intangible assets—patents, brand image, customer relations, non-binding contracts, strategic alliances, or others. Goodwill is the difference between the full amount paid for an acquisition less all other intangible and tangible assets.

IBM Chief Executive Officers' Yearly Goodwill

In 1981, when Warren Buffett discussed some of his failed acquisitions with shareholders, he chalked it up to occasionally buying “toads at bargain prices … clearly our kisses fell flat.” When talking about some of his successes, he said, “We have done well with a couple of princes … at least our kisses didn’t turn them into toads.”

To extend Warren Buffett’s toad-kissing acquisition analogy, IBM has learned from watching its competition that it is better to be standing knee-deep in a multitude of small, croaking toads than to invest in one large bullfrog with a bullhorn. HP spent $13.9 billion for EDS and $10.3 billion for Autonomy, and Microsoft paid $7.2 billion for Nokia and $6.3 billion for aQuantive, only to be forced to reverse these transactions and take goodwill impairments of $8 billion, $8.8 billion, $7.6 billion, and $6.2 billion, respectively. These were large, highly visible acquisition failures.

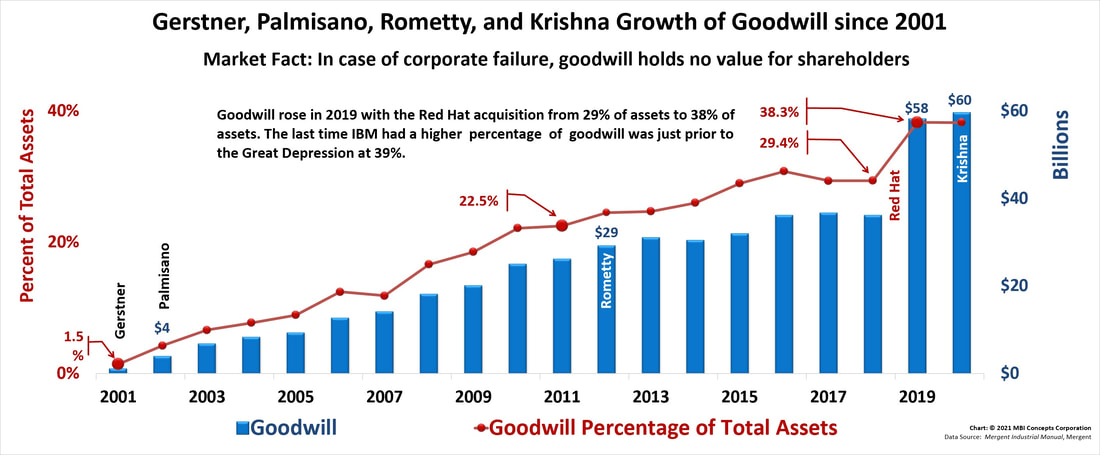

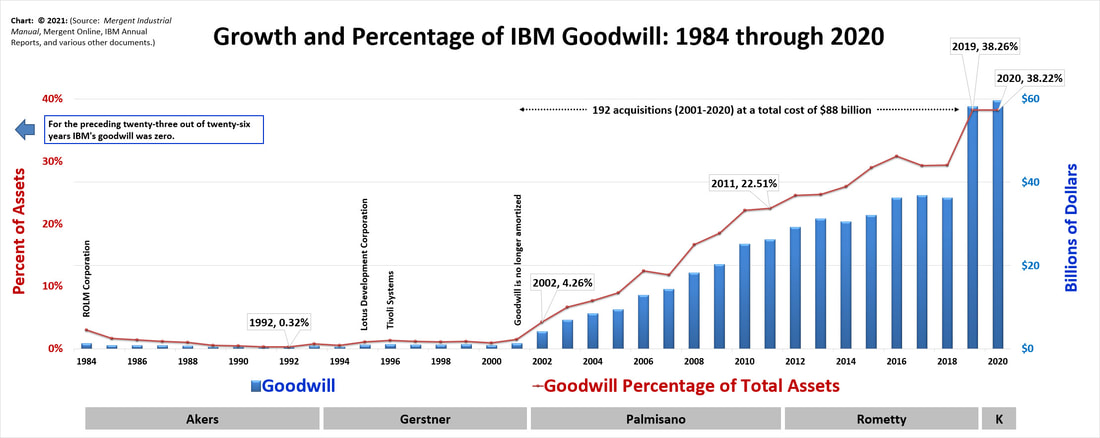

IBM’s strategy has been to avoid kissing bullfrogs and instead act as a princess—smooching a multitude of lesser toad-princes. Through 2020, it had spent $88 billion on 192 acquisitions, for an average expenditure of approximately $280 million (without Red Hat which broke the curve). This is a significant number of small toads, and when one croaks—rather than transforming—it goes unnoticed by shareholders, consultants, and the press.

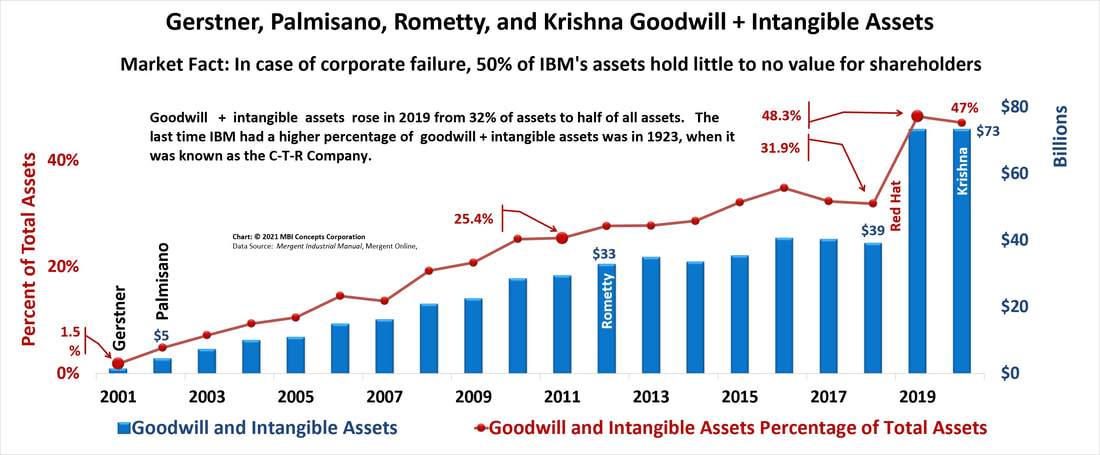

In 2019, Ginni Rometty kissed a bullfrog to pass on to her successors: Red Hat. Its purchase resulted in the addition of $23.1 billion in goodwill and $13.5 billion in other intangible assets. IBM paid $3 million per employee and goodwill is now almost 40% of the corporation’s total assets, while intangible assets have risen to almost 50%.

It will be interesting to see how Arvind Krishna handles the bullfrog with its bullhorn:

Undoubtedly with IBM's Principles of Trust and Transparency.

IBM’s strategy has been to avoid kissing bullfrogs and instead act as a princess—smooching a multitude of lesser toad-princes. Through 2020, it had spent $88 billion on 192 acquisitions, for an average expenditure of approximately $280 million (without Red Hat which broke the curve). This is a significant number of small toads, and when one croaks—rather than transforming—it goes unnoticed by shareholders, consultants, and the press.

In 2019, Ginni Rometty kissed a bullfrog to pass on to her successors: Red Hat. Its purchase resulted in the addition of $23.1 billion in goodwill and $13.5 billion in other intangible assets. IBM paid $3 million per employee and goodwill is now almost 40% of the corporation’s total assets, while intangible assets have risen to almost 50%.

It will be interesting to see how Arvind Krishna handles the bullfrog with its bullhorn:

Undoubtedly with IBM's Principles of Trust and Transparency.

Summary of IBM CEO Yearly Goodwill

- Goodwill (and Shareholder Risk) Observation: There is nothing "good" in IBM's current goodwill performance. What it took Watson Sr. forty-two years to get rid of, IBM's four, twenty-first-century chief executives have put back on the books in twenty years.

Shareholders' investments are at great risk especially with the unknowns of the Kyndryl divestiture.

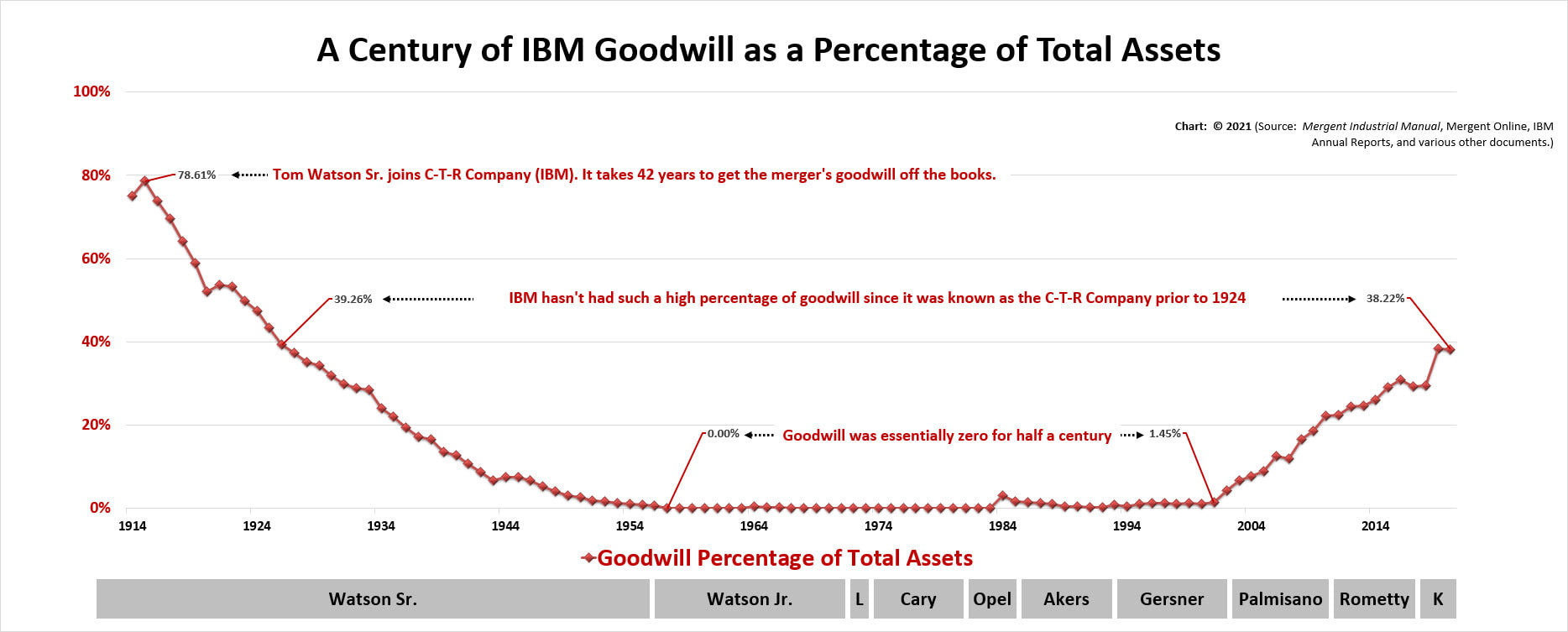

At a Glance: Examining a Century of IBM Goodwill

- Goodwill (and Shareholder Risk) Observation: Goodwill and Shareholder Risk are at 1924 Levels

|

At a Glance: Examining Goodwill Growth over the Last Two Decades: 2001 – 2020 |

- Goodwill (and Shareholder Risk) Observation: Will Arvind (IBM) or Martin (Kyndryl) Carry the Risk?

Facts worthy of consideration: Fifty percent of IBM's total assets are now "intangibles." The "James (Jim) Whitehurst" intangible left the building. How many of the other Red Hat "intangibles"—human assets at $3 million a person—are heading for the exits?

|

The Last Two Decades Goodwill Growth in Context: John F. Akers through Arvind Krishna 1984 – 2020 |

- Goodwill (and Shareholder Risk) Observation: Goodwill "Impairment" Anyone?

Facts worthy of consideration: Two decades, 192 acquisitions, $88 billion spent with $60 billion in goodwill still on the books and no goodwill impairments. Even the 20th Century IBM was never that good: think ROLM, Intel and WorldCom. It defies logic. It isn't ethical. It isn't the act of a leadership that claims to be trustworthy and transparent.

|

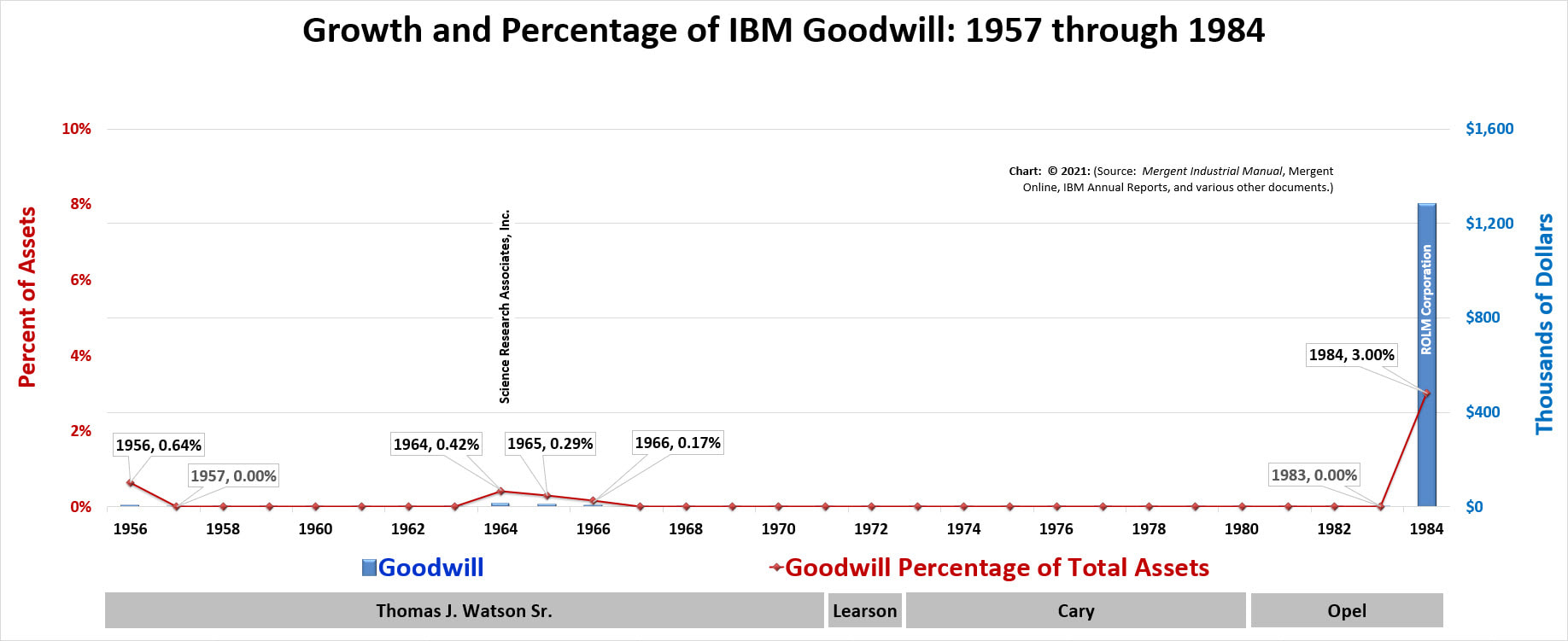

Thomas J. (Tom) Watson Jr. through John R. Opel: 1956 through 1984 |

- Goodwill and Shareholder Risk Observations: Under Control and Amortized

Facts worth noting: There was a minor recognition of goodwill (less than 1% of total assets in the 1960s) with the acquisition of Science Research Associates, one that was amortized over the next few years. Goodwill was zero in all other years, even though IBM invested $5 billion in System/360 research and development (R&D), because R&D expenditures are handled differently from money spent on an acquisition. Instead, IBM’s tangible assets grew by more than fourteen times — $624 million to $9.6 billion. Shareholder risk was well controlled during this time frame.

The ROLM Corporation acquisition was a dismal failure, but by the time this was acknowledged it had been amortized (written off over its expected useful lifetime). Under today’s rules of goodwill accounting, IBM would have not amortized the ROLM acquisition; rather, it would have carried the goodwill until it was acknowledged as a failure, and then taken a one-time goodwill impairment.

Under today’s accounting rules, the goodwill from the Lotus and Tivoli acquisitions, rather than being amortized, would most likely still be on the books.

The ROLM Corporation acquisition was a dismal failure, but by the time this was acknowledged it had been amortized (written off over its expected useful lifetime). Under today’s rules of goodwill accounting, IBM would have not amortized the ROLM acquisition; rather, it would have carried the goodwill until it was acknowledged as a failure, and then taken a one-time goodwill impairment.

Under today’s accounting rules, the goodwill from the Lotus and Tivoli acquisitions, rather than being amortized, would most likely still be on the books.

|

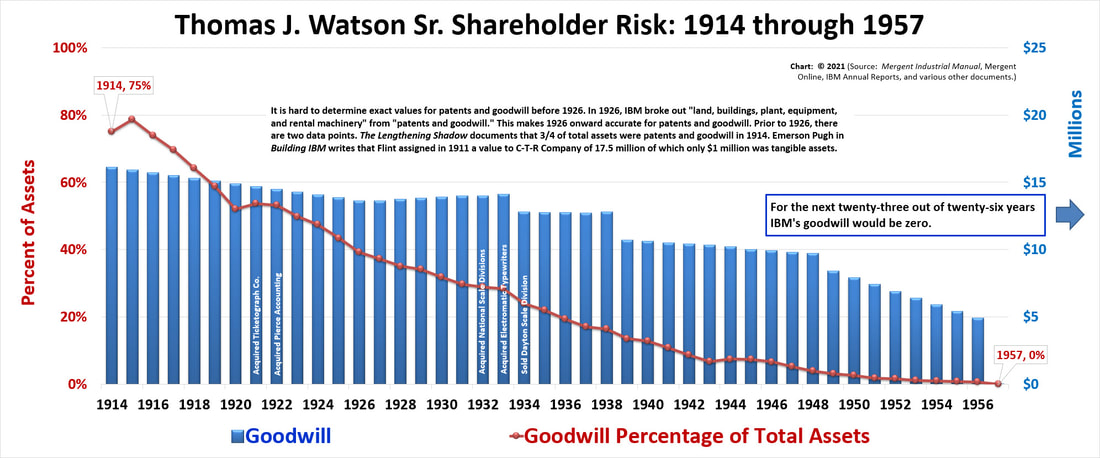

Thomas J. (Tom) Watson Sr.: May 1914 – May 1956 |

- Goodwill and Shareholder Risk Observations: Forty-Two Years to Rid the Corporation of Goodwill

Facts worth noting: The overall trend, no matter the lack of detailed information prior to 1926, shows that Watson Sr. improved shareholder risk in two ways. First, he reduced the percentage of goodwill (39% to less than 1%) by increasing tangible assets. Second, he decreased the actual dollar amount of goodwill ($14 million to $5 million). Both actions improved shareholder equity and reduced shareholder risk significantly in IBM’s first half century of existence.

Watson Jr. wrote off the last bit of goodwill after his father's death.

Watson Jr. wrote off the last bit of goodwill after his father's death.