Lou Gerstner wrote, "People truly do what you inspect, not what you expect." … Lest we forget, these "inspection pages" exist because chief executives are "people" too.

Arvind Krishna's 2020-23 Revenue and Profit Performance

- The Importance of Revenue and Profit

- Arvind Krishna's 2020-23 Revenue by the Numbers

- Arvind Krishna's 2020-23 Net Income by the Numbers

Evaluating Arvind Krishna's 2020-23 Revenue and Net Income (Profit)

What were Arvind Krishna's fourth-year 2020-23 revenue and profit performance numbers?

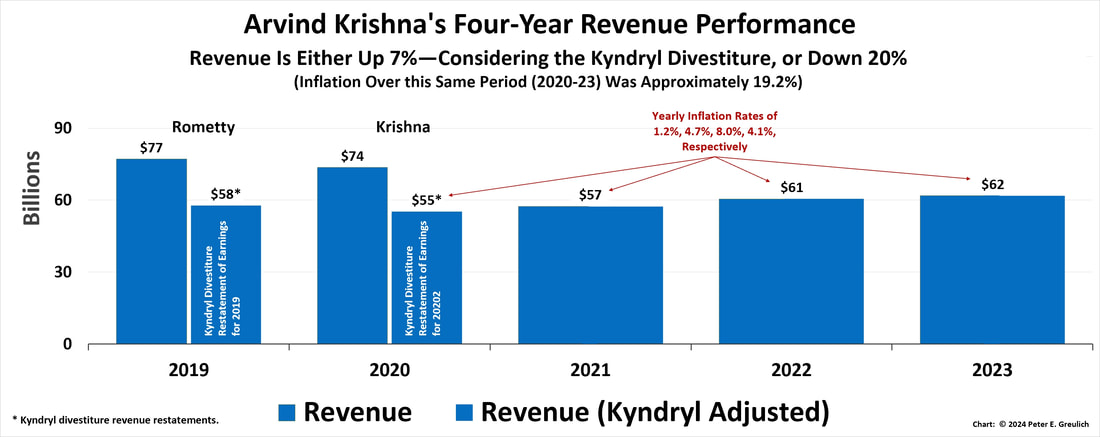

IBM’s 2023 Revenue under Arvind Krishna’s four years of leadership is down $15.3 billion since the end of 2019, falling $3.5 billion in 2020, falling $16.3 billion in 2021, rising $3.1 billion in 2022, and finally, rising $1.3 billion in 2023 to reach $61.9 billion—a 20% decline in revenue from the $77-billion corporation Arvind Krishna inherited from Virginia (Ginni) M. Rometty in 2020.

- Taking the Kyndryl divestiture into consideration, IBM’s 2023 Revenue under Arvind Krishna’s leadership is up $4.1 billion since the end of 2019, falling $2.5 billion in 2020, rising $2.2 billion in 2021, rising $3.2 billion in 2022, and finally rising $1.3 billion in 2023 to achieve $61.9 billion—a 7% revenue increase from the $57.7‑billion corporation Arvind Krishna inherited from Virginia (Ginni) M. Rometty in 2020 (using Kyndryl adjusted revenue numbers from IBM’s Annual Reports).

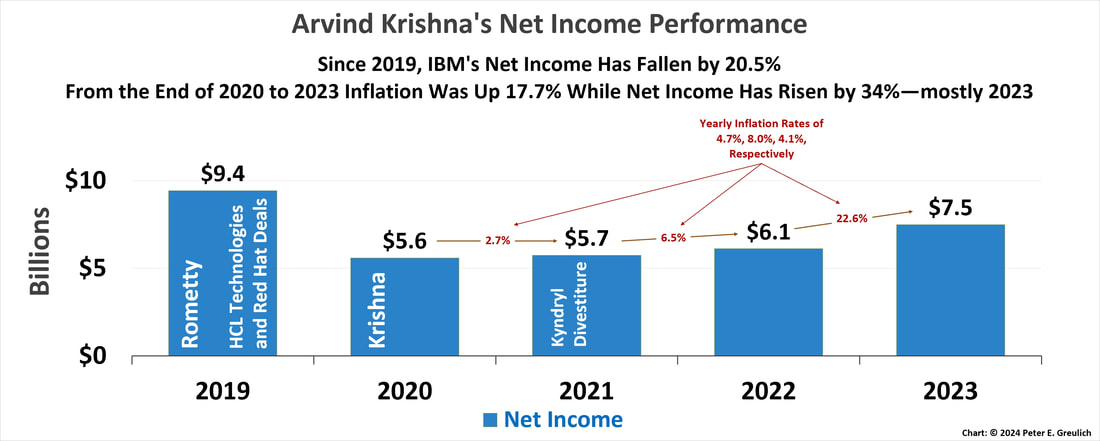

IBM’s 2023 Profit under Arvind Krishna’s four years of leadership is down $1.93 billion since the end of 2019: falling $3.8 billion in 2020, increasing $.15 billion in 2021, increasing $.38 billion in 2022, and finally, increasing by $1.4 billion in 2023.

A worthless car is one that can’t move passengers or cargo between points "A" and "B" safely and reliably. [Link to "The Importance of Sales Productivity" on this website] Corporations, within a capitalist economy, lose value as they fail in their main purpose: moving products of competitively higher value off the showroom floor into a customer’s hands while generating enough profits to ensure a self-sustaining stakeholder ecosystem—enough money to invest equitably between customers, employees, shareholders, and their supportive societies.

In this respect the following charts show that IBM has been failing to deliver products of higher value to its customers. Selling continuously-improving, higher-quality products at a profit is, ultimately, the responsibility of the corner office. These charts reflect what should be the two top priorities . . . and responsibilities of the corner office.

Long-term, sustainable revenue and profitability should be the chief executive’s two top performance metrics.

Long-term, sustainable revenue and profitability should be the chief executive’s two top performance metrics.

Arvind Krishna's 2020-23 Revenue by the Numbers

- Arvind Krishna 2020–23 Revenue Performance

- IBM’s 2023 Revenue under Arvind Krishna’s four years of leadership is down $15.3 billion since the end of 2019, falling $3.5 billion in 2020, falling $16.3 billion in 2021, rising $3.1 billion in 2022, and finally, rising $1.3 billion in 2023 to reach $61.9 billion—a 20% decline in revenue from the $77-billion corporation Arvind Krishna inherited from Virginia (Ginni) M. Rometty in 2020.

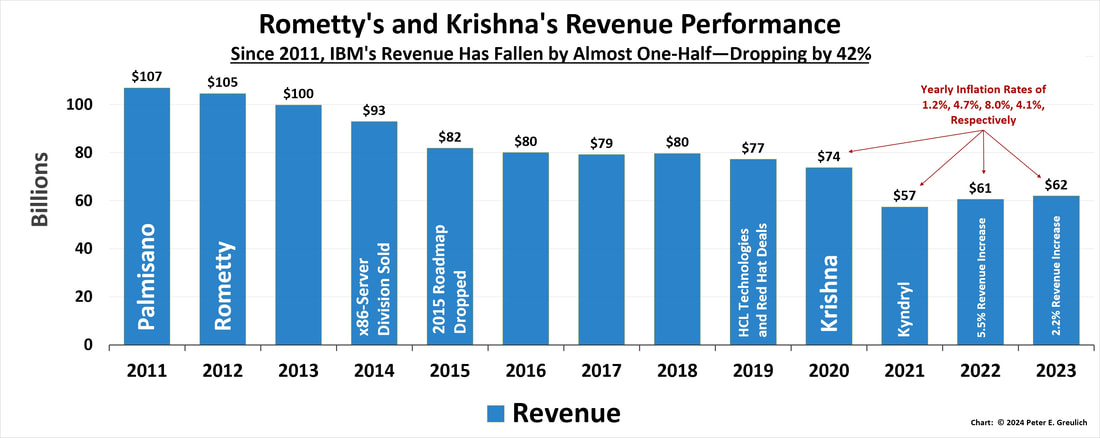

- Krishna & Rometty 2011–23 Revenue Performance

- IBM Revenue was down $45.1 billion since the end of 2011—a consistent, methodical, decade-long, decline of 42.1% from the $107-billion corporation Virginia (Ginni) M. Rometty inherited from Samuel J. Palmisano.

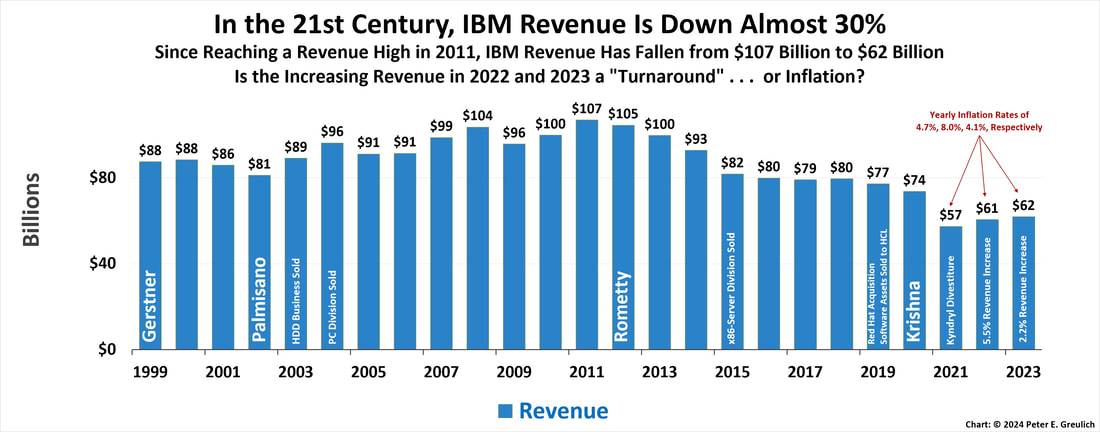

- Krishna, Rometty, Palmisano & Gerstner 1999–2023 Revenue

- IBM Revenue was down $25.7 billion since the end of 1999. After achieving a history-setting, revenue high of $107 billion in 2011--IBM's Centennial--revenue's decline has only in the last three years been interrupted by an apparent string of revenue increases, but as the chart reflects, Inflation became a serious performance consideration over this timeframe.

Even allowing for the Kyndryl divestiture, IBM’s revenue increases did not keep up with inflation: ‑4.4% in 2020 vs. inflation of +1.2%, +3.9% in 2021 vs. inflation of +4.7%, +5.5% in 2022 vs. inflation of 8.0%, and finally +2.2% in 2023 vs. inflation of 4.1%--in total, IBM revenue only increased 7.2% vs. an inflation rate of 19.2% over this same four-year period.

- IBM Revenue was down $25.7 billion since the end of 1999. After achieving a history-setting, revenue high of $107 billion in 2011--IBM's Centennial--revenue's decline has only in the last three years been interrupted by an apparent string of revenue increases, but as the chart reflects, Inflation became a serious performance consideration over this timeframe.

Arvind Krishna's 2020-23 Net Income (Profit) by the Numbers

- Arvind Krishna 2020–23 Profit Performance

- IBM’s 2023 Profit under Arvind Krishna’s four years of leadership is down $1.93 billion since the end of 2019: falling $3.8 billion in 2020, increasing $.15 billion in 2021, increasing $.38 billion in 2022, and finally, increasing by $1.4 billion in 2023. This is a string of positive profit news that some analysts have suggested might indicate an improvement in the corporation's earnings prospects, but as the chart reflects, Inflation became a serious performance consideration over this timeframe.

If IBM’s net income or profits had kept up with inflation over this four-year period, IBM’s net income would have increased from $9.4 billion in 2019 to $11.2 billion—instead of its $7.5 billion, in 2022.

- IBM’s 2023 Profit under Arvind Krishna’s four years of leadership is down $1.93 billion since the end of 2019: falling $3.8 billion in 2020, increasing $.15 billion in 2021, increasing $.38 billion in 2022, and finally, increasing by $1.4 billion in 2023. This is a string of positive profit news that some analysts have suggested might indicate an improvement in the corporation's earnings prospects, but as the chart reflects, Inflation became a serious performance consideration over this timeframe.

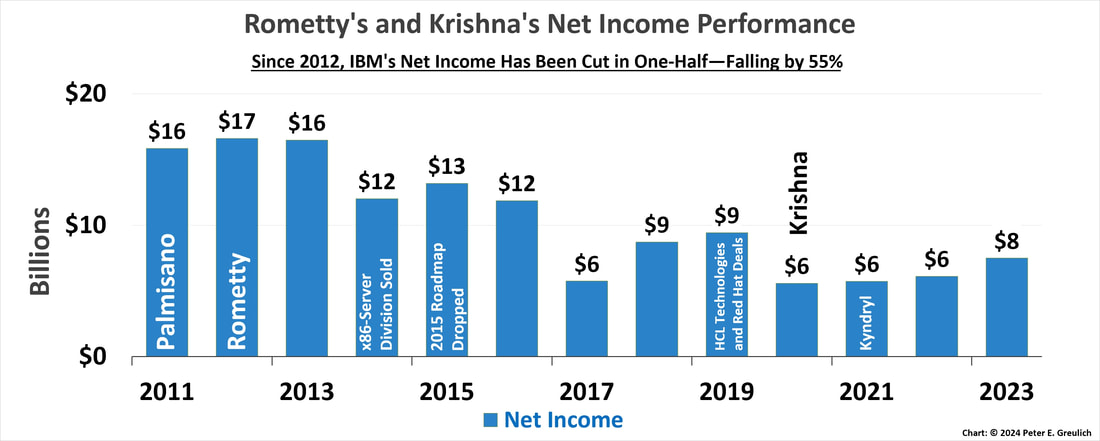

- Krishna & Rometty 2011–23 Profit Performance

- IBM Net Income or Profit of $15.9 billion in 2011 was down $8.4 billion by the end of 2023, falling 54.9% since a achieving a two-decade-long, profit peak in 2012.

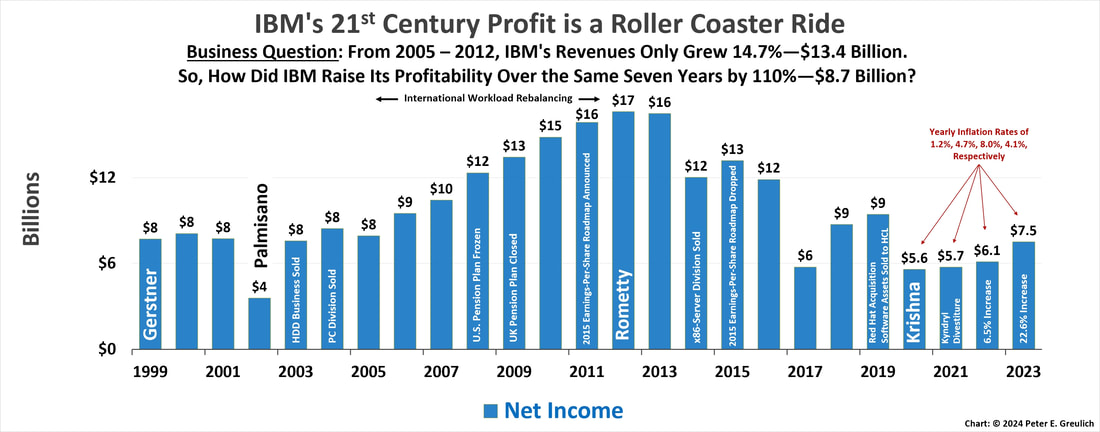

- Krishna, Rometty, Palmisano & Gerstner 1999–2023 Profit

- IBM Net Income or Profit of $7.7 billion in 1999 was down $2 billion by the end of 2021, falling 25.5% after reaching a two-decade-high peak in 2012. This 21st Century summit was achieved through (1) financial engineering: workforce rebalancing, and (2) aggressive bookkeeping: pension plan changes, 401(k) retirement changes, severance pay reductions, and divestitures. In 2011-13 these non-sales oriented financial practices appeared to have reached their all-to-predictable limits.