If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

IBMers Aren't Buying What IBM Is Selling

|

|

Date Published: July 30, 2021

Date Modified: June 22, 2024 |

At one time, Thomas J. Watson Jr. believed that IBM would gradually become an employee-owned corporation.

"There is enormous strength in proprietorship—people develop strong attachments to the things they own, especially if they can influence whether those things succeed or fail—and it seemed imprudent to let the ownership of a business rest with people [capitalists] and institutions [bankers] that are not directly involved.

"Remedying this situation would have to be an evolutionary process, but as I imagined it, gradually, over two or three generations, a business would, by law, shift into the hands of employees [through stock ownership]."

"Remedying this situation would have to be an evolutionary process, but as I imagined it, gradually, over two or three generations, a business would, by law, shift into the hands of employees [through stock ownership]."

Thomas J. Watson Jr., Inception of IBM ESPP in 1958, "Father, Son & Company"

IBMers Aren't Buying What IBM Is Selling

- Touching the Employees' Hearts and Minds

- Research Produces an ESPP Key Performance Indicator (KPI)

- The IBM Employee Stock Purchase Plan

Touching the Employees' Hearts and Minds

A New IBM Employee Engagement Key Performance Indicator (KPI)

|

Corporate stakeholders watch for returns on their investments

In the late 20th Century—1993, Wall Street believed that IBM was a “dead man walking.” As I wrote in THINK Again: The Rometty Edition the employees did not. They, which included me at the time, believed in our company and our fellow employees . . . just not the corner office. Employees were still engaged, employee-owners and the 1993 employee stock purchase plan (ESPP) participation was outstanding as IBMers still believed in the company and themselves. |

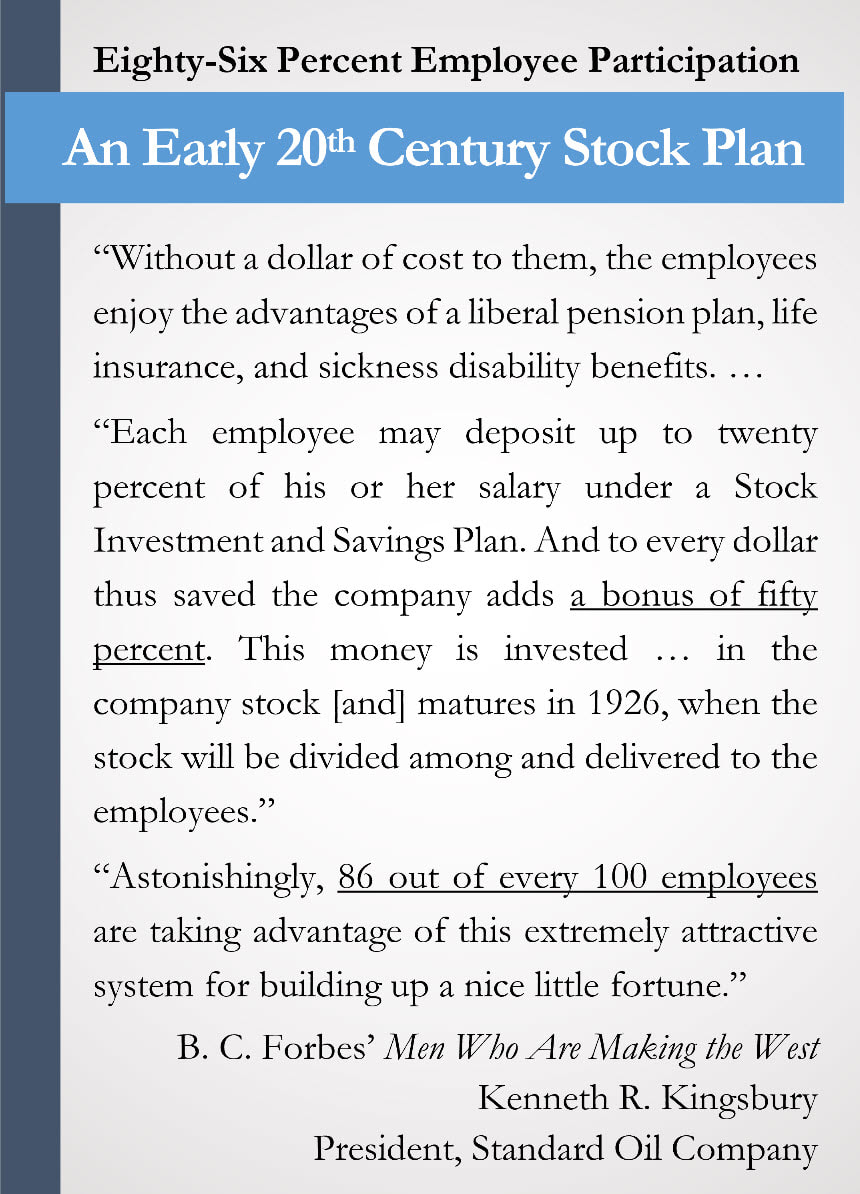

Consider this 86% employee participation rate from a hundred years ago when evaluating IBM's performance in the chart(s) below.

|

In the 21st Century, consider this three-decade-long employee stock purchase plan (ESPP) trend when deciding where to deposit your next investment as either a customer, a shareholder, a supportive society, or . . . an employee.

Fear of unemployment and social-media, performance-based appraisals may mute IBM's employees, but they are speaking loud and clear in other ways: in their productivity and with their wallets. Maybe the Drucker Institute and the Wall Street Journal will one day look deeper into IBM's real problems because they recognize some dire corporate symptoms: a three-decade decline in employee stock purchase plan participation and a two-decade decline in employee revenue and profit productivity. (It should be noted that while IBM is ranked #5 overall by the Wall Street Journal and the Drucker Institute in the link provided, IBM in this information is not even in the top 100 when it comes to "employee engagement and development." Evidently a "best-run company" according to the Drucker Institute and the Wall Street Journal has little to do with employee engagement and development.)

Evaluating and weighting employee engagement properly would surely help the Wall Street Journal's and the Drucker Institute's credibility because since 1993, while IBM’s full-time headcount had increased by almost 40% [pre-Kyndryl], the number of shares purchased by its employees had fallen by 90%. It still hasn't recovered to a 1993 employee stock purchase level as approximately the same number of employees in 2023 are purchasing 216% fewer shares.

Evaluating and weighting employee engagement properly would surely help the Wall Street Journal's and the Drucker Institute's credibility because since 1993, while IBM’s full-time headcount had increased by almost 40% [pre-Kyndryl], the number of shares purchased by its employees had fallen by 90%. It still hasn't recovered to a 1993 employee stock purchase level as approximately the same number of employees in 2023 are purchasing 216% fewer shares.

- In 1993, 256,000 full time IBM employees purchased 9.8 million shares.

- In 2020, 356,000 full-time IBM employees purchased 1.0 million shares—“approximately.”

- In 2021, 282,100 full-time IBM employees purchased 1.0 million shares—“approximately.”

- In 2022 and 2023, 290,900 full-time IBM employees purchased 3.1 and 2.4 million shares, respectively and —“approximately.”

- The increase in the last two years was driven primarily by a change effective April 1, 2022 when the corporation changed the ESPP percentage discount from 5 percent back to an earlier 15 percent off average market price on the date of purchase. Although this produced a significant increase in the total number of shares purchased, this is still significantly below the stock purchases per employee at other leading technology firms (see chart immediately below). In 2023, IBM's employees purchased approximately 11 shares of stock per employee. Compare this number to Cisco's 250 shares per employee or Microsoft's 76 shares per employee and draw your own conclusions.

IBM Employees Have Stopped Buying into Their Corporation

By 2020, while IBM’s full-time headcount had increased by almost 40% the number of shares purchased by its employees had fallen by 90%. Even with the changes to the ESPP plan in 2022, the shares-per-employee is significantly below the 1993 level: 10.7 shares per employee in 2023 vs. almost 40 shares per employee in 1993.

- In 1993, 256,000 full time employees purchased 9.8 million shares.

- In 2020, 356,000 full-time employees purchased 1.0 million shares—“approximately.”

- In 2023, 290,000 full time employees purchased 3.1 million shares—“approximately.”

As shown in a competitive look below, Symantec's 12,000 employees purchased the same number of Symantec shares of its stock (3 million) through their employee stock purchase plan (ESPP) as IBM's 290,900 employees purchased of their IBM stock. This should be an embarrassment to IBM's Chief Executive Officer and the IBM Board of Directors.

|

The IBM Employee Stock Purchase Plan: 1993-2021 |

The IBM Employee Stock Purchase Plan: Competitive View |

Footnote: In 2005, Sam Palmisano as part of his ongoing employee-benefit, cost-reduction measures, reduced the employee stock purchase plan (ESPP) discount percentage from 15% to 5%. From discussions with fellow employees at the time, many long-term employees stopped their employee stock investments and started selling their shares as a five-percent discount was not enough to compensate for the risk involved, and the collapse of Enron (2001) was fresh on many fellow employees' minds.

This is from the 2005 Annual report:

Prior to April 1, 2005, . . . the share price paid by an employee . . . was the lesser of 85 percent of the average market price on the first business day of each offering period or 85 percent of the average market price on the last business day of each pay period. Effective April 1, 2005, the company modified the terms of the plan such that eligible participants may purchase full or fractional shares of IBM common stock under the ESPP at a five percent discount off the average market price on the day of purchase.

This is from the 2005 Annual report:

Prior to April 1, 2005, . . . the share price paid by an employee . . . was the lesser of 85 percent of the average market price on the first business day of each offering period or 85 percent of the average market price on the last business day of each pay period. Effective April 1, 2005, the company modified the terms of the plan such that eligible participants may purchase full or fractional shares of IBM common stock under the ESPP at a five percent discount off the average market price on the day of purchase.