If my foresight were as clear as my hindsight, I should be better off by a damned sight.

If my foresight were as clear as my hindsight, I should be better off by a damned sight.

Evaluating IBM Shareholder's Risk

|

|

Date Published: July 27, 2021

Date Modified: July 6, 2024 |

"We are responsible to more than sixteen hundred stockholders—men, women and children—who are scattered over the civilized world. It is their money we are spending. Not mine, nor yours. It is the money, in many cases, belonging to widows and orphans; so, we have to deal with it in a serious and honest way.

"When we do not put up the best we have against that money which they have entrusted to us, we are not playing a fair and honest game."

"When we do not put up the best we have against that money which they have entrusted to us, we are not playing a fair and honest game."

Thomas J. Watson Sr., One Hundred Percent Club, 1926

Evaluating IBM Shareholder Risk

- Balancing Risk vs. Reward Is a Basic Investment Decision

- Understanding the Risk in Shareholders’ Equity Less Goodwill

- Shareholders’ Equity Less Goodwill Is Significantly Negative

- How a 21st Century Goodwill "Asset" Goes Bad

- IBM’s "Drill Presses" Are Growing Legs and Walking out the Door

- Without Fundamental Change, IBM’s Current Decline Will Continue

Balancing Risk vs. Reward Is a Basic Investment Decision

|

Most long-term shareholders seek a balance between risk and reward. It is one of the most basic questions an investment advisor asks a potential customer: “What is the amount of risk you want to bear for any given reward?” Even though IBM has spent $201 billion on share buybacks, its twenty-first-century returns have underperformed some common indexes.

So far in this century, a long-term shareholder would have received higher returns by investing in a low-cost, index mutual fund. |

In addition to these subpar returns, there is a new, ever-growing risk: shareholder equity less goodwill (and shareholder equity less all intangible assets). This risk is exaggerated at IBM because of the corporation’s: (1) opaque handling of the successes and failures of its 207 acquisitions since 2001 and (2) inability to retain or make more productive the best-of-the-best of these acquired human assets. This means that IBM’s executive team has suffered the on-going loss of what financial analysts consider “intangible” assets.

IBM for almost two decades has been suffering continual losses of its most valuable, intangible asset: its human assets. Too many analysts downplay this trend not only at IBM but within the knowledge industry in general because, to them, human assets were once intangible; but because of an accounting change in 2001, these "assets" are now quite tangible and quite visible to anyone who cares to look.

As part of IBM's total assets, they are what is referred to as goodwill!

As part of IBM's total assets, they are what is referred to as goodwill!

Understanding the Risk in Shareholders’ Equity Less Goodwill

An intangible asset is something that, if dropped on your toe, doesn’t leave a mark. Its value is open to personal interpretation, imagination, and creative thinking. For the purposes of this article, intangible assets are considered in two ways: first, the goodwill that arises from an acquisition; and second, all other intangible assets—such as patents, brand image, customer relations, non-binding contracts, and strategic alliances.

Goodwill is the difference between the full amount paid for an acquisition, less all other tangible and intangible assets.

Goodwill is the difference between the full amount paid for an acquisition, less all other tangible and intangible assets.

|

For instance, in its 2004 annual report, IBM documented the 2002 acquisition of PricewaterhouseCoopers Consulting (PwCC) for $3.89 billion. Of the purchase price, IBM estimated that PwCC had $320 million in tangible assets (chairs, desks, computers, buildings, etc.), and $410 million in “other” intangible assets (strategic alliances, client relationships, and customer contracts).

The remaining $3.16 billion—81% of the purchase price—was listed as goodwill. As stated in IBM's annual report: "Almost half of the goodwill was estimated to be generated by the value of the acquired, assembled workforce, . . . [and the other half from] . . . synergies gained between PwCC and IBM created by the combination, and the premium paid by IBM for the right to control PwCC." |

The intangibility of working together for a common goal.

|

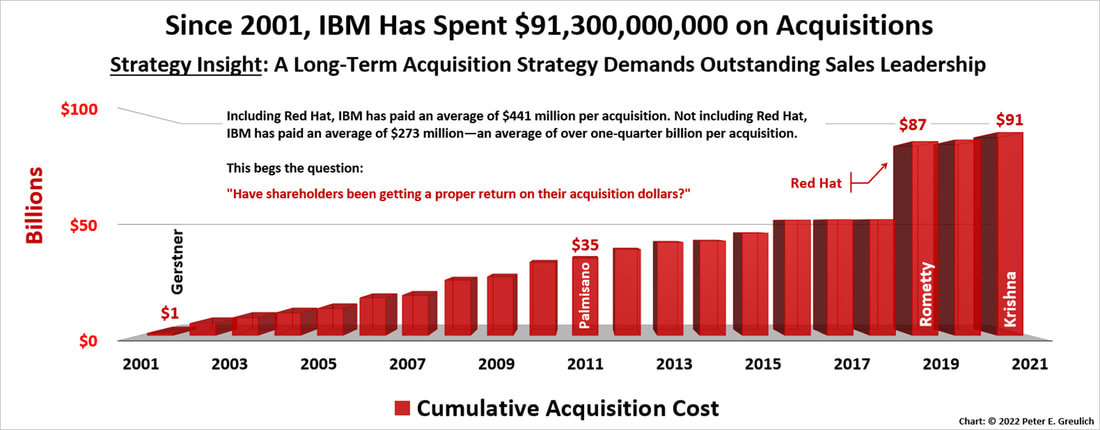

Of the $92 billion paid for its 207 acquisitions since 2001 [detail is here], $64 billion was carried as goodwill—70% of all acquisition dollars. This goodwill carries no inherent value and, in a worst-case scenario such as bankruptcy, it would have little or no monetary worth.

Shareholders’ Equity Less Goodwill Is Significantly Negative

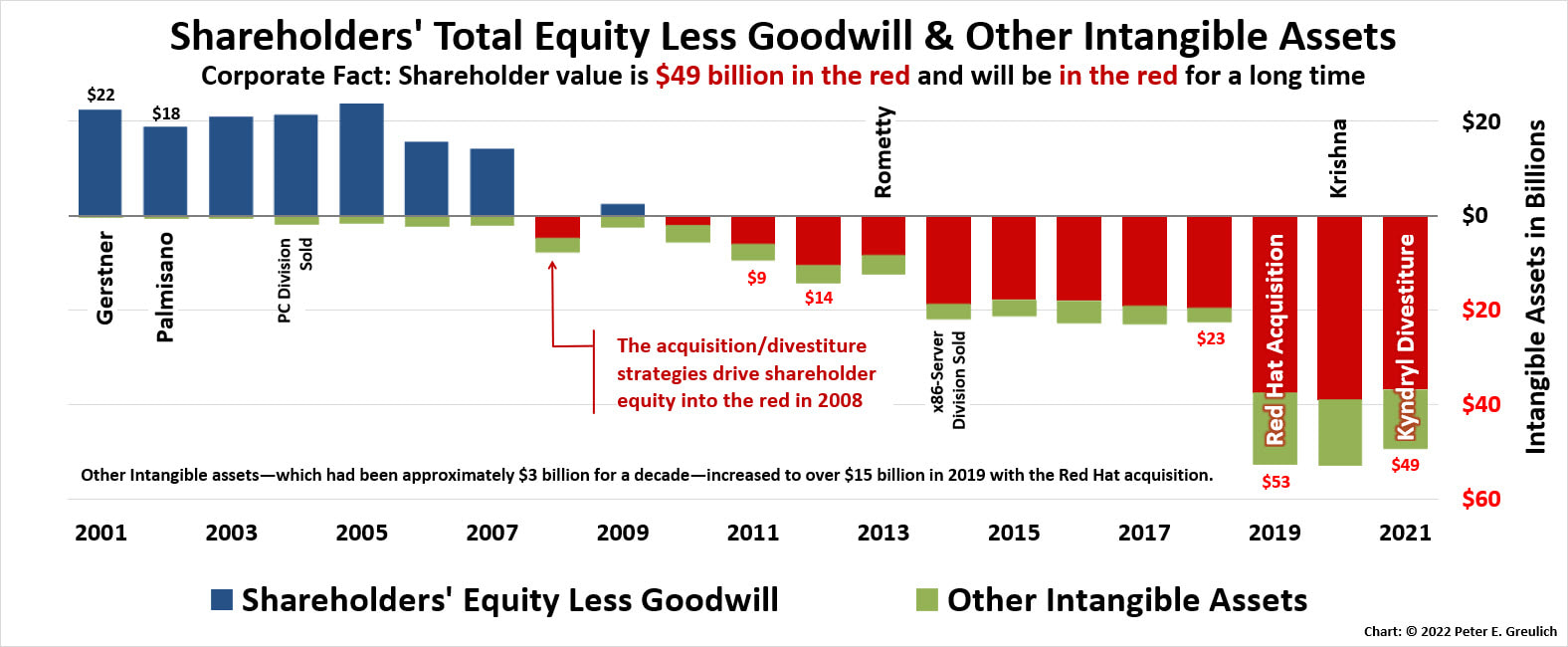

The dropping value of IBM’s tangible (hard) assets and the growth of one intangible asset—goodwill—has affected shareholders’ equity (an investor’s claim on assets after all liabilities have been paid). Shareholders’ equity less goodwill turned negative in 2008 and has continued downward.

Other intangible assets besides goodwill were relatively insignificant until 2019. As the chart above shows, that is no longer true since the Red Hat acquisition. The Red Hat acquisition added a significant amount of both goodwill and other intangible assets to the financial statements.

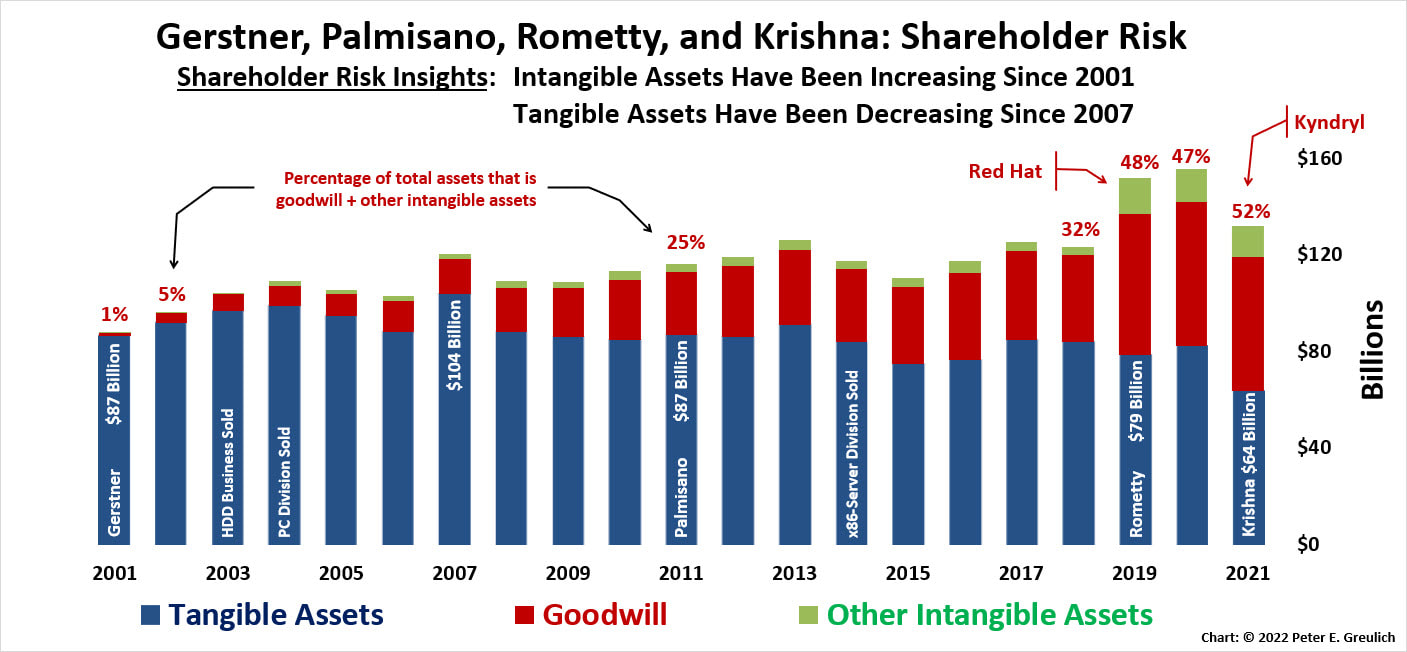

As the following chart shows, although IBM’s total assets have grown by over 50% since 2001, this growth is a mirage created by an ever-increasing percentage of goodwill and—now with the Red Hat acquisition—intangible assets. In the same time frame, its tangible assets have declined from $87 billion to $64 billion—a 26% decrease.

As the following chart shows, although IBM’s total assets have grown by over 50% since 2001, this growth is a mirage created by an ever-increasing percentage of goodwill and—now with the Red Hat acquisition—intangible assets. In the same time frame, its tangible assets have declined from $87 billion to $64 billion—a 26% decrease.

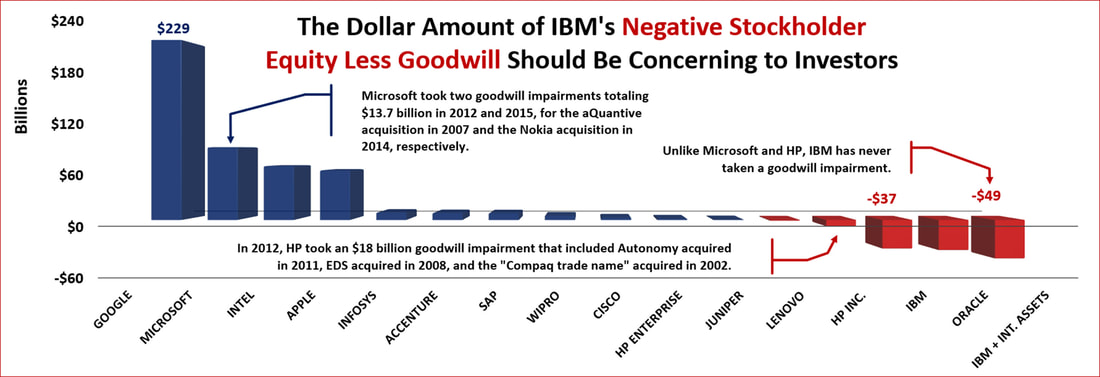

Goodwill may not hurt when it is dropped on your toe, but if you own a corporate stock that suffers the impact of a goodwill impairment (a corporation’s acknowledgement that an acquisition did not yield the expected return and writes off the worthless goodwill), it will hurt your investment portfolio when it is dropped off the books.

How a 21st Century Goodwill "Asset" Goes Bad

IBM’s chief executives have positioned their acquisition/divestiture strategy as the exchange of lower-value products for those of higher value in higher-value markets. In other words, they are pursuing a perfectly balanced, profit-only-driven, product portfolio. To supposedly achieve this goal, its chief executives have: (1) sacrificed $23 billion in tangible hardware and software assets (such as the x86-Server Division, Lotus and WebSphere) since 2001, (2) discarded $50 billion in revenue since 2011, and (3) spent $91.3 billion on acquisitions in the last two decades.

|

Because IBM's chief executives haven’t acknowledged a single goodwill impairment since the financial rules changed in 2001, they have conveyed to their investors an on-going, passive acceptance that these acquisitions have been good for the corporation, were successfully integrated into the business, and have expanded or—at a minimum—retained their value.

Even as IBM’s financial team reports its goodwill “by the book,” IBM’s chief executives still have an ethical responsibility to be transparent on the status of the corporation’s serial acquisitions—on average, almost one a month every month for the last twenty years . . . assuming the acquisition team took time off for Christmas each year and a breather just before the Red Hat acquisition.

|

All of IBM's 207 acquisitions for the last two decades have been positioned as "blue skies and goodness."

|

The amount of stakeholder money invested in these acquisitions dictates discussion and dialog not annual reports filled with executive escape clauses.

Arvind Krishna inherited much of this goodwill from his predecessors but, now, he owns the goodwill and must either account for it or pass it on in what resembles a high-stakes game of hot potato. The on-going executive officers' failure to address this ever-increasing shareholder risk is not playing a “fair and honest game” with their investor’s livelihoods and, although the owners of IBM’s stock are no longer widows and orphans, the stock is the financial base of many pensioners and 401(k) investors that, in failing to act on risks in a timely manner with incremental goodwill impairments, could impact the futures of both old and new generations.

Interestingly, goodwill impairments have been acknowledged by other major corporations with as large but also significantly fewer acquisitions. Some of these impairments stretched back a decade, and some have been acknowledged on a timely basis.

Interestingly, goodwill impairments have been acknowledged by other major corporations with as large but also significantly fewer acquisitions. Some of these impairments stretched back a decade, and some have been acknowledged on a timely basis.

From IBM there has been only silence for too long. Since 2001 goodwill has been a growing industry problem, and IBM is the industry’s poster child for bad behavior. To believe that every one of its monthly acquisitions for the last twenty years has been handled appropriately and still retain their goodwill valuation, some of which was assigned almost two decades ago, breaches the boundaries of the believable and credible.

The executives of the corporation seem to deem it better to remain dense, silent and opaque rather than shining a light into the darkness. As a result, IBM’s goodwill by being too much of a good thing wrapped for too long in too little transparency should be regarded as an exposure to a significant goodwill impairment.

IBM’s goodwill smells rank: it is goodwill gone bad.

The executives of the corporation seem to deem it better to remain dense, silent and opaque rather than shining a light into the darkness. As a result, IBM’s goodwill by being too much of a good thing wrapped for too long in too little transparency should be regarded as an exposure to a significant goodwill impairment.

IBM’s goodwill smells rank: it is goodwill gone bad.

IBM’s "Drill Presses" Are Growing Legs and Walking out the Door

The oxymoron—bad goodwill—may only become more prevalent within the high-tech and knowledge industries as the century progresses. When a high-tech corporation takes a goodwill impairment, it should be asked if its leadership understood that the success of their acquisition depended on integrating the knowledge and expanding the productivity of the acquired workers.

|

Peter F. Drucker predicted the growing value of these knowledge workers. He believed that the knowledge worker would become this century’s critical asset and now, because of a goodwill accounting change, it is finally possible—like never before—to visualize their expected economic impact in charts and graphs derived from data living in a financial spreadsheet.

Drucker’s intangible is now completely tangible: in the case of IBM, it has acquired employees that it has estimated are worth some $68 billion dollars (as of IBM's 2021 Annual Report). Unfortunately, they are being involuntarily exited without regard to their individual value, performance or productivity, and increasingly, they are hitting the exits under their own power. Shareholders investing in a manufacturing concern expect the executive team to care for its material assets. An on-going loss of manufacturing assets is the sign of an incompetent management team. |

Goodwill is a measurement of people power--bringing together two workforces for profitable gain. In IBM's case, 70.9% of all acquisition dollars has been classified as goodwill on its books.

|

Bookkeepers see red when a tool—such as a drill press that is purchased to get a job done—suddenly disappears because of theft or poor maintenance. If a manufacturing executive tried to explain away decades of such losses, the chief executive would be the first to ask emphatically, “What! Did the drill presses grow legs and walk out the door?" or "Did you not hear the bearings squeaking from the lack of maintenance?”

|

B. C. Forbes' thoughts on a different kind of "Goodwill."

|

IBM’s dropping sales and profit productivity is a result of the later—the lack of proper lubricants to maintain and improve employee productivity after its acquisitions. In the case of the former, each of IBM’s fastest growing intangible assets came fitted with a pair of legs and a quite elegant, functional brain that serves double duty as a smoke detector.

More and more often these brains are telling their owner’s legs to evacuate the premises before the corporate building collapses upon itself. Figuratively, IBM’s drill presses—the people the company purchased through 224 acquisitions (as of the end of 2023) to get a job done—are walking out its exit doors on their own volition. IBM has been destroying—for more than two decades—its employees' feelings of "goodwill" as articulated by B. C. Forbes in the sidebar. |

Financial analysts that cover the knowledge industry should be seeing red when human assets that are acquired at a premium are misused, discarded, or lost through poor human relations practices. Failing to acknowledge this red ink on a timely basis, if not an accounting mistake, is an ethical lapse that exposes an investor to long-term, unnecessary financial risks.

In IBM's case, the risk is called: A Negative Shareholder Equity Less Goodwill.

In IBM's case, the risk is called: A Negative Shareholder Equity Less Goodwill.

Without Fundamental Change, IBM’s Current Decline Will Continue

|

When Arvind Krishna took charge, he should have done what other successful executives at IBM have done to ensure a fresh start: wipe the slate clean of his predecessor’s non-productive processes, products, and tangible and intangible assets (In 1956, Watson Jr. called a constitutional convention for feedback from his executive team on how to move forward). One of these actions should have been to write off the corporation’s bad goodwill. When this impairment is finally taken, it will punctuate a two-decade long deterioration in employee productivity, and the outright loss of critical employees through resource actions and resignations.

|

Read how Resource Actions affect employees

|

These goodwill impairments will reveal to the chief financial officers in the knowledge industry something that has been intuitively obvious to their manufacturing counterparts for over a century: (1) warehouses, even virtual warehouses, need to be continually refreshed and refilled with new products of significantly higher value, not filled with the stale vestiges of value remaining from yesteryear; (2) manufacturing facilities, especially virtual, high-tech manufacturing facilities distributed worldwide in home offices, need human assets that are self-motivated, creative, engaged, and passionate about their work; (3) intangible human assets, like their tangible counterparts, need investment and on-going maintenance to perform their jobs and to achieve their estimated goodwill value; and finally, (4) the business must first invest in making people more productive, processes more effective, and products more valuable, before exchanging one form of paper—greenbacks—for another form of paper through stock buybacks.

To Drucker's credit, the twenty-first century growth of goodwill in the knowledge industry is documenting his twentieth century assertion of the growing value of human assets to a corporation. The disregard IBM’s chief executives have shown in valuing, retaining and making these assets more productive demonstrates how they have lost touch with their corporation’s institutional memory: they no longer understand the essence of the most basic of human financial equations—that an enthusiastic, engaged and passionate employee is a productive employee.

As a result, factor into your investments a significant goodwill impairment at IBM. It is just a matter of time and transparency, or one triggering event that the board of directors should ensure comes sooner rather than later along with a change of direction and leadership.

The Kyndryl divestiture may force this decision.

Cheers,

- Peter E.

To Drucker's credit, the twenty-first century growth of goodwill in the knowledge industry is documenting his twentieth century assertion of the growing value of human assets to a corporation. The disregard IBM’s chief executives have shown in valuing, retaining and making these assets more productive demonstrates how they have lost touch with their corporation’s institutional memory: they no longer understand the essence of the most basic of human financial equations—that an enthusiastic, engaged and passionate employee is a productive employee.

As a result, factor into your investments a significant goodwill impairment at IBM. It is just a matter of time and transparency, or one triggering event that the board of directors should ensure comes sooner rather than later along with a change of direction and leadership.

The Kyndryl divestiture may force this decision.

Cheers,

- Peter E.